Precious Metals Surge Amid Global Turmoil

In recent trading sessions, global gold prices have soared to around $4,000 per ounce, even reaching $4,200 per ounce at times—marking a historic high. This unprecedented surge, as experts describe it, has driven domestic gold prices to a record level of approximately 154 million VND per tael, reflecting the dual impact of international volatility and the local market’s supply constraints.

Speaking to reporters, Dr. Nguyen Tri Hieu, Director of the Global Financial and Real Estate Market Research and Development Institute, commented: “This sharp rise is a vivid testament to the ‘flight to gold’ trend amidst the chaotic and highly unpredictable global economic and political landscape.”

Gold’s dramatic spikes are not merely technical market movements but rather a response from international capital seeking a safe haven amid widespread instability. This precious metal has officially outpaced traditional investment channels, becoming the top ‘defensive asset’ in the eyes of institutional investors.

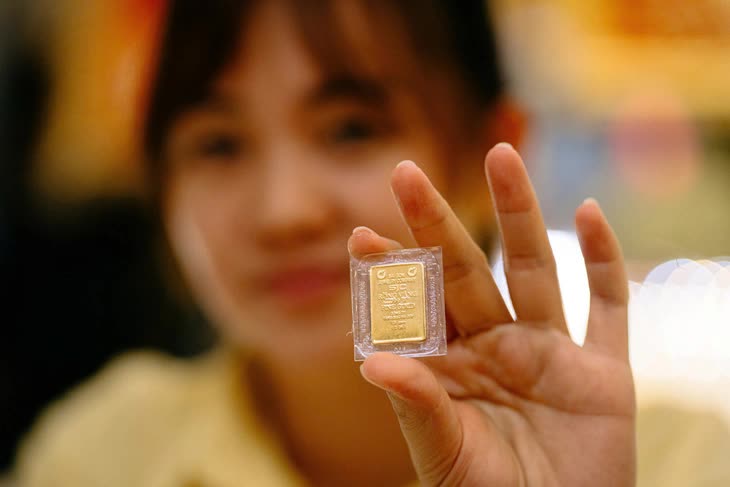

Gold remains a key trading and storage asset.

Why is gold attracting such massive capital inflows?

Economists assert that the rapid and sustained rise in global gold prices is supported by three robust macroeconomic pillars: escalating macro and geopolitical instability, accommodative monetary policies, and gold’s irreplaceable status as a safe-haven asset.

Firstly, macro and geopolitical instability is the most potent trigger. Dr. Hieu warns that the U.S. economy faces challenges with persistently high inflation (around 3%) coupled with a weakening labor market, raising the specter of stagflation. This scenario diminishes the appeal of risky assets like stocks, reinforcing gold’s role as a safe haven.

Additionally, prolonged trade tensions between the U.S. and major partners, along with unresolved geopolitical uncertainties, have severely eroded trust in the global fiat currency system. James Thorne, Ph.D. in Economics and Chief Market Strategist at Wellington Altus Private Wealth, bluntly states that the world is gradually “losing faith” in the current monetary system, compelling investors to view gold as a primary trading and storage asset. This shift is further evidenced by Trinh Ha, Strategist at Exness Investment Bank, who notes that the ratio between the S&P 500 index and gold prices is at a historic low, signaling a significant wave of capital moving from equities (risky assets) to gold (safe-haven assets), opening up substantial upside potential for the precious metal.

“Gold prices have far exceeded traditional valuation ranges, significantly increasing the risk of a correction. I believe buying at this level is no longer safe, especially for short-term investors,” remarked Tran Han Huy, a precious metals investor in Hanoi.

The second pillar is monetary policy and smart money flows from large institutions. According to Vu Duy Khanh, Director of the Analysis Center at SmartInvest Securities, gold is directly benefiting from the global trend of monetary expansion and easing. As central banks cut interest rates or maintain accommodative policies, the opportunity cost of holding non-yielding gold decreases significantly, making it an attractive alternative to low-yielding bonds and cash.

