Hope Emerges After a Period of Market Neglect

The tariff shock in April 2025 significantly impacted industrial zone (IZ) stocks, which had previously benefited directly from FDI and industrial production activities.

During mid-year periods, IZ stocks often fell off analysts’ recommendation radars due to uncertainties stemming from global trade tensions.

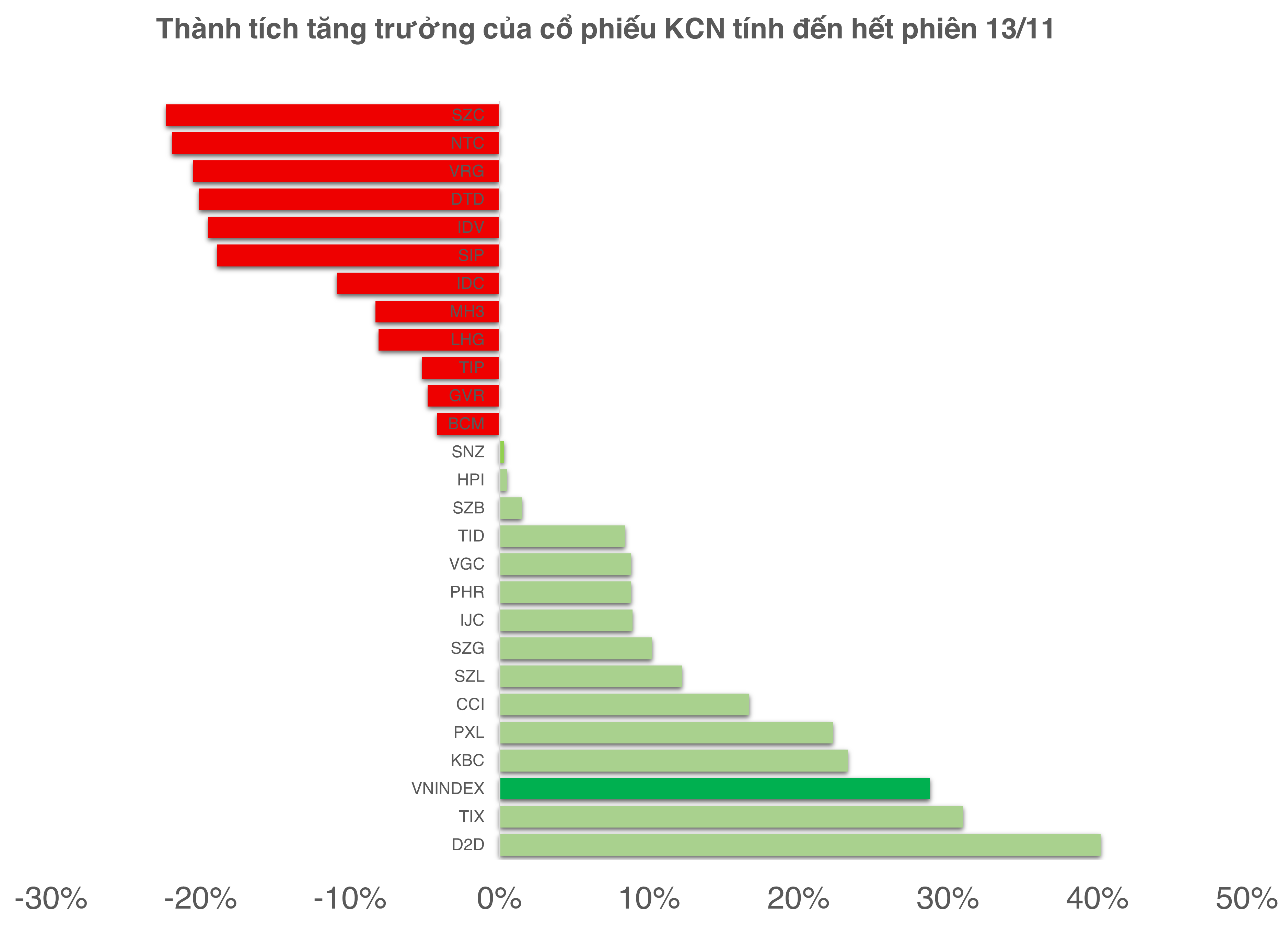

Now, after more than seven months, recovery signs remain weak compared to the recent surge of the VN-Index.

|

Among 26 listed IZ stocks, only two outperformed the VN-Index (+28.8%) as of November 13: Urban and Industrial Zone No. 2 Development JSC (D2D, +40.2%) and Tan Binh Investment and Trading JSC (TIX, +31%).

