These are notable insights from experts during the Vietstock LIVE program on November 14th, addressing the question of whether to “trade stocks, hold real estate, or store gold.”

Two Factors Continue to Drive Gold Prices Up in the Medium to Long Term

From a technical perspective, gold embarked on a strong upward trend from the end of Q1 2024, peaking in Q3 2025 with a surge from $3,300/oz to over $4,000/oz. According to Mr. Nguyễn Quang Minh, Director of Research at Vietstock, the intriguing aspect is that the MA50 and MA100 lines are providing excellent support. Currently, gold has tested the support level and is likely to witness another upward movement through Q1 2026.

Mr. Nguyễn Quang Minh sharing at the Vietstock LIVE program on November 14th

|

As per statistics from Mr. Vũ Duy Khánh, Director of SmartInvest Securities Analysis Center (AAS), historically, when money supply expanded, the ultimate safe-haven asset was US government bonds. However, central banks are now increasing their gold purchases. Previously, they bought 300-500 tons annually, but in the last three years, this has risen to around 1,000 tons. This year, the largest buyer is Turkey with approximately 500 tons, followed by China.

There are two key factors to monitor when assessing gold trends. First, if global M2 money supply continues to rise, gold prices will be supported as it remains a destination for capital flow. Second, if the gold reserve ratio (previously around 28% but currently only about 4%) increases, gold prices will be strongly supported in the medium to long term.

In the shorter term, as gold has already risen over 50% since the beginning of the year, a technical correction may occur soon.

Mr. Vũ Duy Khánh sharing at the Vietstock LIVE program on November 14th

|

Real Estate Market May Face Risks from 2027

Regarding the current Vietnamese real estate market, Mr. Khánh believes it is mirroring the 2011-2013 period, with new real estate laws, apartment fever starting in Hanoi and gradually spreading south. Typically, the market will expand to provincial areas or new segments (previously Condotels). However, the key difference lies in the real estate credit-to-GDP ratio, which has increased from around 20% previously to about 30% now.

The Vietnamese real estate market shares similarities with China’s past. Structurally, China faced issues when real estate credit-to-GDP reached 40% (in 2019) and collapsed at 50% (in 2021). Thus, Vietnam may encounter risks if this ratio rises from the current 30% to 40%, potentially posing challenges in 2027-2028 if real estate credit growth remains unchanged.

In the short term, the market will remain vibrant in 2026, but investors should prioritize profit-taking or shift from medium to short-term holdings.

The SmartInvest expert also highlights that China’s market remains in crisis under a stricter policy environment than Vietnam. First, planning changes are difficult. Second, projects delayed beyond permitted timelines face increased taxes, impacting project NPV. Regarding future property sales, China previously allowed only 25% of projects to be sold in advance, and many provinces are now piloting a ban on this practice. Additionally, second-home purchases in China require higher equity.

Stock Market is Bottoming Out, Aiming for a More Consensus Uptrend

In another segment related to stock investments, Mr. Khánh notes that the market is forming a bottom. Valuations are supported by corporate profit growth, with a market P/E of around 13 times, which is acceptable.

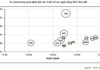

Furthermore, despite recent increases in deposit interest rates, the gap between market P/E and deposit P/E based on one-year rates remains relatively high at about 4 times. Typically, such a high gap indicates a bottoming phase for the market.

Analyzing recent market structure, the trend has been localized. Normally, the pattern is selective growth in wave 1, uniform growth in wave 3, and a final wave 5. “The market may be in correction wave 2 with some bottoming signals, such as immediate rebounds after dipping below 1,600 points, minimal selling pressure, and new capital inflows”—Mr. Khánh shared.

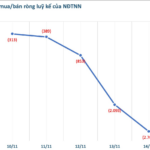

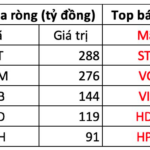

Comparing with the most recent strong uptrend in 2021, Mr. Khánh identifies key differences. Previously, individual investors absorbed all selling from institutions, proprietary traders, and foreign investors. Currently, especially since April, institutions have been net buyers while individual influence has diminished. This reduces future supply pressure as institutions tend to buy and hold.

– 13:58 17/11/2025

Afternoon of November 14th: Gold Ring Prices Continue to Decline

The price of gold rings at Bao Tin Minh Chau has dropped by an additional 500,000 VND per tael compared to earlier this morning.