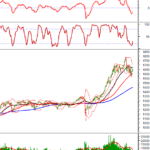

The VN-Index demonstrated a robust recovery last week, climbing 2.27% to reach 1,635 points. This positive momentum was bolstered by FTSE Russell’s announcement regarding Vietnam’s increased weighting in the FTSE Emerging Markets Index, alongside the addition of new leading stocks to the index.

Several banking, real estate, and securities stocks, which had previously experienced deep discounts during the recent downturn, are now showing signs of recovery. Investors are actively seeking opportunities in stocks with short-term growth potential, such as MCH, PVD, NVL, and DGC.

The VN-Index maintained its recovery trend last week, although investor sentiment remains cautious.

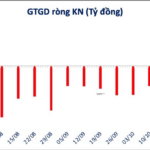

Meanwhile, foreign investors net sold VND 2,297 billion on HoSE, primarily in STB, VCI, and HDB. Conversely, VNM saw significant net buying, along with HPG and FPT. Liquidity continued to decline compared to the previous week, reflecting a cautious market sentiment. The index is expected to experience short-term volatility as it approaches the technical resistance zone of 1,640–1,645 points, with immediate support at 1,620 points.

According to Dinh Viet Bach, an analyst at Pinetree Securities, a key market driver is the National Assembly’s ambitious target of achieving a 10% or higher GDP growth rate by 2026, signaling a strong commitment to comprehensive reforms. The market has also responded positively to favorable signals from FTSE Russell and Vanguard following the recent upgrade.

During a meeting with the State Securities Commission in Melbourne, representatives from Vanguard, a global fund managing nearly USD 13 trillion, announced plans to open trading and indirect capital accounts in Vietnam, marking a significant step toward increased investment post-upgrade. Additionally, FTSE’s projection of 28 companies meeting upgrade criteria and the reduction in foreign net selling pressure are providing crucial support.

Pinetree’s experts view the current low liquidity as a positive sign, indicating that supply pressure has eased. Meanwhile, bottom-fishing investors, particularly in banking and securities sectors, have realized short-term gains, with no stocks breaking previous lows.

Vietcombank Securities (VCBS) analysts noted that the VN-Index’s 36-point recovery last week was driven by large-cap stocks and individual stocks with unique growth stories attracting significant investment.

VCBS advises investors to hold onto stocks maintaining strong upward trends while exploring short-term opportunities in sectors attracting speculative capital, such as real estate, chemicals, and construction.

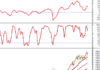

Meanwhile, BETA Securities experts describe the market as being at a crossroads, emphasizing the need for caution without complete withdrawal. Despite cautious sentiment, positive signals are emerging as certain stock groups attract bottom-fishing demand.

This phase demands flexibility, careful observation, and avoidance of aggressive trading. Investors are advised to probe investments in deeply discounted zones rather than chasing falling prices. Anticipating a trend reversal upon confirmed recovery signals is recommended, while maintaining cash reserves for emerging opportunities.

VN-Index Rebounds Unexpectedly Amid Low Liquidity: Is This the Bottom or Just a Bull Trap?

Experts suggest that last week’s market movements paint a picture of cautious optimism, with investors tentatively stepping out of a bearish trend rather than falling prey to a fleeting bull trap characterized by rapid inflation followed by immediate sell-offs.

Market Pulse 11/17: Real Estate Sector Drives Gains, VN-Index Continues Recovery

At the close of trading, the VN-Index surged by 18.96 points (+1.16%), reaching 1,654.42 points, while the HNX-Index climbed 1.08 points (+0.4%), settling at 268.69 points. Market breadth favored the bulls, with 486 advancing stocks outpacing 238 decliners. Similarly, the VN30 basket saw a dominant green trend, with 28 gainers and only 2 losers.

Market Pulse 17/11: Uptrend Narrows, Buyers Maintain Dominance

As of 10:30 AM, major indices showed signs of narrowing their gains. The VN-Index rose by over 7 points, trading around 1,642 points, while the HNX-Index saw a slight increase, hovering near 268 points.

Fastest Capital-Raising Real Estate Firm Set to List on HoSE

The Ho Chi Minh City Stock Exchange (HoSE) has recently received the listing application for 200 million RGG shares from Regal Group Joint Stock Company. Prior to this, Regal Group successfully offered 20 million shares to existing shareholders at a price of 10,000 VND per share, increasing its chartered capital from 1.8 trillion VND to 2 trillion VND.