I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON NOVEMBER 17, 2025

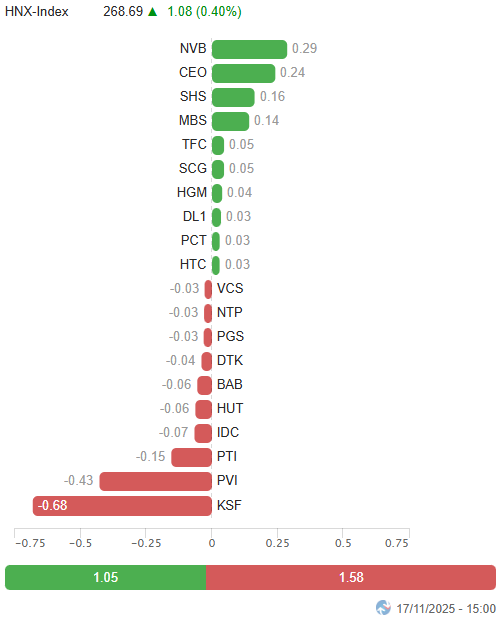

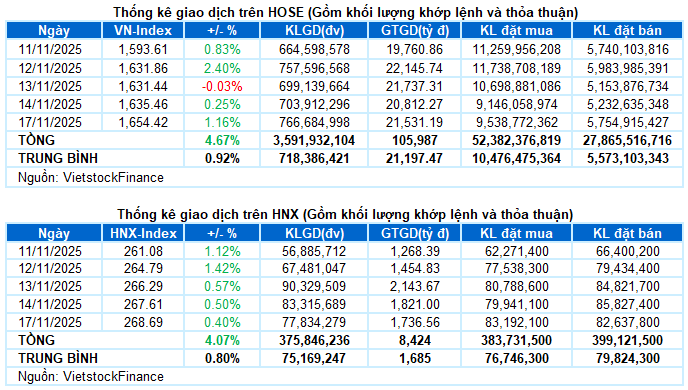

– Major indices continued to rise during the November 17 trading session. The VN-Index increased by 1.16%, reaching 1,654.42 points, while the HNX-Index rose by 0.4%, closing at 268.69 points.

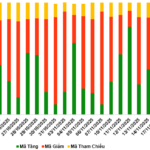

– Trading volume on the HOSE platform saw a slight 1.8% increase, surpassing 661 million units. The HNX platform recorded over 68 million matched orders, a 2.5% rise compared to the previous session.

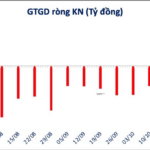

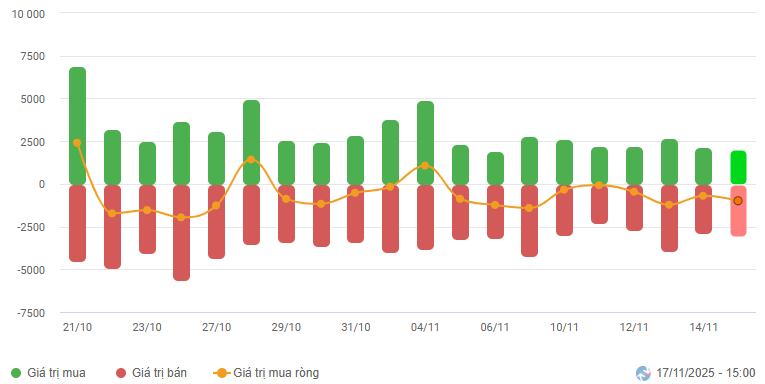

– Foreign investors continued to net sell, with values exceeding 920 billion VND on the HOSE platform and 1.9 billion VND on the HNX platform.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

