The State Bank of Vietnam has officially issued Circular 30/2025/TT-NHNN, amending and supplementing several regulations related to non-cash payment services. Effective from November 18, 2025, this circular marks a significant adjustment to align with the digital transformation and standardization of identity documents in financial transactions.

According to the new document, the list of valid identity papers has undergone notable changes compared to Circular 15/2024/TT-NHNN. Notably, Citizen Identity Cards (CMND) and Residence Cards are no longer considered valid documents for Vietnamese citizens when conducting non-cash payment transactions. This adjustment aims to unify and synchronize the citizen identification system according to new standards.

Instead, Vietnamese citizens can only use valid documents such as Citizen Identification Cards, identity cards, or electronic identification accounts for transactions. These documents must remain valid throughout the entire transaction process to prevent risks, information discrepancies, and ensure payment security.

The circular also introduces provisions for individuals of Vietnamese origin with undetermined nationality. Accordingly, the valid document for non-cash payment transactions is the Certificate of Vietnamese Origin issued by competent authorities. This is a significant update, providing a clearer legal basis for this group when accessing domestic financial services.

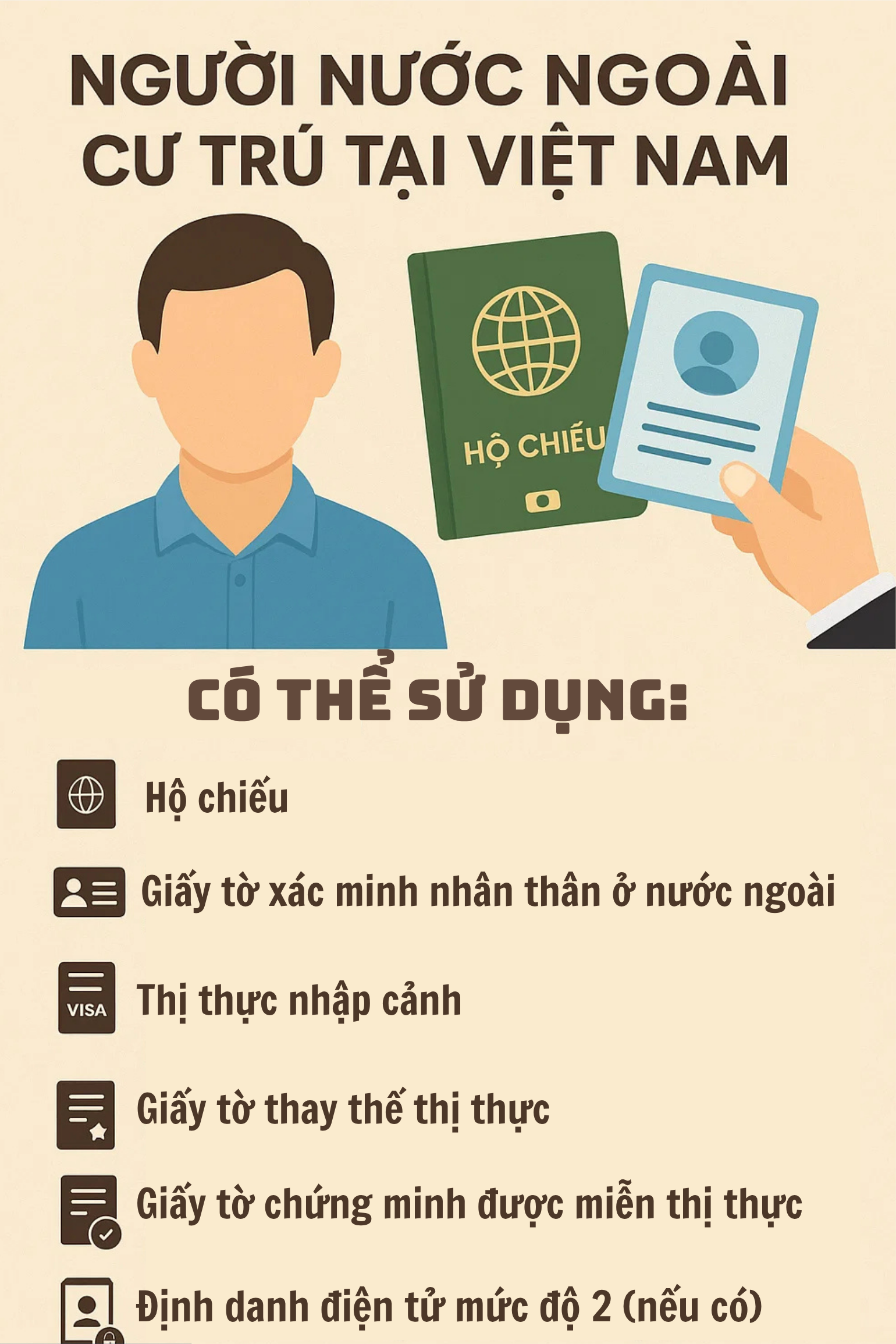

For foreigners residing in Vietnam, the State Bank allows the use of various identity verification documents, including: passports, documents issued by foreign authorities, documents related to entry visas, visa substitutes, documents proving visa exemption, or electronic identities through level 2 electronic identification accounts (if available).

Thus, Circular 30/2025/TT-NHNN not only eliminates outdated documents like CMND or Residence Cards for Vietnamese citizens but also expands and clarifies the list of valid documents for individuals of Vietnamese origin with undetermined nationality and foreigners.

Additionally, the circular emphasizes that all identity documents must remain valid throughout the use of non-cash payment services, ensuring legality and transaction security.

Governor Nguyễn Thị Hồng: Revised Deposit Insurance Law Draft Includes Both Flat and Differential Fee Provisions

According to the Governor, Vietnam currently operates under a flat-rate fee mechanism for deposit insurance. As conditions permit, the country may gradually transition to a differentiated deposit insurance fee structure. This shift aims to incentivize well-performing credit institutions by reducing their deposit insurance costs.

Unlocking Capital Solutions for Year-End Import-Export Growth

International trade activities in the first 10 months of the year have maintained a robust growth rate, serving as a key driver of economic expansion. To support this momentum, policy mechanisms, including monetary and credit policies, have been strategically focused on facilitating the growth and development of import-export businesses.

Biometric Verification Mandatory for Digital Wallets Starting January 1, 2026

Under the new regulations, e-wallet service providers are required to conduct in-person meetings with e-wallet owners and perform thorough identity verification checks. This process includes cross-referencing official identification documents and confirming the biometric data of the e-wallet owner to ensure accuracy and security.