At the event “Riding the Eastern Wave of Saigon – Golden Opportunity for Hanoi Investors” held on November 16th in Hanoi, Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, asserted that the real estate market bordering the eastern part of Ho Chi Minh City is entering a phase of distinct movement. A new investment cycle with a long-term vision is opening up in areas like Bien Hoa and Long Thanh, thanks to their vast land reserves, synchronized infrastructure, and attractive rental yields.

Launchpad from Consolidation Strategy and Public Investment

The expert analyzed that following the historic administrative merger, Ho Chi Minh City and Dong Nai are demonstrating positive development potential within the Southeast region.

The formation of the new Ho Chi Minh City (comprising Ho Chi Minh City, Ba Ria – Vung Tau, and Binh Duong) and the new Dong Nai (including Dong Nai and Binh Phuoc) is not merely an expansion of administrative boundaries but a consolidation of strengths to create a key economic region. Post-merger, Ho Chi Minh City’s GRDP reached over 2.7 million billion VND (in 2024), leading the nation, while Dong Nai ranked fourth with over 609 trillion VND.

The area bordering Dong Nai with Ho Chi Minh City has a low population density, ample land with low price levels, providing significant room for urban development. Additionally, public investment is being accelerated as a driver of economic growth. As of September 2025, Ho Chi Minh City has disbursed 50% of public investment capital, and Dong Nai has achieved 35%.

Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, speaking at the event.

Dong Nai holds a strategic position in the expanded urban landscape and logistics network of ports and airports east of Ho Chi Minh City. A series of key infrastructure projects are gradually transforming the eastern area, including: Long Thanh International Airport, Cai Mep – Thi Vai Port, Bien Hoa – Vung Tau Expressway, Ho Chi Minh City – Long Thanh – Dau Giay Expressway, Cat Lai Bridge, Phu My 2 Bridge, Dong Nai 2 Bridge, and the Thu Thiem – Long Thanh railway line…

Dong Nai – The New Focal Point of Eastern Capital Flow

The synergy between regional planning, infrastructure, and urbanization is driving the shift of investment capital to the east.

According to data from Batdongsan.com.vn, as of September 2025, interest in Dong Nai real estate increased by 21%, double that of the eastern area of Ho Chi Minh City and far surpassing other regions.

Real estate in the eastern region sees growing interest, particularly in Dong Nai.

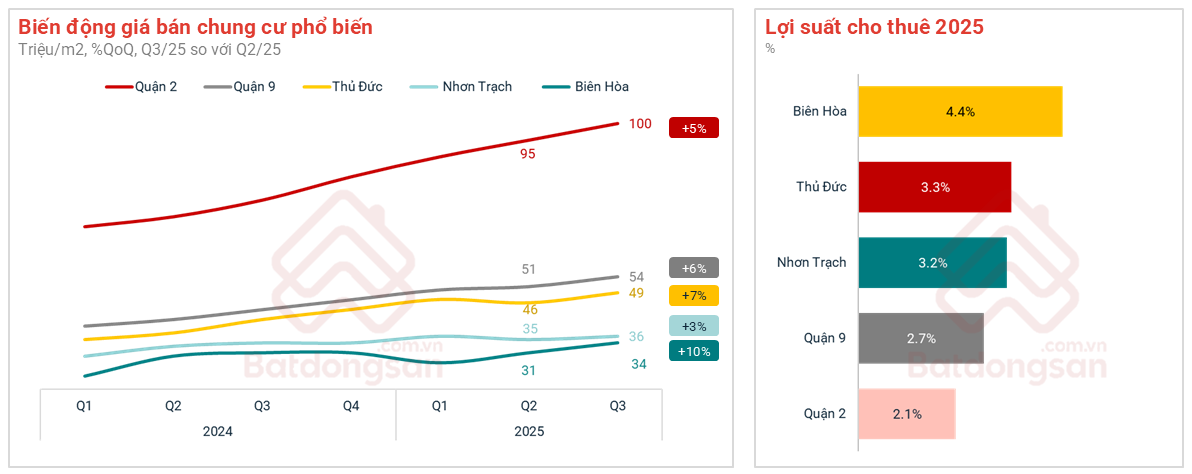

Another highlight of the real estate market bordering the eastern part of Ho Chi Minh City is the rental yield for apartments. While District 2 achieves 2.1%, District 9 around 2.7%, and Thu Duc 3.3%, Bien Hoa leads with 4.4%, followed by Nhon Trach at 3.2%.

Bien Hoa leads in rental yields in the eastern region.

This demonstrates the actual profit potential of the Bien Hoa market in Dong Nai, not only for long-term holding but also for short-term cash flow through rentals, a factor attracting investor attention in a market seeking high liquidity.

