On November 13th, multiple locations of the Mailisa beauty clinic chain in Ho Chi Minh City and other provinces were unexpectedly visited by authorities. The inspections, which lasted from morning until late afternoon, drew significant attention from both locals and customers. During the process, officials seized several boxes of documents for further investigation and temporarily halted operations at the inspected sites.

Shortly after the inspections at several Mailisa beauty clinics, a video resurfaced, showing containers of the brand’s cosmetics arriving at the port. The clip quickly went viral.

High demand forced Mailisa to import cosmetics via multiple container shipments to Vietnam.

In an early 2025 TikTok video, Ms. Phan Thị Mai, owner of the Mailisa beauty clinic chain, proudly announced, “This time, we’ve imported 4 containers, totaling 60,000 sets.”

According to Tuổi Trẻ newspaper, the imported products are Doctor Magic N3 skincare sets, marketed to reduce dark spots, freckles, and age spots. Each set is priced at 2.3 million VND, potentially generating 138 billion VND in revenue.

However, Ms. Mai emphasized that the 60,000 sets are insufficient to meet the demand from over 100,000 customers on the waiting list. She prioritized existing customers over new ones, explaining, “We owe it to our loyal customers to fulfill their orders first.”

She also addressed the issue of resellers inflating prices, with some sets being sold for 3.8 to 5 million VND. To combat this, Mailisa limited purchases to one set per customer. “The manufacturer is producing as fast as they can, but demand is overwhelming,” she added.

Regarding quality, Ms. Mai assured customers that the products are safe and certified. “We’ve built our brand for 27 years. Would Mailisa risk selling subpar products?” she asked, citing the chain’s wealth and expansive facilities as proof of its credibility.

Over the years, Mailisa has consistently imported large quantities of cosmetics, often in 4-5 to 10-container shipments, yet still struggles to meet demand.

The products are typically marketed as “imported” or “foreign-made.”

Unveiling the Origins of Doctor Magic Cosmetics and the Companies Behind Them

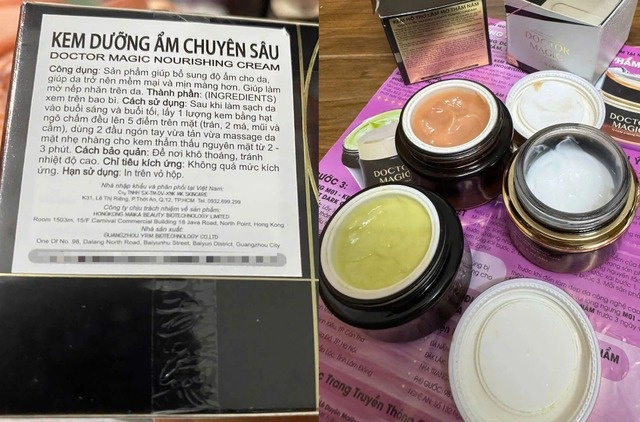

However, according to Dân Trí newspaper, Doctor Magic products are manufactured in Hong Kong, China. The company claims they are produced in professional facilities adhering to international standards and approved by the Ministry of Health for nationwide distribution.

The importer and distributor of Doctor Magic products is owned by Mr. Hoàng Kim Khánh (Screenshot).

Dân Trí’s investigation revealed that Doctor Magic products sold at Mailisa clinics are indeed from Hong Kong, China.

Each product features a supplementary label indicating its origin, importer, distributor, and cosmetic circulation license number issued by the Drug Administration of Vietnam. Customers also receive a retail invoice upon purchase.

Specifically, the labels on Doctor Magic products list MK SKINCARE Trading Manufacturing Service Import-Export Co., Ltd. (formerly in District 12, Ho Chi Minh City) as the importer and distributor. Established in September 2017, the company is owned and managed by Mr. Hoàng Kim Khánh, who serves as both CEO and legal representative.

With a registered capital of 10 billion VND, the company specializes in wholesale cosmetics, pharmaceuticals, and medical devices. As of early this year, it employs five workers.

The responsible companies for Doctor Magic products are HongKong Doctor Magic Biotechnology Limited and HongKong Maika Beauty Biotechnology Limited, both based in Hong Kong. They operate in cosmetics, beauty, biotechnology, and import-export.

For instance, HongKong Maika Beauty Biotechnology Limited is responsible for the pigment removal cream, while HongKong Doctor Magic Biotechnology Limited handles the dark spot fading cream.

The manufacturer, Guangzhou YRM Biotechnology Co., Ltd., is located in Guangzhou, Guangdong, China.

According to Qichacha, a Chinese business information provider, Guangzhou YRM Biotechnology Co., Ltd. was founded in 2015. It specializes in cosmetic formula research and development, as well as OEM (original equipment manufacturing) and ODM (original design manufacturing) services.

“White Gold” Root Crop: Vietnam Imports 9 Million Tons from Cambodia

This Vietnamese root vegetable is poised to seize significant opportunities in the international market, yet it also faces mounting pressure to transition toward a sustainable development model.

Ministry of Home Affairs Addresses Rumors of Further Merging 16 Provinces and Cities

This morning, November 17th, Phan Trung Tuan, Director of the Department of Local Government at the Ministry of Home Affairs, confirmed that currently, the Party, National Assembly, and Government have no plans to continue implementing the reorganization or merger of provinces, cities, or commune-level administrative units.

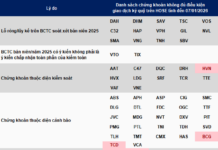

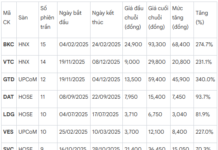

Two Individuals Fined VND 3 Billion for Stock Manipulation Using 19 Accounts

The State Securities Commission (SSC) has recently issued penalties against multiple individuals involved in the manipulation of Petro Times Corporation’s (PPT) stock. Two individuals were fined a total of 3 billion VND for using 19 accounts to repeatedly buy and sell shares, artificially creating supply and demand to manipulate the stock price.

Thai Tycoon Reaps Windfall Dividends from Vietnamese Enterprises

After 13 years, Nawaplastic Industries Co., Ltd. has reaped over VND 2.824 trillion in dividends from Binh Minh Plastics, equivalent to their initial investment in shares. Meanwhile, Vietnam Beverage has garnered approximately VND 15.4 trillion in dividends from Sabeco, and F&N Dairy Investments has collected more than VND 15 trillion in dividends from Vinamilk.