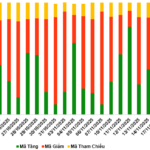

Market sentiment improved, driving a strong rally in the VN-Index during the first trading session of the week. The VN-Index closed the November 17th session up nearly 19 points (1.16%) at 1,654 points. Trading volume remained low, with transaction values on HOSE exceeding 21 trillion VND.

Foreign trading activity was a downside, with net selling reaching 979 billion VND.

On HOSE, foreign investors net sold 911 billion VND

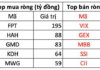

On the buying side, HPG was the most purchased stock by foreign investors on HOSE, with a value of over 236 billion VND. FPT followed closely, with 173 billion VND in purchases. Additionally, VNM and KDH were bought for 70 billion VND and 52 billion VND, respectively.

Conversely, STB was the most heavily sold stock by foreign investors, with 234 billion VND. VHM and VCI were also significantly offloaded, with 121 billion VND and 119 billion VND, respectively.

On HNX, foreign investors net sold 2 billion VND

On the buying side, PVS saw the strongest net purchases, with a value of 33 billion VND. HUT followed with 4 billion VND in net buys. Foreign investors also allocated a few billion VND to NRC, TIG, and VGS.

On the selling side, SHS faced the most significant foreign selling pressure, with nearly 33 billion VND. DTD followed with 5 billion VND, while CEO, IDC, and VFS were sold for a few billion VND each.

On UPCOM, foreign investors net sold 66 billion VND

On the buying side, PXL was purchased by foreign investors for 0.4 billion VND. F88 and CMF also saw net buys of a few billion VND each.

Conversely, MCH was net sold by foreign investors for 40 billion VND. Foreign investors also offloaded ACV, QNS, and other stocks.

Vietstock Daily November 18, 2025: Strengthening the Recovery Momentum

The VN-Index extended its recovery, breaking above the Middle Bollinger Band. The Stochastic Oscillator continued its upward trajectory, reinforcing the buy signal after exiting oversold territory. Similarly, the MACD indicator echoed this positive outlook, bolstering short-term optimism.