Coteccons Construction JSC (Stock Code: CTD, HoSE) has announced a Board Resolution approving the payment of the 2025 dividend in cash.

Specifically, Coteccons plans to distribute a 10% cash dividend to shareholders, meaning each shareholder holding one share will receive VND 1,000.

The final registration date for shareholders eligible for the dividend payment is December 2, 2025, with the expected payment date being December 22, 2025.

Illustrative image

With over 101.4 million CTD shares outstanding, Coteccons is estimated to pay approximately VND 101.4 billion in dividends. The payment will be sourced from the company’s undistributed after-tax profits.

Additionally, Coteccons has approved a plan to issue shares to increase its charter capital from the company’s equity.

The company plans to issue nearly 5.1 million bonus shares to shareholders at a ratio of 20:1, meaning every 20 shares held will entitle the shareholder to one new share.

The total issuance value, based on the par value, is over VND 50.7 billion, sourced from the Development Investment Fund in the audited 2025 standalone financial statements.

The issuance is expected to take place after the company receives the notification of receipt of the issuance report documents from the State Securities Commission (SSC).

If the issuance is successful, Coteccons’ total issued shares will increase from over 103.6 million to more than 108.7 million, raising the charter capital from over VND 1,036 billion to over VND 1,078 billion.

This share issuance plan is implemented in accordance with Resolution No. 07/2024/NQ-DHCD dated October 19, 2024 (Resolution 07) and Resolution No. 08/2025/NQ-DHCD dated October 20, 2025, which amends Resolution 07 of the Annual General Meeting of Shareholders.

In other news, in mid-October 2025, Coteccons announced a Resolution approving the issuance plan, capital use plan, and debt repayment plan from the proceeds of the 2025 public bond offering.

Coteccons plans to issue bonds with a maximum face value of VND 1,400 billion. The bonds are non-convertible, unsecured, and without warrants.

The expected number of bonds to be issued is 14 million, with a face value of VND 100,000 per bond, an expected interest rate of 9% per annum, and a term of 3 years.

Coteccons will offer the bonds to domestic and foreign organizations and individuals through a public offering via SSI Securities Corporation as the underwriter.

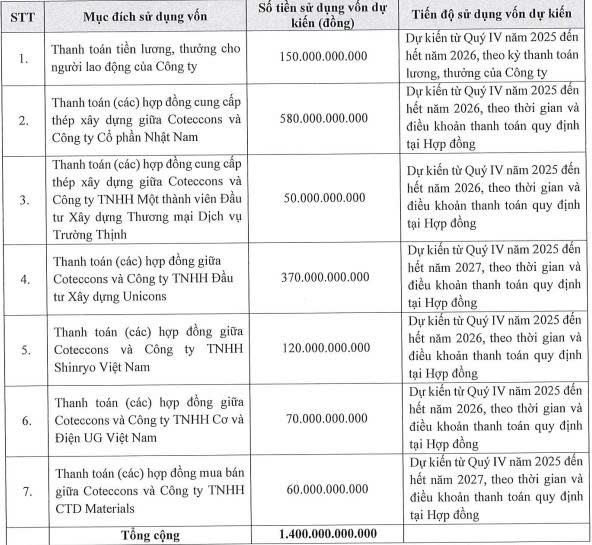

The proceeds will be used to supplement working capital for business operations, specifically to settle contracts and agreements with suppliers, subcontractors, and to pay wages and bonuses to employees. The detailed allocation is as follows:

Source: CTD

The issuance is expected to take place in Q4/2025 to Q1/2026, following the receipt of the Public Bond Offering Registration Certificate from the State Securities Commission (SSC). The specific issuance date will be determined by the Chairman of the Board of Directors.

PV

Who’s Behind the Tallest 2-Story Logistics Industrial Complex in Northern Vietnam?

With a total floor area exceeding 139,000 m² and a floor-to-floor height of 12.5 meters, this two-story logistics complex stands as the tallest of its kind in Northern Vietnam to date.