Recently, Hai An Transport and Logistics JSC (Stock Code: HAH, HoSE) has released documents for the Extraordinary General Meeting of Shareholders (EGM) scheduled for December 8, 2025.

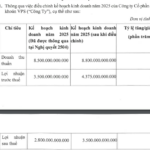

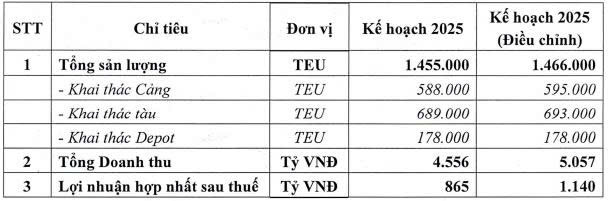

Notably, Hai An Logistics will present to shareholders for consideration and approval the adjustment of the 2025 business plan, with a projected total volume of 1,466,000 TEU, a 0.8% increase from the initial plan; total revenue is expected to reach 5,057 billion VND, up by 11%; and post-tax profit is forecasted at 1,140 billion VND, a 31.8% increase.

Hai An Logistics explained that the adjustment to the 2025 business plan is based on the company’s actual business performance.

Source: HAH

The company aims to raise revenue and profit targets following its positive business results in the first nine months of the year.

Specifically, in the first nine months of 2025, Hai An Logistics generated nearly 3,791.5 billion VND in net revenue, a 36.3% increase compared to the same period last year. After deducting taxes and fees, the company reported a net profit of over 1,040.9 billion VND, 2.3 times higher than the same period.

According to the initial business plan, the company expected to achieve 4,556 billion VND in revenue and 865 billion VND in consolidated post-tax profit for 2025.

Thus, by the end of the first three quarters, the company has completed 83.2% of its revenue plan and 120.3% of its profit plan.

As of September 30, 2025, Hai An Logistics’ total assets increased by 12.2% compared to the beginning of the year, reaching nearly 8,265.3 billion VND. Fixed assets account for 58% of total assets, amounting to over 4,795 billion VND; short-term receivables are nearly 1,351.7 billion VND, representing 16.4% of total assets.

On the other side of the balance sheet, total liabilities stand at over 3,230.4 billion VND, a slight decrease of 2.6% from the beginning of the year. Of this, short-term and long-term loans total nearly 2,081.7 billion VND, accounting for 64.4% of total liabilities.

Additionally, at the upcoming EGM, Hai An Logistics will also seek shareholder approval for amendments and supplements to the 2025 employee stock option plan and other matters within the competence of the EGM.

Unprecedented Surge in Extraordinary Shareholder Meetings Convened by Leading Securities Firms

MBS and Vina Securities have jointly finalized the list of shareholders eligible to attend the Extraordinary General Meeting of Shareholders in 2025, scheduled for November 19th.

Phú Bài Fiber’s Pre-Tax Profit Surges 72% in 9 Months

On September 24, 2025, the Board of Directors of Phu Bai Fiber Joint Stock Company (UPCoM: SPB) approved the estimated business results for the first nine months of 2025. The company reported net revenue of VND 822 billion and pre-tax profit exceeding VND 17 billion. While revenue decreased by 12%, profit surged by nearly 72% compared to the same period last year.