According to the Vietnam Pepper and Spice Association (VPSA), U.S. President Donald Trump recently signed an executive order amending the scope of retaliatory tariffs announced in April this year. Under the new regulations, several agricultural products, including coffee, tea, tropical fruits, juices, cocoa, spices, bananas, citrus fruits, and tomatoes, will be exempt from additional tariffs. This change took effect on November 13.

The U.S. explained that the tariff exemptions were granted following progress in bilateral trade negotiations. This shift indicates a move from a defensive stance to a more flexible approach, aimed at stabilizing domestic supply chains and consumer prices. For Vietnam, a leading exporter of pepper, coffee, and fruits, this presents a significant opportunity to strengthen its presence in the U.S. market, which boasts over 350 million consumers.

VPSA representatives view this as a positive development for spice products, which have been impacted by retaliatory tariffs since April 2025. The exemption reduces cost pressures, enhances competitiveness, and enables Vietnamese businesses to regain market share in the U.S., provided they meet import standards. However, VPSA emphasizes that tariff exemptions do not eliminate all import taxes, and technical barriers such as SPS standards, traceability, residue limits, and food safety remain critical challenges.

Pepper is among the products exempted from U.S. tariffs.

Vietnam’s pepper exports in the first 10 months of the year showed promising results, with 206,427 tons exported, valued at $1.3 billion, despite a slight decline in volume. The U.S. remains the largest market, accounting for 44,262 tons, or over 21% of total exports. This trend highlights U.S. buyers’ willingness to pay higher prices for high-quality products, and the tariff exemption is expected to boost export volumes to the U.S. in the coming months.

For the coffee sector, industry responses have been cautious. Nguyen Nam Hai, Chairman of the Vietnam Coffee and Cocoa Association (VICOFA), noted that previous U.S.-Brazil trade tensions had led to predictions of a shift in coffee imports favoring Vietnam. With the new tariff exemptions, the market dynamics have largely returned to a balanced state. “Recent price drops in international coffee markets are short-term reactions from speculators,” Hai explained. “The medium to long-term outlook remains positive, as global demand continues to outpace supply.”

VICOFA leaders believe the tax benefits could encourage higher exports of processed coffee but stress that the U.S. market maintains stringent standards for labeling, chemical residues, and testing.

Representatives from Vina T&T Group, a leading fruit exporter to the U.S., see the tariff exemptions as a powerful catalyst for the fruit and vegetable industry’s export growth. Orders from the U.S. have rebounded this year, particularly for mangoes, fresh coconuts, packaged longans, and fruit juices.

According to Vina T&T, even small tariff differences previously led importers to switch suppliers. With the removal of these barriers, many U.S. partners have resumed negotiations and proposed expanded distribution quotas. However, the company emphasizes that while tax incentives create opportunities, meeting stringent U.S. standards remains the key to long-term success, dependent on Vietnamese businesses’ compliance capabilities.

Data from the Vietnam Fruit and Vegetable Association shows that in the first 10 months of the year, fruit and vegetable exports reached $7.09 billion, a 15.1% increase year-on-year, with the U.S. being one of the fastest-growing markets. This growth suggests that U.S. tariff exemptions could propel Vietnam’s fruit and vegetable sector toward its 2025 target of $8–8.5 billion in exports.

“White Gold” Root Crop: Vietnam Imports 9 Million Tons from Cambodia

This Vietnamese root vegetable is poised to seize significant opportunities in the international market, yet it also faces mounting pressure to transition toward a sustainable development model.

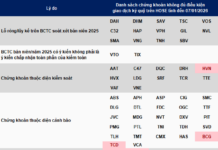

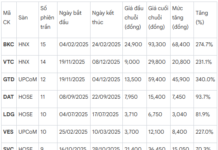

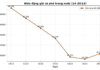

Two Individuals Fined VND 3 Billion for Stock Manipulation Using 19 Accounts

The State Securities Commission (SSC) has recently issued penalties against multiple individuals involved in the manipulation of Petro Times Corporation’s (PPT) stock. Two individuals were fined a total of 3 billion VND for using 19 accounts to repeatedly buy and sell shares, artificially creating supply and demand to manipulate the stock price.

Thai Tycoon Reaps Windfall Dividends from Vietnamese Enterprises

After 13 years, Nawaplastic Industries Co., Ltd. has reaped over VND 2.824 trillion in dividends from Binh Minh Plastics, equivalent to their initial investment in shares. Meanwhile, Vietnam Beverage has garnered approximately VND 15.4 trillion in dividends from Sabeco, and F&N Dairy Investments has collected more than VND 15 trillion in dividends from Vinamilk.

Infrastructure Bond Funds: Essential Yet Requiring Oversight to Safeguard Investors

Vietnam’s infrastructure investment demand is projected to reach $245 billion by 2030, yet the forecasted budget is expected to cover only 70% of this requirement.