Most notably, central banks and large funds continue to aggressively accumulate gold at historic scales. J.P. Morgan Private Bank forecasts that strong buying from central banks in emerging economies is the primary driver of this price cycle, as many economies with budget surpluses seek to “reinvest” in the safest asset. This race to increase gold reserves shows no signs of slowing, creating sustained demand pressure and maintaining gold’s upward trajectory.

Interestingly, in certain individual markets, particularly Vietnam, domestic supply-demand dynamics have further complicated the gold price landscape, pushing the price gap between domestic and international markets to record highs and creating unique upward pressure on the local market. The shortage of official supply has heightened speculation, making investment and gold storage decisions for individuals and businesses more complex and risky than ever, contributing to the high domestic gold prices relative to global levels.

Will gold reach $5,000 per ounce by 2026?

Current realities indicate that major global financial institutions unanimously predict gold prices will continue to surge in 2026, with the upward trend potentially extending for another two years. Dr. Nguyen Tri Hieu offers an optimistic, even “shocking,” outlook: “I see no force capable of pulling gold prices down in the next 12 months.” He estimates that gold could reach $5,000 per ounce by 2026, and some other experts even target $10,000 per ounce before 2030.

Thus, gold will maintain its role as a safe-haven asset as long as significant risks persist, from geopolitical instability to inflation and monetary supply. However, Dr. Hieu also notes that after 2025—a period of frenzied growth—the phase leading up to 2026 may be more stable, with less volatility but still an upward trend.

Gold may continue to rise in 2026, but volatility is expected to be lower compared to the 2025 “storm.”

Conversely, Hamad Hussain, a climate and commodities economist at Capital Economics, warns that the latest gold price surge “resembles a bubble in its final stages.” This expert anticipates prices will drop to $3,500 per ounce by the end of 2026 as FOMO (fear of missing out) sentiment dominates.

Notably, Dr. Hieu cautions that if credit grows twice as fast as GDP, as Vietnam aims for, the influx of money could create bubbles in gold, stocks, or real estate. Investors must remain highly vigilant against bubble effects and the “bubble of belief.”

Smart Holding Strategies for Vietnamese Investors

For Vietnamese investors, gold is a consideration as a risk-hedging channel rather than a tool for quick profits. However, beware of bubble effects, opportunity costs, and domestic policy fluctuations. At this juncture, “smart holding” and “flexible asset structuring” will be key to preserving wealth, rather than passively “holding gold and waiting for gains.”

With gold prices currently at historic highs, Vietnamese individual investors must adopt an extremely cautious and flexible strategy. Experts emphasize that gold is being accumulated as a safe-haven asset against macro risks, making it suitable for defensive, long-term storage strategies to preserve value, rather than short-term speculative trading for profit.

However, investors must also seriously consider opportunity costs. Expert Trinh Ha clarifies that allocating too much capital to gold at such high prices may cause investors to miss out on larger profit opportunities from more cyclical assets like stocks or real estate when the economy recovers.

Particularly in the Vietnamese market, investors must heed the significant price gap between domestic and international markets, along with risks from local policies related to gold imports and quotas. The opacity surrounding gold import enterprises may create instability, causing domestic gold prices to fluctuate rapidly and unpredictably. Therefore, closely monitoring regulatory moves is crucial for asset preservation.

“Despite the strong price increase, I maintain my gold allocation because global uncertainties have not subsided… gold remains a reliable hedge,” affirmed Nguyen Thu Linh, an investor in Bac Ninh./.

Mastering the 10M Consumer Price Index: Strategies for Stability and Control

Inflation was kept firmly in check throughout the first ten months of 2025, setting the stage for a year-end outcome that mirrors this stability.

Which Investment Channel Will Shine Next: Gold, Real Estate, or Stocks?

The three major investment channels are entering distinct phases. Gold is forecasted to continue its upward trajectory in the medium to long term, while real estate maintains short-term vibrancy but carries potential risks from 2027 onward. Meanwhile, the stock market is showing signs of bottoming out, paving the way for a more unified upward trend.

November 15: Ring and Bullion Gold Prices Continue to Plummet

Gold bar and ring prices have plummeted, dropping an average of 2.2 to 2.6 million VND per tael compared to yesterday’s closing session.