I. MARKET DYNAMICS OF WARRANTS

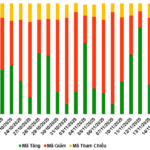

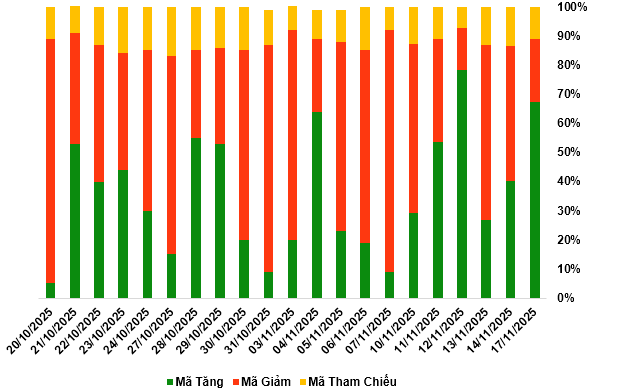

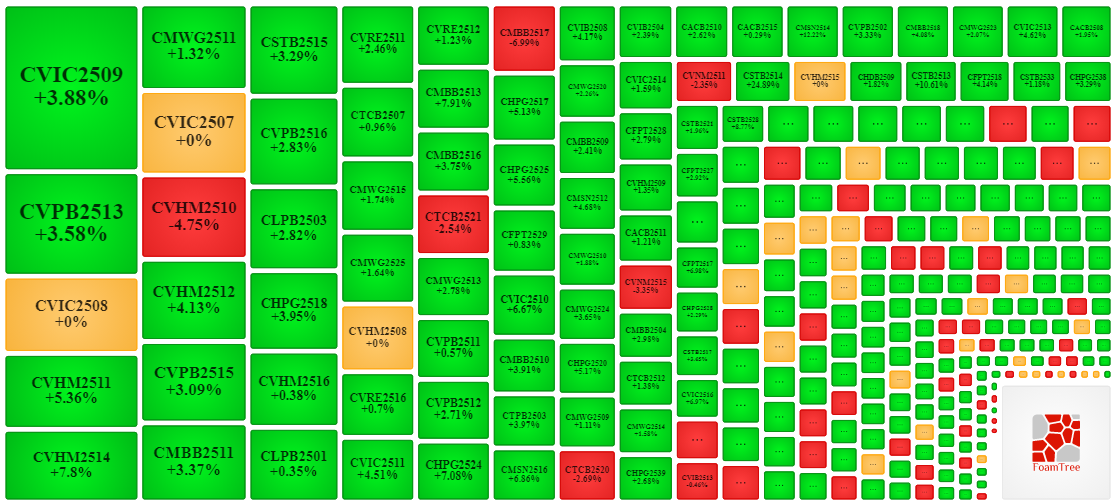

By the close of trading on November 17, 2025, the market saw 203 gainers, 67 decliners, and 31 unchanged securities.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

Source: VietstockFinance

During the November 17, 2025 session, buyers regained control, driving most warrant prices higher. Notably, top gainers included CVIC2509, CVPB2513, CVHM2511, and CMWG2511.

Source: VietstockFinance

Source: VietstockFinance

Total market volume on November 17 reached 50.88 million warrants, up 2.98%; trading value hit 94.79 billion VND, a 10.38% increase from November 14. CSTB2528 led in volume with 3.73 million warrants, while CMBB2518 topped trading value at 4.67 billion VND.

Foreign investors continued net selling on November 17, totaling 2.05 billion VND. CVHM2521 and CSHB2513 saw the highest net outflows.

