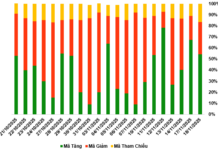

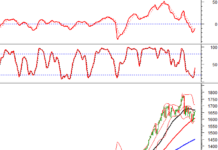

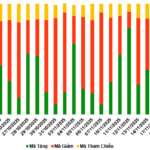

Market sentiment saw a positive upswing during the first session of the week on November 17th. The VN-Index opened with a price gap, maintaining an upward trend throughout the session. By the close, the VN-Index had risen by 18.96 points (+1.16%) to reach 1,654.42 points. Foreign trading activity remained a downside, with net selling totaling 979 billion VND.

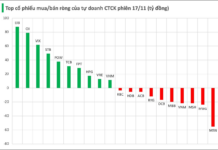

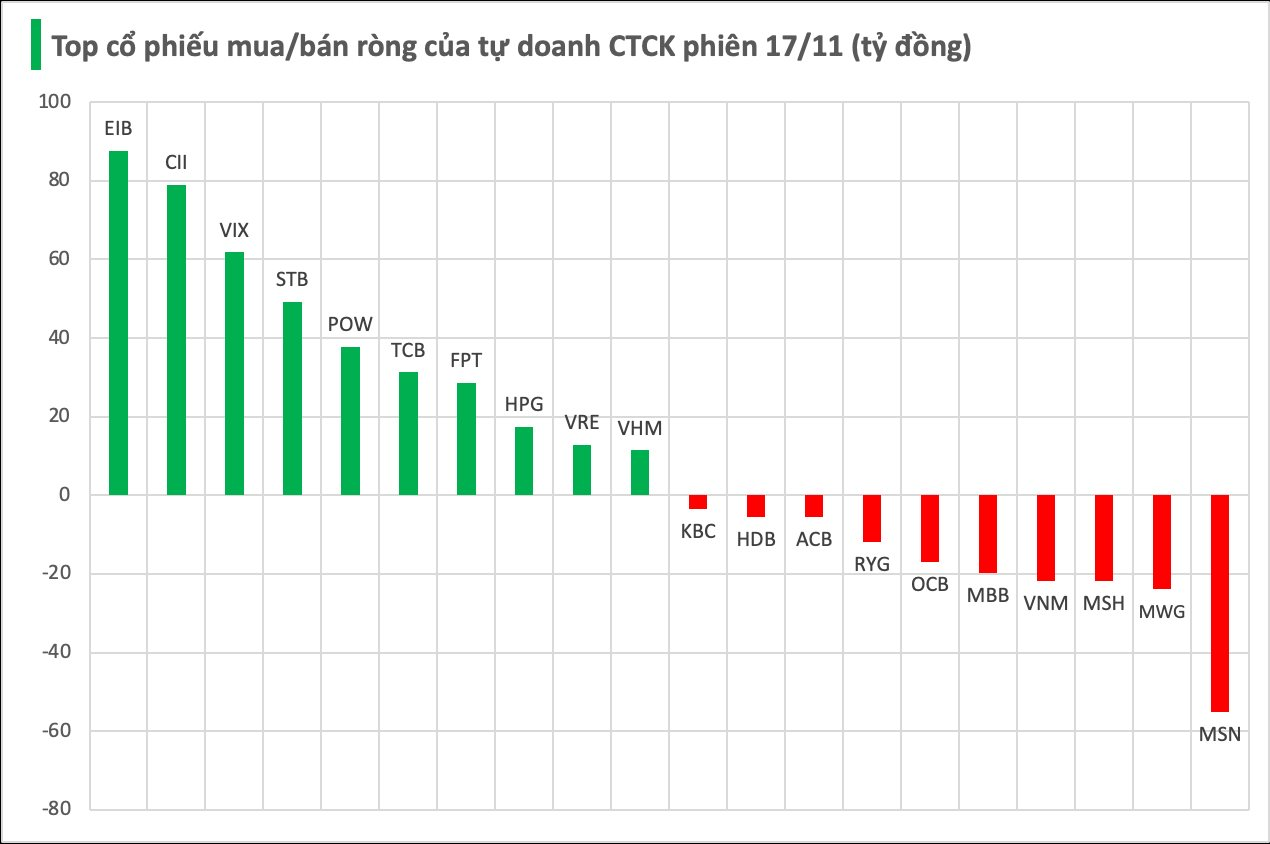

Securities firms continued their net buying streak, acquiring 247 billion VND worth of stocks on HOSE.

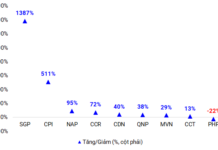

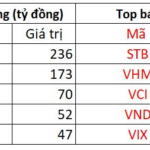

Specifically, EIB led the net buying list with 88 billion VND, followed by CII (79 billion), VIX (62 billion), STB (49 billion), POW (38 billion), TCB (31 billion), FPT (29 billion), HPG (17 billion), VRE (13 billion), and VHM (11 billion VND) – all among the top picks for securities firms’ net buying.

Conversely, MSN topped the net selling list with -55 billion VND, trailed by MWG (-24 billion), MSH (-22 billion), VNM (-22 billion), and MBB (-20 billion VND). Other notable net selling activities were observed in OCB (-17 billion), RYG (-12 billion), ACB (-5 billion), HDB (-5 billion), and KBC (-3 billion VND).

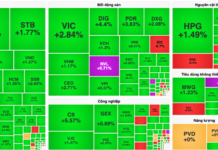

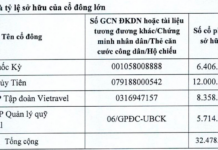

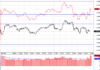

Foreign Block Continues Net Selling Spree, Offloading Nearly 1 Trillion VND as VN-Index Surges, with Heavy Dumping of a Banking Stock

Foreign investors’ trading activity remains a significant drawback, as they continued to offload substantial holdings across all three major exchanges.

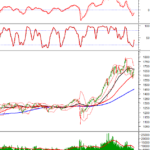

Will the Stock Market Explode Next Week After a Deep Circuit Breaker Halt?

The stock market has rebounded, instilling optimism among investors for a positive trend in the upcoming week.