After four consecutive weeks of decline with dwindling liquidity, the VN-Index briefly dipped below the psychological threshold of 1,600 points early in the week, only to swiftly rebound and close above 1,635 points by week’s end. Commenting on market dynamics, Mr. Bùi Văn Huy, Deputy General Director of FIDT, suggested that the rally resembles a trend reversal rather than a classic bull trap, though conclusive evidence of a solid bottom remains elusive.

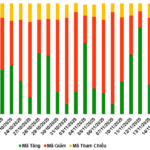

However, weekly trading volume plummeted nearly 20%, hitting a 20-week low, indicating tentative buying interest rather than robust, sustained inflows.

Technically, Huy noted the market is in a “bottom-fishing within a range” phase. The 1,600–1,610 range acts as near-term support, while 1,650–1,660 presents resistance for the upcoming week. The probability of a short-term bottom forming around 1,580 is rising, though volatility may persist if adverse news emerges.

Behaviorally, the market reflects cautious optimism, attempting to exit a downtrend rather than exhibiting a pump-and-dump pattern.

The most significant headwind remains foreign investor activity and global conditions. Last week saw no net foreign buying, with focus on banking stocks (STB, HDB, MBB, CTG, VCB) and select blue chips. Meanwhile, U.S. equities and major markets underwent their sharpest correction in over a month due to rate hike concerns, tempering domestic investor sentiment. The VN-Index’s low-volume recovery amid this backdrop signals a rational post-oversold bounce, not yet a reliable uptrend catalyst.

For the week of November 17–21, experts anticipate range-bound movement between 1,660–1,690, favoring consolidation over breakout. International market risks could test the 1,600 or 1,580 levels, but Huy views this as part of base-building rather than a prolonged downtrend resumption. Levels around 1,600 or slightly lower present buying opportunities ahead of the new year’s potential upswing.

Given narrow-range bottom-fishing and thin liquidity, Huy recommends maintaining a balanced equity exposure of 40–50%, avoiding leverage, and prioritizing capital preservation for deeper pullbacks rather than chasing intraday gains in an unclear trend environment.

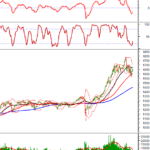

Technical Analysis for the Afternoon Session of November 17: Maintaining a Positive Outlook

The VN-Index continues its upward trajectory, decisively breaking above the Bollinger Bands’ Middle line. Meanwhile, the HNX-Index demonstrates even greater momentum, extending its winning streak to a fifth consecutive session.

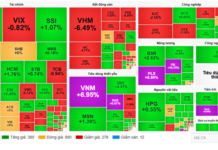

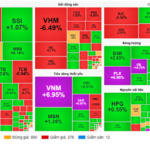

Market Pulse 11/17: Real Estate Sector Drives Gains, VN-Index Continues Recovery

At the close of trading, the VN-Index surged by 18.96 points (+1.16%), reaching 1,654.42 points, while the HNX-Index climbed 1.08 points (+0.4%), settling at 268.69 points. Market breadth favored the bulls, with 486 advancing stocks outpacing 238 decliners. Similarly, the VN30 basket saw a dominant green trend, with 28 gainers and only 2 losers.

Fastest Capital-Raising Real Estate Firm Set to List on HoSE

The Ho Chi Minh City Stock Exchange (HoSE) has recently received the listing application for 200 million RGG shares from Regal Group Joint Stock Company. Prior to this, Regal Group successfully offered 20 million shares to existing shareholders at a price of 10,000 VND per share, increasing its chartered capital from 1.8 trillion VND to 2 trillion VND.