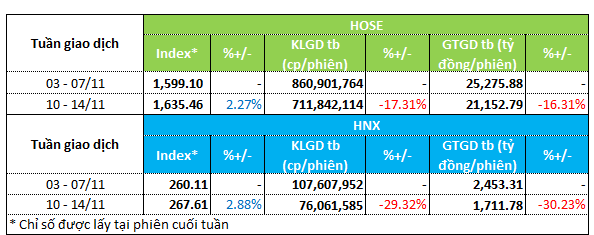

During the trading week of November 10-14, the market indices showed a positive recovery. The main indices on the HOSE and HNX exchanges performed well compared to the previous week, with the VN-Index rising 2.27% to 1,635.46 points and the HNX-Index climbing nearly 3% to 267.61 points.

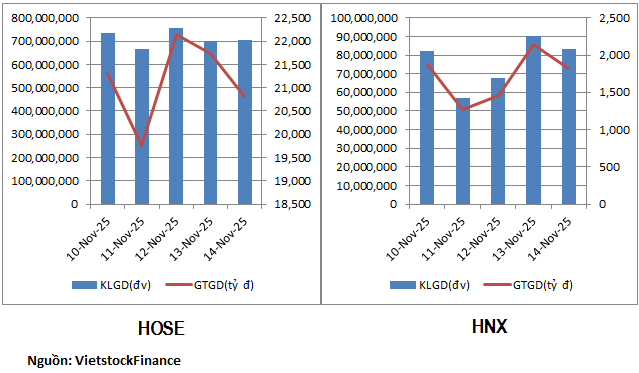

However, market liquidity weakened, with trading volumes on both exchanges remaining subdued compared to the previous week. On HOSE, trading volume decreased by over 17% to 711.8 million units, while trading value dropped 16% to VND 21.1 trillion per session. On HNX, liquidity fell by approximately 30%, with trading volume and value averaging 76 million units and VND 1.7 trillion per session, respectively.

|

Overview of Liquidity for the Week of November 10-14

|

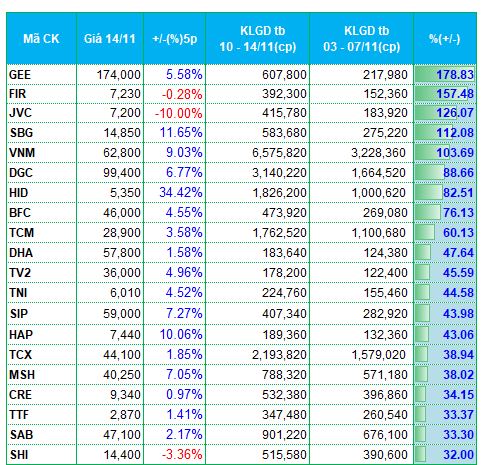

In a cautious market environment, no particular sector stood out in terms of attracting investment. Capital was dispersed among the top-performing stocks on both exchanges. Some stocks saw significant increases in trading volume, including GEE (up nearly 180% from the previous week), FIR (up nearly 160%), JVC (up nearly 130%), SBG (up over 110%), and VNM (up over 100%).

The textile and garment sector saw some notable performers, with stocks like TCM, MSH, and TNG experiencing trading volume increases ranging from 16% to 60%.

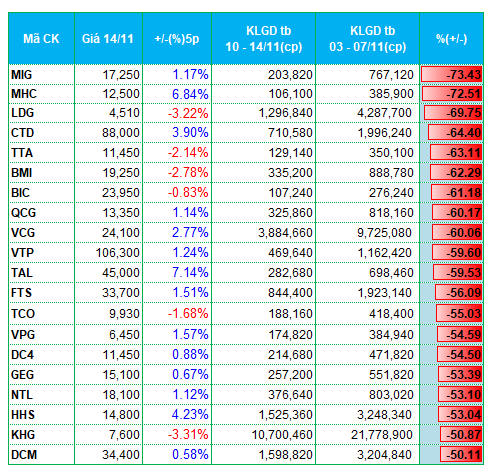

Conversely, several sectors experienced capital outflows during the week, including insurance, construction, and real estate.

In the insurance sector, many stocks saw significant declines in trading volume. MIG recorded a 70% drop to 204,000 units per session, while BMI and BIC saw decreases of 62% and 60%, respectively.

The real estate sector also witnessed reduced liquidity in stocks such as LDG, QCG, TAL, NTL, KHG, AAV, CEO, and API, with liquidity declines ranging from 37% to 70%.

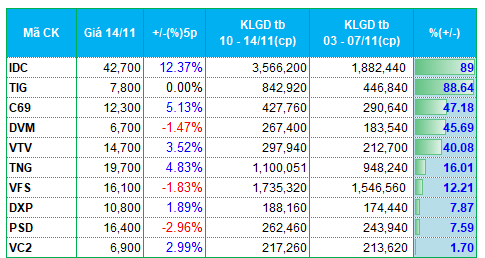

On the HNX exchange, securities stocks faced capital outflows, with IVS, SHS, BVS, and APS seeing average trading volume decreases of 42% to 58% compared to the previous week.

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HOSE

|

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HNX

|

The list of stocks with the highest liquidity increases and decreases is based on average trading volumes exceeding 100,000 units per session.

– 19:28 17/11/2025

Stock Market Soars in Spectacular Rally, Shares Universally Surge in Green and Purple

Liquidity on the HoSE (Ho Chi Minh City Stock Exchange) surged past VND 21,800 billion, marking the highest level in numerous recent sessions. This uptick underscores a gradual improvement in investor sentiment.