Other notable performers include Kinh Bac City Development JSC (KBC, +23.3%) and Long Son Petroleum Industrial Zone Investment JSC (PXL, +22.3%). However, most IZ stocks underperformed the broader market.

Weakness was evident in SZC (-22.3%) and NTC (-21.9%), while major players like BCM (-4.2%) and GVR (-4.8%) left pre-April investors underwater.

Notably, NTC failed to capitalize on its recent uplisting. Since October 28, NTC has officially traded on the HOSE, completing its transition from UPCoM.

Despite market corrections post-upgrade, glimmers of hope have emerged for IZ stocks.

Rather than deepening the market downturn, IZ stocks maintained over 40% of codes in long-term uptrends, a ratio that improved post-November 13.

A Challenging Year, But Not Without Bright Spots

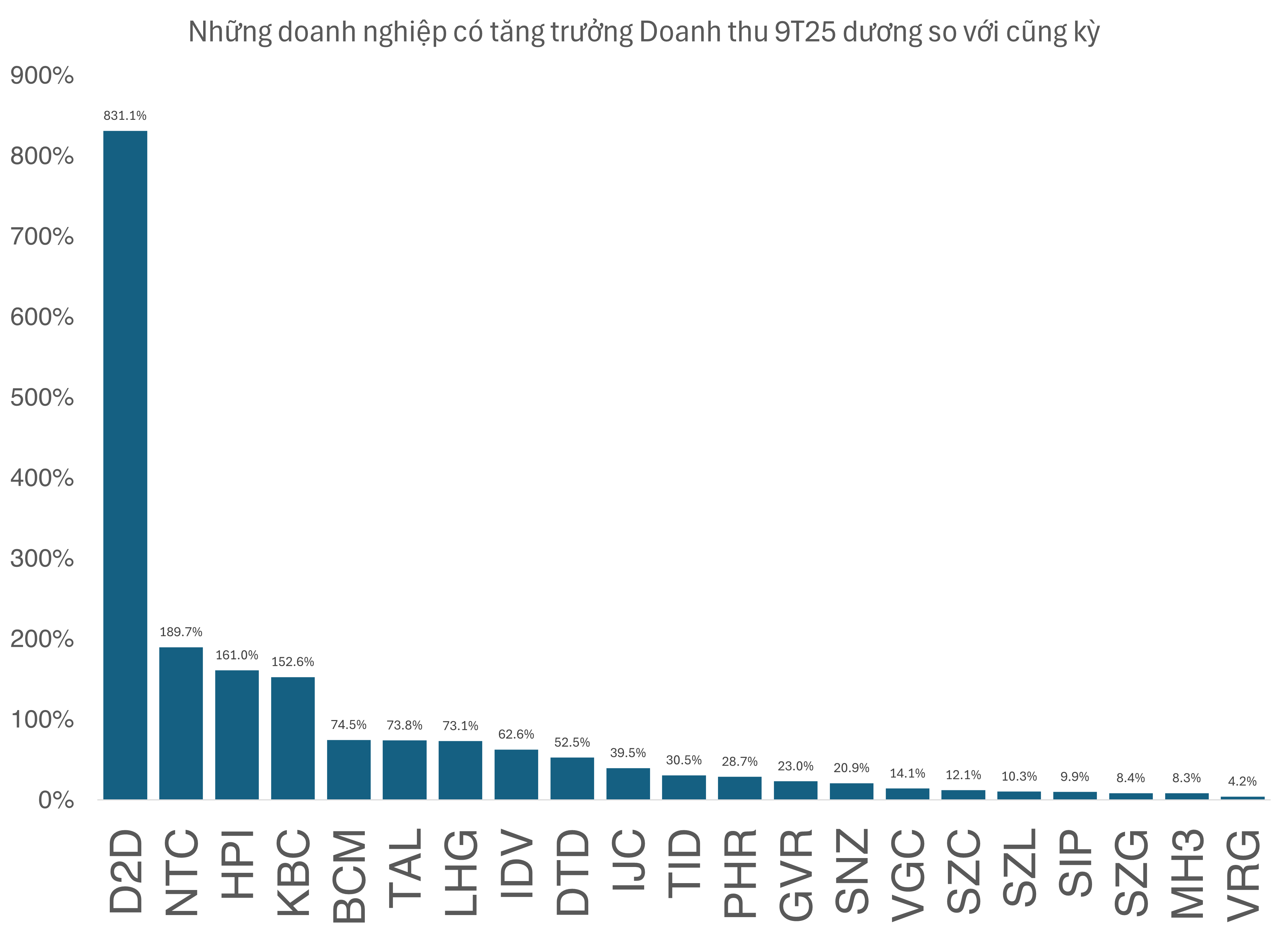

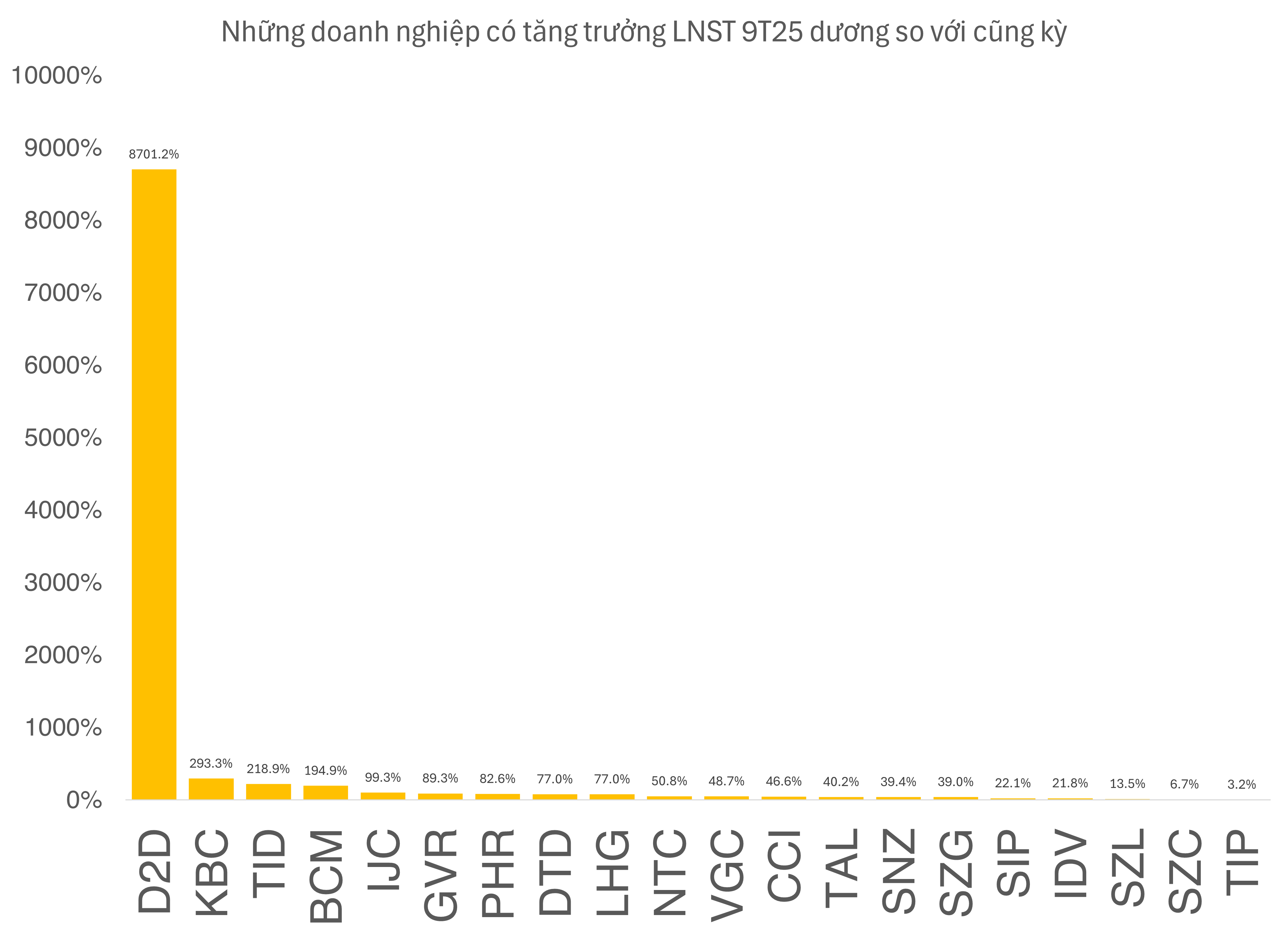

Q3 reports revealed positive highlights for some IZ companies. Notably, KBC (+153%), NTC (+190%), and D2D (+831%) reported significant revenue growth in 9M2025, with D2D benefiting from a land transfer in Chau Duc IZ.

These figures underscore the ongoing impact of land leasing and infrastructure transfers on IZ operations.

|

