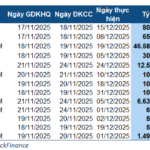

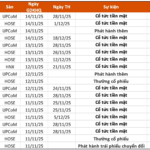

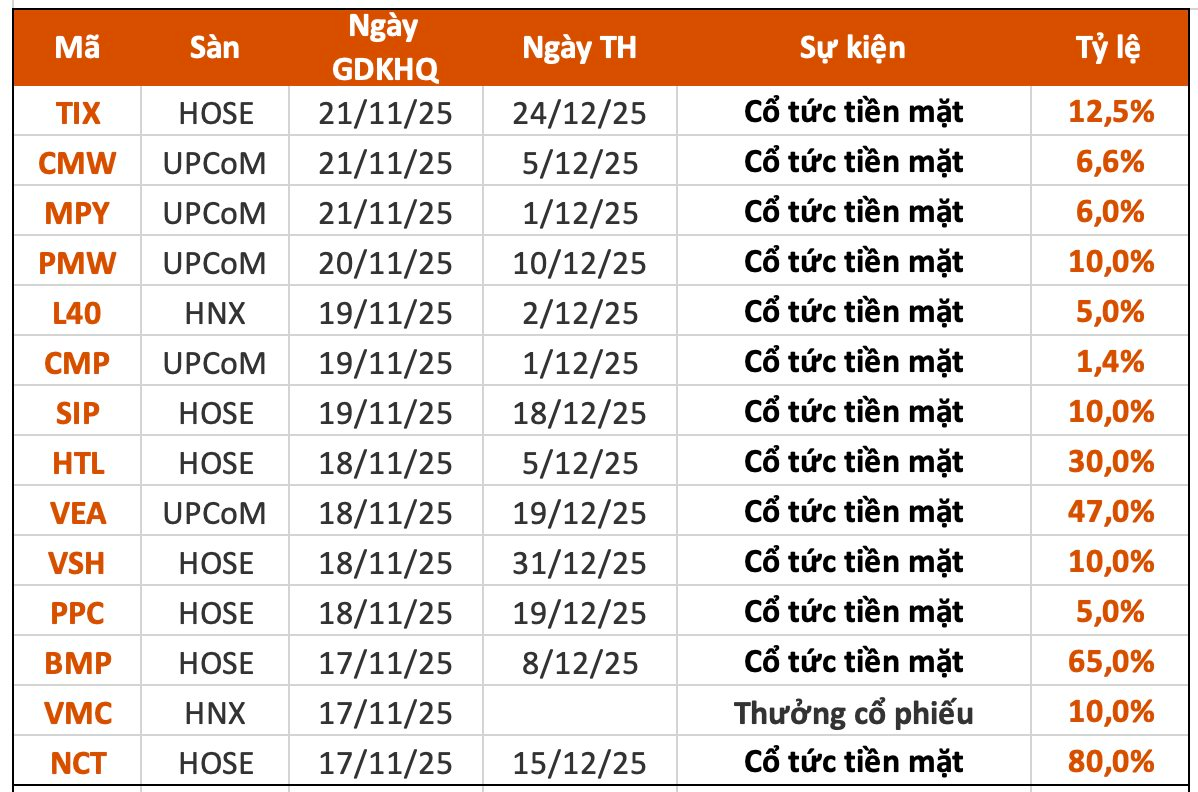

According to recent statistics, 14 companies announced dividend payout schedules for the week of November 16–21. Among these, 13 companies are distributing cash dividends, with rates ranging from 1.4% to a high of 80%. Additionally, one company is offering a stock dividend during this period.

On November 19, Truong Long Automotive and Technical JSC (Hino Truong Long, stock code: HTL) will hold its final registration date for the second cash dividend payment of 2024, at a rate of 30% (3,000 VND per share). With 12 million shares outstanding, the company is expected to allocate approximately 36 billion VND for this dividend. The payment is scheduled for December 5, 2025.

Previously, in December 2023, the company paid an interim dividend for the first tranche of 2024 at a rate of 35%. Combined with the current payout, shareholders will receive a total dividend of 65% for 2024, the highest in the company’s history. In 2023, the dividend rate was also substantial at 50%.

Vietnam Engine and Agricultural Machinery Corporation (VEAM, stock code: VEA-UPCoM) has announced November 19 as the record date for its 2024 cash dividend payment. The dividend rate is set at 46.5808% (over 4,658 VND per share), with the payment date on December 19.

With 1.3288 billion shares outstanding, VEAM is estimated to disburse nearly 6.19 trillion VND for this dividend. As of September 30, 2025, the Ministry of Industry and Trade holds approximately 88.47% of VEAM’s equity, expected to receive around 5.476 trillion VND from this dividend distribution.

Binh Minh Plastics (stock code: BMP) will pay an interim cash dividend at a rate of 65% (6,500 VND per share). The record date is November 18, 2025, with payment scheduled for December 8, 2025.

With over 81.86 million shares outstanding, Binh Minh Plastics is expected to allocate more than 532 billion VND for this dividend. Thai shareholder Nawaplastic Industries Co., Ltd., holding over 45 million shares, is projected to receive over 292.6 billion VND in dividends.

Noi Bai Cargo Services JSC (stock code: NCT) will finalize its dividend list on November 18, with the ex-dividend date on November 17 and payment on December 15. The dividend rate is 80% (8,000 VND per share), totaling over 209 billion VND for approximately 26.2 million shares. This rate was approved at the 2025 Annual General Meeting in June.

As of September 30, 2025, Vietnam Airlines (HOSE: HVN), the parent company holding 55.13% of NCT’s equity, is set to receive over 115 billion VND. Additionally, Vietnam Airlines’ 51% stake in NASCO (UPCoM: NAS), which owns 6.98% of NCT, will further enhance its consolidated benefits.

Stock Market Flash News & Event Calendar for November 12, 2025

Uncover the latest and most impactful news snippets surrounding listed companies on the stock exchange, all meticulously compiled in one place.