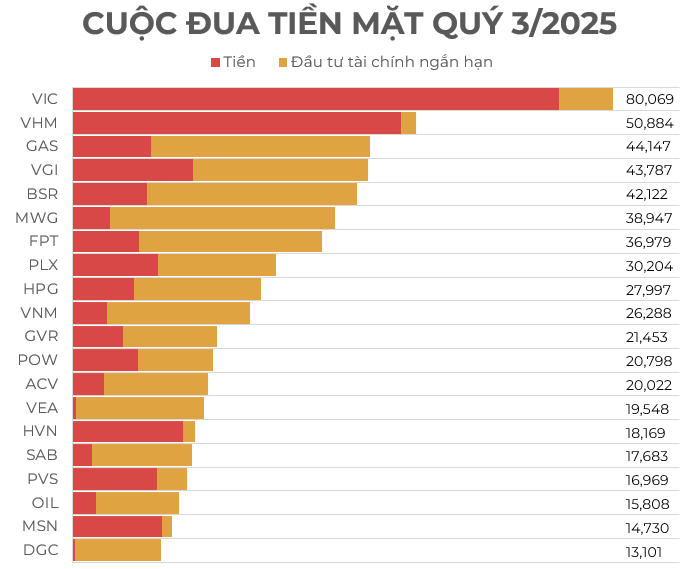

As of September 30, 2025, statistics reveal that 13 companies hold cash reserves (including cash, cash equivalents, and short-term deposits) exceeding 20 trillion VND. Collectively, these companies boast a staggering 484 trillion VND in cash holdings.

Source: VietstockFinance

|

Vingroup (HOSE: VIC) maintains its dominant position with a record-breaking 80.069 trillion VND in cash and short-term financial investments, predominantly in pure cash. Notably, VIC has established a substantial lead of nearly 30 trillion VND over the second-ranked company.

In addition to its substantial cash reserves, Vingroup achieved a historic milestone, surpassing 1 million trillion VND in total assets (equivalent to over 41 billion USD) as of September 30, 2025, reflecting a 30% increase since the beginning of the year.

Vinhomes (VHM), a Vingroup subsidiary, secured the second position with 50.884 trillion VND, a significant increase of approximately 20.4 trillion VND compared to the start of the year.

PV Gas (GAS) unexpectedly overtook Viettel Global (VGI) to claim the third spot with 44.147 trillion VND, primarily from short-term financial investments. VGI slipped to fourth place with 43.787 trillion VND, evenly distributed between cash and short-term investments.

Binh Son Refining and Petrochemical (BSR) maintained its strong position in the top 5 with 42.122 trillion VND. The Gioi Di Dong (MWG) ranked sixth with 38.947 trillion VND, followed by FPT with 36.979 trillion VND.

Among the top 10 companies, Petrolimex (PLX) and Hoa Phat (HPG) held 30.204 trillion VND and 27.997 trillion VND, respectively. Vinamilk (VNM) secured the tenth position with 26.288 trillion VND.

The top 20 list also features prominent companies such as PLX, HPG, VNM, GVR, POW, ACV, VEA, HVN, and SAB.

– 12:00 PM, November 17, 2025

Surprise Powerhouse Injects Nearly $52 Million to Scoop Up Vietnamese Stocks in Final Week’s Session

Proprietary trading desks at securities companies unexpectedly turned net buyers on the Ho Chi Minh Stock Exchange (HOSE), scooping up a staggering VND 1.195 trillion worth of shares.