Kinh Bac Urban Development Corporation (KBC) reported 9M2025 net profit of VND 1,563 billion, 3.9x YoY, driven by revenue recognition.

Becamex IDC Corporation (BCM) also reported strong 9M2025 results, with revenue up 74.4% and net profit tripling YoY.

BCM‘s profit was bolstered by a 117.8% increase in associate income (VND 530 billion), thanks to strong growth from IJC, BW Industrial, and Becamex Binh Phuoc.

In Q3 alone, IJC reported VND 254 billion in net profit, 3x YoY, driven by the handover of Sunflower Expansion and IJC Hoa Loi projects.

|

Another VN30 constituent, Vietnam Rubber Group (GVR), also posted solid growth.

GVR projects FY2025 revenue and pre-tax profit of VND 32 trillion and VND 6.9 trillion, respectively, exceeding targets by 3% and 19%, implying 24% profit growth versus 2024.

FDI data for 10M2025 showed registered capital of USD 31.5 billion (+15.6% YoY) and disbursed FDI of USD 21.3 billion (+8.8%).

Vietcap Securities noted, “Vietnam’s fundamental advantages—geographic location, skilled labor, competitive wages, FTAs, and recent diplomatic upgrades—should continue supporting long-term FDI inflows.”

The latest PMI report highlighted the first export order recovery in a year, signaling potential export growth in coming months amid rising holiday demand.

Bui Van Huy, Deputy Chairman and Head of Research at FIDT, stated, “Industrial real estate and logistics are driven by strong FDI, rising demand for industrial land and warehousing. Investors should focus on companies with clean land banks, attractive leasing rates, and clear legal status.”

He emphasized that domestic factors remain key variables, urging short-term investors to carefully select entry points.

– 08:00 17/11/2025

Stock Market Rebounds After 200-Point Plunge: Genuine Bottom or Just a “Bull Trap”?

To signal a clear trend reversal, the index must consistently remain above the 1,650-point threshold, which is considered the critical level confirming a shift in market direction.

Stock Market Liquidity Continues to Hit New Lows

Throughout today’s trading session (November 6th), the VN-Index predominantly fluctuated in negative territory. Despite briefly recovering to the reference level towards the close, the benchmark index struggled to maintain momentum. During the afternoon session, as T+ stocks became available for trading, sellers remained cautious, refraining from aggressive selling. This hesitation reflects the subdued sentiment surrounding short-term trading opportunities, which currently offer limited profit potential.