Technical Signals of VN-Index

During the morning trading session on November 17, 2025, the VN-Index continued its upward trend, surpassing the Middle line of the Bollinger Bands.

The Stochastic Oscillator has issued a buy signal in the oversold region, and the MACD indicator echoes this positive outlook, suggesting a favorable short-term prognosis.

Technical Signals of HNX-Index

In the morning session on November 17, 2025, the HNX-Index marked its fifth consecutive day of gains, nearing the Upper Band of the Bollinger Bands.

The short-term outlook remains positive, with both the MACD and Stochastic Oscillator indicators signaling a buy. However, volume should surpass the 20-day average in upcoming sessions to confirm the upward momentum.

CEO – C.E.O Group Corporation

In the morning session on November 17, 2025, CEO shares continued to rise after retesting the 100-day SMA, accompanied by increased trading volume, reflecting investor optimism.

Currently, CEO’s price is retesting the Middle line of the Bollinger Bands, while the MACD indicator is signaling a buy. If these signals strengthen in the coming sessions, the recovery trend will become more sustainable.

DGW – Digital World Joint Stock Company

In the morning session on November 17, 2025, DGW shares surged for the second consecutive day, forming a long-bodied candlestick pattern with volume exceeding the 20-session average, indicating active trading.

Currently, DGW’s price has successfully broken through the short-term downtrend line, while the Stochastic Oscillator continues to rise after issuing a buy signal.

Additionally, the stock price is closely tracking the Upper Band of the Bollinger Bands, with the MACD indicator rising toward the zero line after signaling a buy. If these positive technical signals persist, the short-term upward trend will be further reinforced.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, the signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:05 November 17, 2025

Market Pulse 11/17: Real Estate Sector Drives Gains, VN-Index Continues Recovery

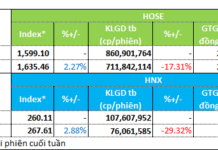

At the close of trading, the VN-Index surged by 18.96 points (+1.16%), reaching 1,654.42 points, while the HNX-Index climbed 1.08 points (+0.4%), settling at 268.69 points. Market breadth favored the bulls, with 486 advancing stocks outpacing 238 decliners. Similarly, the VN30 basket saw a dominant green trend, with 28 gainers and only 2 losers.

Fastest Capital-Raising Real Estate Firm Set to List on HoSE

The Ho Chi Minh City Stock Exchange (HoSE) has recently received the listing application for 200 million RGG shares from Regal Group Joint Stock Company. Prior to this, Regal Group successfully offered 20 million shares to existing shareholders at a price of 10,000 VND per share, increasing its chartered capital from 1.8 trillion VND to 2 trillion VND.