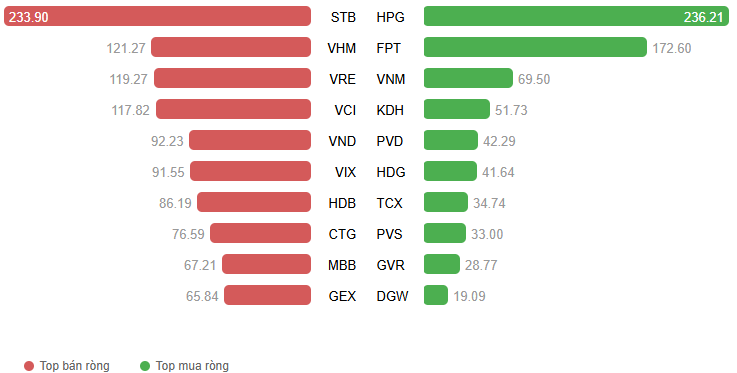

Net Trading Value by Stock Code. Unit: Billion VND

– The market maintained a positive recovery momentum during the first trading day of the week. Green dominated the market from the opening bell, propelling the VN-Index to the 1,650-point region within the first hour. The upward trend slightly slowed as the index approached this resistance level, accompanied by minor fluctuations due to short-term profit-taking pressures. However, the adjustment range was limited, and buying interest quickly resurfaced, indicating a significant improvement in investor sentiment. Strong buying momentum in the final trading hours helped the VN-Index close at its intraday high of 1,654.42 points, a 1.16% increase from the previous session.

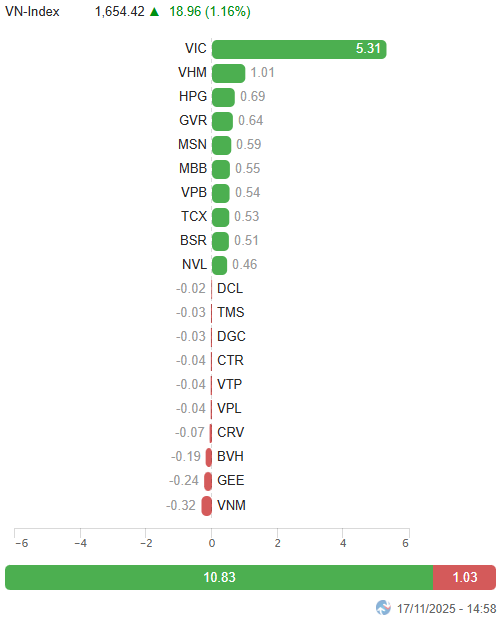

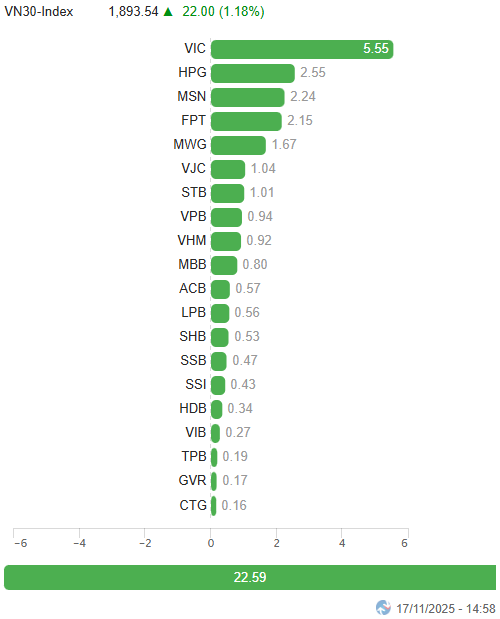

– In terms of influence, VIC was the most positive contributor, adding 5.3 points to the VN-Index. VHM, HPG, and GVR collectively contributed an additional 2.3 points. Meanwhile, the top 10 negatively influencing stocks only deducted 1 point from the overall index.

Top Influencing Stocks on the Index. Unit: Points

– The VN30-Index surged by 22 points, equivalent to 1.18%, reaching 1,893.54 points. The breadth favored buyers, with 28 out of 30 stocks gaining, led by VIC with a 2.8% increase. Only VNM (-1.1%) and DGC (-0.4%) experienced declines within the index.

Green dominated most sectors. Real estate led the market with a remarkable 1.95% increase, featuring standout performers such as NVL hitting the ceiling, VIC (+2.84%), VHM (+1.17%), CEO (+2.71%), DIG (+4.4%), KDH (+1.3%), KBC (+4.02%), PDR (+3.83%), DXG (+2.08%), TCH (+2.11%), and KHG (+2.5%).

Energy, information technology, and materials sectors also recorded gains exceeding 1%, driven by notable contributions from BSR (+2.81%), PVT (+1.08%); FPT (+1%), CMG (+1.31%), VEC (+12.77%); HPG (+1.49%), GVR (+2.46%), DPM (+2.1%), and DCM (+1.74%).

Additionally, the consumer sector featured notable performers such as HAG and DGW hitting the ceiling, MSN (+2.18%), HNG (+3.45%), MWG (+1.23%), and PET (+1.37%).