In the land plot segment, the eastern market of Ho Chi Minh City is also recovering. Interest in this area in September 2025 increased by 6% compared to April 2025, higher than the West (+3%) and the North (+5%), contrasting with the decline in the South.

Specifically in Bien Hoa and Long Thanh, the asking prices in Q3/2025 ranged from 16 to 23 million VND/m², up 5-7% from Q1/2025. Compared to the average price of 130 million VND/m² in central Ho Chi Minh City, this gap indicates significant growth potential.

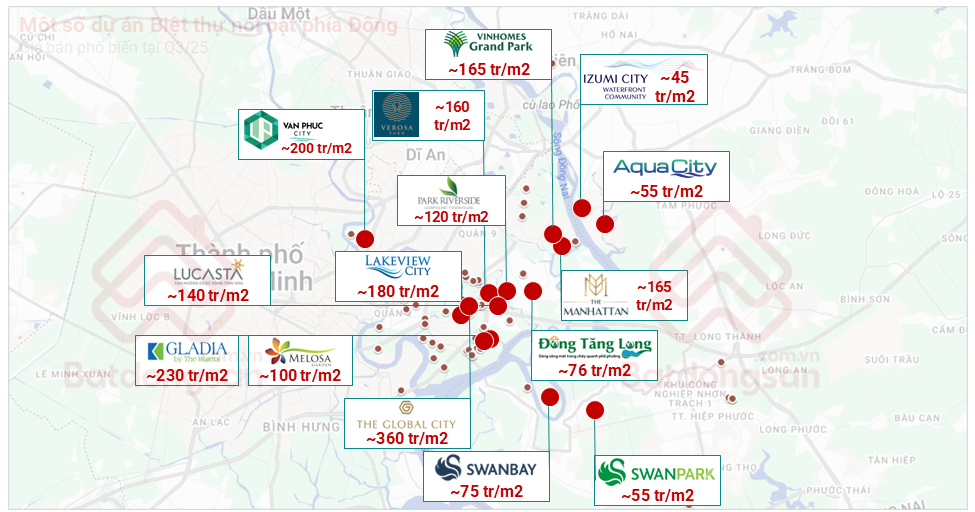

Price levels of projects in the eastern area of Ho Chi Minh City belonging to Dong Nai.

For low-rise properties in urban areas, interest in Bien Hoa – the eastern border area of Ho Chi Minh City, increased by 58% in Q3/2025 compared to the previous quarter.

The price level for low-rise properties in central Ho Chi Minh City is slightly decreasing and remains at 248 million VND/m². Meanwhile, the price level for low-rise properties in Dong Nai – bordering the eastern part of Ho Chi Minh City, fluctuates around 55 million VND/m² and still increased by 6% compared to Q1/2023.

Some urban areas still offer attractive price points, such as Izumi City (Long Hung, Dong Nai) with a scale of nearly 170 hectares, currently priced at around 45 million VND/m².

According to Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, in the short term, investors should prioritize areas where urban development is already evident, with potential for rental exploitation or meeting real housing needs. In the long term, infrastructure progress and urbanization speed will determine the actual value of the eastern region in the next development cycle.

“In reality, as land prices in central Ho Chi Minh City continue to rise and land reserves become increasingly limited, the trend of population dispersion and investment expansion to the outskirts is inevitable. Among these, Dong Nai, as the gateway connecting the Southeast region, holds a ‘three-in-one’ advantage: low land prices, accelerated infrastructure, and high rental yields,” the expert concluded.

Proposed Capital Increase for Bến Thành – Tham Lương Metro Line to VND 52 Trillion

The proposed investment for the 11-kilometer railway line has been revised upward from 47.890 trillion VND to 52.047 trillion VND. This adjustment accounts for expanded construction scope, technology upgrades, and inflationary impacts.

Free Health Insurance for Students and Seniors Over 65 in Ho Chi Minh City

At its 5th session on November 14th, the Ho Chi Minh City People’s Council passed a resolution outlining financial support for health insurance premiums for both seniors and students residing in the city. This initiative allocates nearly 2 trillion VND to provide free health insurance coverage for over 2 million students and more than 530,000 individuals aged 65 and above.

Ho Chi Minh City Expands Special Incentive Policy, Offering 1 Billion VND in Rewards

The Ho Chi Minh City People’s Council has unanimously approved a special incentive policy to attract top experts, scientists, and talented individuals across the city following its consolidation.

Unlocking Homeownership: How Young Buyers Are Gaining an Edge in the Year-End Market

Many young individuals are now able to purchase homes with the support of their parents, grandparents, or by taking advantage of developer incentives and favorable financial policies. These opportunities empower them to make the decision to invest in property sooner rather than waiting to accumulate sufficient savings.