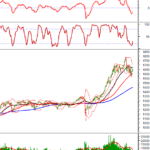

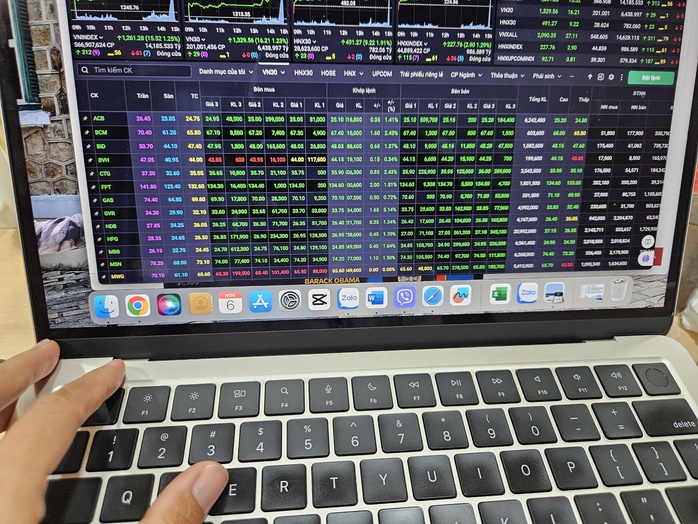

After four consecutive weeks of declining points and dwindling liquidity, the VN-Index experienced a positive recovery, closing at 1,635 points—a 2.27% increase from the previous week and above the psychological support level of 1,600 points. The VN30 index also ended the week up 2.57% at 1,871 points.

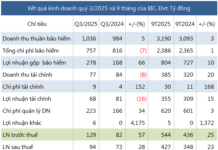

Market breadth showed a robust recovery, with most sectors rebounding after a period of adjustment and accumulation. Notable gains were seen in insurance, energy, agriculture, retail, securities, chemicals, construction, and industrial zones, where many stocks performed well with active trading volumes.

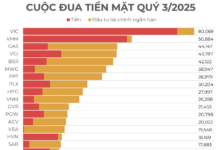

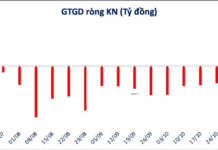

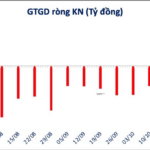

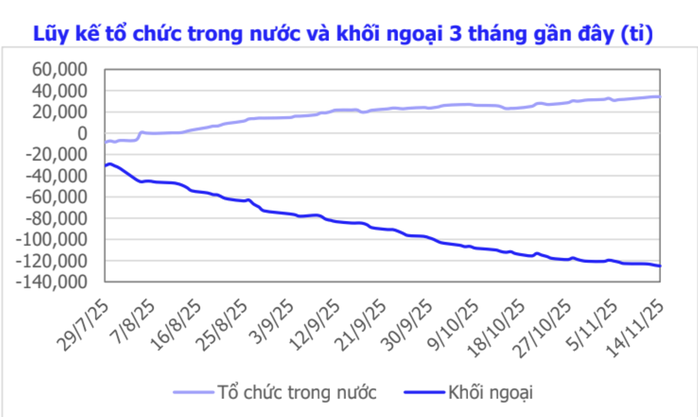

Overall market liquidity decreased, with trading volumes on HOSE dropping by 21% compared to the previous week, indicating strong divergence. However, improved capital flow shifted towards fundamentally strong stocks with positive business results. A notable downside was foreign investors’ continued net selling, totaling over 2,280 billion VND on HOSE—marking the 16th consecutive week of net outflows.

Many investors are optimistic about the market’s continued recovery after a prolonged period of “holding losses.” In reality, numerous investors report significant portfolio drawdowns ranging from 20% to 30%.

Investors await a breakout session to confirm the renewed uptrend.

According to Dinh Viet Bach, an analyst at Pinetree Securities, last week’s recovery was fueled by two key developments: the National Assembly’s target of achieving 10% GDP growth by 2026 and positive signals from FTSE Russell and Vanguard regarding investment in Vietnam’s upgraded stock market.

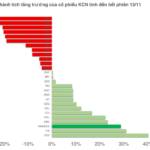

Capital flow shifted noticeably from large-cap stocks to mid- and small-cap sectors that had previously lagged, such as energy, chemicals, fertilizers, and industrial zones. Conversely, previously leading large-cap groups, including VinGroup, banking, and securities, underperformed.

“Despite continued foreign net selling, market sentiment stabilized as the VN-Index recorded four consecutive recovery sessions, closing near 1,635 points. Next week, the market anticipates a Follow-Through Day (FTD) to confirm whether the VN-Index can enter a new uptrend. If this positive scenario materializes, mid-cap stocks are likely to lead the rally,” stated Mr. Bach.

While foreign investors persist in net selling, domestic institutional investors are net buying. Source: CSI

SHS Securities notes that the VN-Index’s short-term trend is recovering and reaccumulating after the recent correction. Key factors to monitor include still-weak liquidity and ongoing market volatility, with potential retests of the 1,610 support level. However, expectations of new capital inflows from investment funds—especially following FTSE Russell’s updated eligibility list post-upgrade—could sustain the VN-Index’s recovery. This presents a favorable opportunity for investors to consider allocation and increased exposure.

Regarding specific stock groups, CSI Securities advises investors to allocate smaller positions during broader market corrections and gradually increase exposure as profits materialize in mid-cap sectors that outperformed last week, such as energy, chemicals, retail, and construction.

Will the Stock Market Shift Gears Next Week?

The VN-Index continued its recovery last week, though investor sentiment remained cautious with subdued trading volumes. Despite this, positive signals emerged in select stock groups, attracting bottom-fishing demand. Analysts advise investors to position for a potential trend reversal once recovery signals are confirmed, while maintaining a cash reserve to capitalize on emerging opportunities.

Where Do Industrial Zone Stocks Stand 7 Months After the Tariff Shock?

Following the tariff shock in April 2025, which directly impacted the industrial zone (IZ) sector, many stocks remain undervalued. However, as the broader market enters a correction phase post-upgrade wave, signs of recovery are emerging for these once-overlooked shares.

Market Pulse 11/17: Real Estate Sector Drives Gains, VN-Index Continues Recovery

At the close of trading, the VN-Index surged by 18.96 points (+1.16%), reaching 1,654.42 points, while the HNX-Index climbed 1.08 points (+0.4%), settling at 268.69 points. Market breadth favored the bulls, with 486 advancing stocks outpacing 238 decliners. Similarly, the VN30 basket saw a dominant green trend, with 28 gainers and only 2 losers.