Conversely, the communication services sector index declined by 1.31%, influenced by adjustments in VGI (-1.82%), CTR (-1.51%), ICT (-6.36%), despite FOX (+0.49%), VNZ (+1.69%), and YEG (+1.24%) attracting decent buying interest. Similarly, the healthcare sector was dominated by red, pressured by IMP (-0.82%), DCL (-4.17%), DP3 (-1.54%), and DHD (-1.64%).

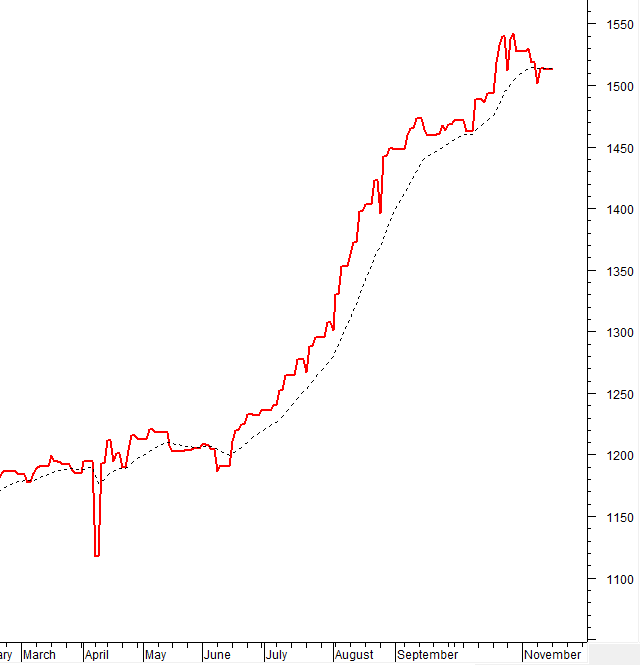

The VN-Index continued its recovery, surpassing the Middle line of the Bollinger Bands. The Stochastic Oscillator indicator maintained its upward trajectory after providing a buy signal and exited the oversold region. The MACD indicator also gave a similar signal, reinforcing the positive short-term outlook.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Surpassing the Middle Line of Bollinger Bands

The VN-Index continued its recovery, surpassing the Middle line of the Bollinger Bands.

The Stochastic Oscillator indicator maintained its upward trajectory after providing a buy signal and exited the oversold region. The MACD indicator also gave a similar signal, reinforcing the positive short-term outlook.

HNX-Index – Fifth Consecutive Session of Gains

The HNX-Index recorded its fifth consecutive session of gains and is poised to test the 50-day SMA again. However, trading volume needs to surpass the 20-day average for the upward trend to be more sustainable.

The Stochastic Oscillator and MACD indicators continued their upward movement after providing buy signals. If this state is maintained in the upcoming sessions, the short-term optimistic outlook will persist.

Capital Flow Analysis

Smart Money Flow Dynamics: The Negative Volume Index of the VN-Index remains below the 20-day EMA. If this state continues in the next session, the risk of a sudden downturn (thrust down) may increase.

Foreign Capital Flow Dynamics: Foreign investors continued to net sell during the November 17, 2025 trading session. If foreign investors maintain this action in the upcoming sessions, market fluctuations may occur.

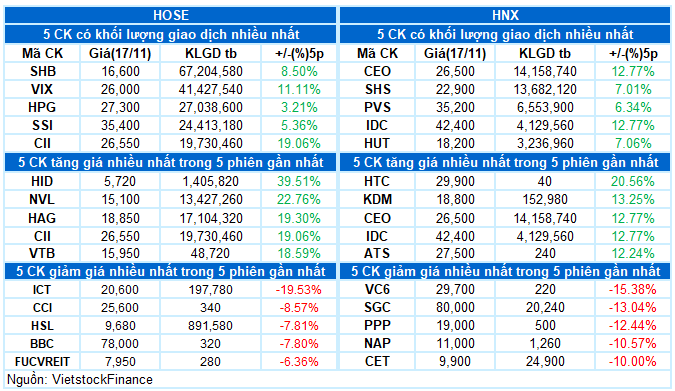

III. MARKET STATISTICS ON NOVEMBER 17, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:02 November 17, 2025

Will the Stock Market Explode Next Week After a Deep Circuit Breaker Halt?

The stock market has rebounded, instilling optimism among investors for a positive trend in the upcoming week.

Will the Stock Market Shift Gears Next Week?

The VN-Index continued its recovery last week, though investor sentiment remained cautious with subdued trading volumes. Despite this, positive signals emerged in select stock groups, attracting bottom-fishing demand. Analysts advise investors to position for a potential trend reversal once recovery signals are confirmed, while maintaining a cash reserve to capitalize on emerging opportunities.