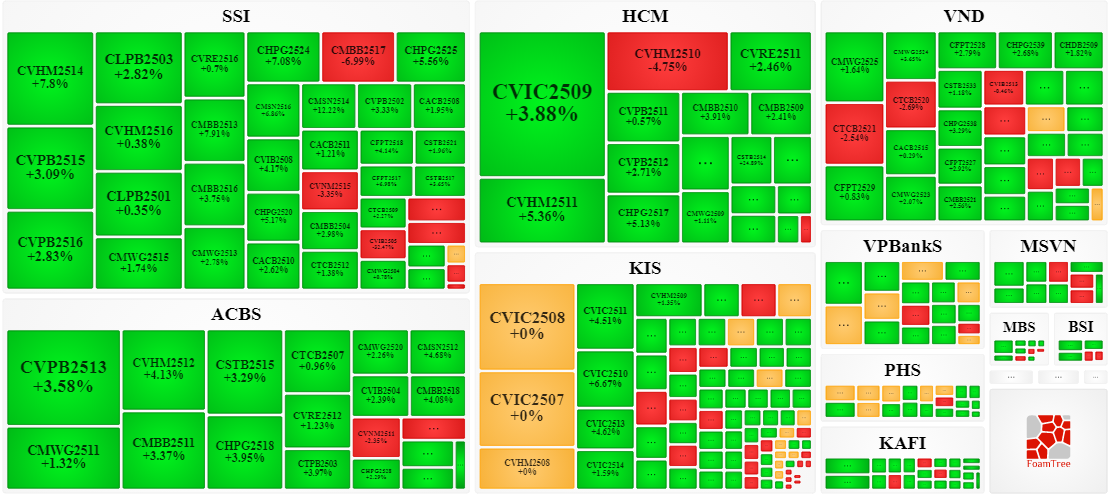

Securities firms SSI, ACBS, KIS, and HCM currently issue the most warrants in the market.

Source: VietstockFinance

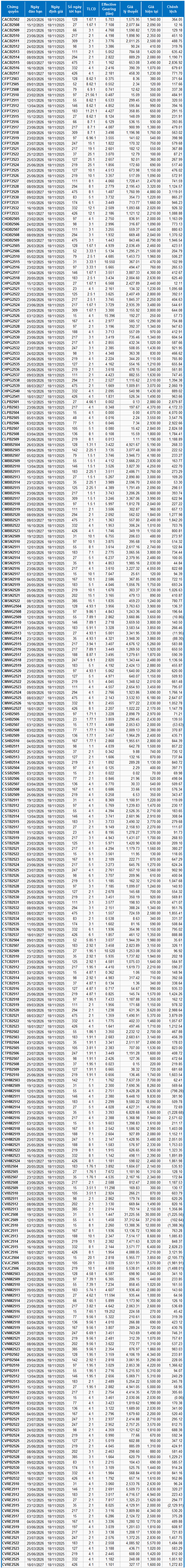

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from November 18, 2025, the fair prices of actively traded warrants are as follows:

Source: VietstockFinance

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturities.

According to this valuation, CVRE2515 and CVJC2504 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying assets. Currently, CVNM2516 and CHPG2526 have the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 17/11/2025

Will the Stock Market Shift Gears Next Week?

The VN-Index continued its recovery last week, though investor sentiment remained cautious with subdued trading volumes. Despite this, positive signals emerged in select stock groups, attracting bottom-fishing demand. Analysts advise investors to position for a potential trend reversal once recovery signals are confirmed, while maintaining a cash reserve to capitalize on emerging opportunities.

Market Pulse 11/17: Real Estate Sector Drives Gains, VN-Index Continues Recovery

At the close of trading, the VN-Index surged by 18.96 points (+1.16%), reaching 1,654.42 points, while the HNX-Index climbed 1.08 points (+0.4%), settling at 268.69 points. Market breadth favored the bulls, with 486 advancing stocks outpacing 238 decliners. Similarly, the VN30 basket saw a dominant green trend, with 28 gainers and only 2 losers.

Fastest Capital-Raising Real Estate Firm Set to List on HoSE

The Ho Chi Minh City Stock Exchange (HoSE) has recently received the listing application for 200 million RGG shares from Regal Group Joint Stock Company. Prior to this, Regal Group successfully offered 20 million shares to existing shareholders at a price of 10,000 VND per share, increasing its chartered capital from 1.8 trillion VND to 2 trillion VND.