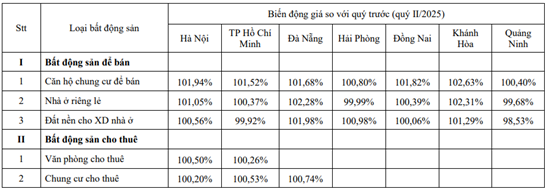

According to the Institute of Construction Economics under the Ministry of Construction, in Q3/2025, land plots in several localities continued to rise in price due to the planning and implementation of large-scale projects in areas like Da Nang, Tay Ninh (formerly part of Long An Province), and the merger of localities such as Hung Yen and Khanh Hoa.

The average apartment prices nationwide also increased compared to the previous quarter.

For detached houses and land plots developed under projects, average prices saw slight increases or remained stable in various localities. Some areas with stable prices include detached houses in Hai Phong, Quang Ninh, and land plots in Ho Chi Minh City.

Rental real estate was no exception, with rental prices in Q3 showing a slight increase compared to the previous quarter.

|

Price fluctuations of various real estate types in the secondary market across several localities in Q3/2025

Source: Institute of Construction Economics

|

While nationwide transaction data remained positive, according to VietstockFinance, the total net revenue and net profit of 76 residential real estate companies listed on the stock exchanges (HOSE, HNX, and UPCoM) in Q3/2025 decreased by 4% and 32% respectively compared to the same period last year, reaching VND 44 trillion and VND 8.9 trillion.

Among these, 43 companies saw profit increases, 16 experienced profit declines, 11 reported losses, and 6 turned losses into profits.

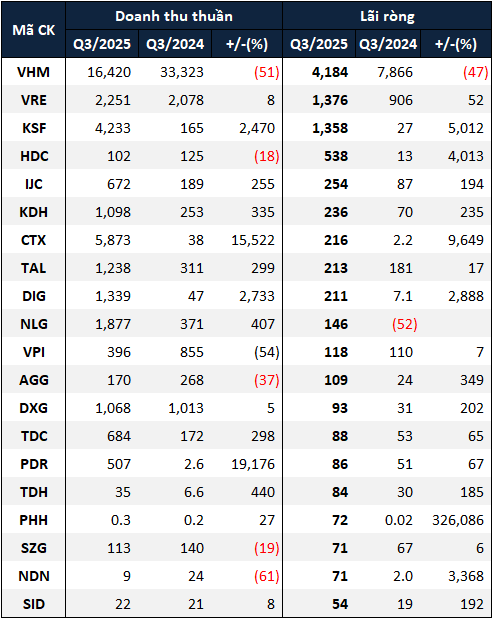

Vinhomes leads in profits

Despite the decline, Vinhomes (HOSE: VHM) still led with a Q3 profit of nearly VND 4.2 trillion.

In the first nine months, VHM‘s sales reached VND 162.6 trillion, up 96%, reflecting strong market demand and effective sales strategies. Unrecorded sales by the end of September hit a record high of VND 223.9 trillion, up 93% compared to the end of Q3/2024.

In contrast to its “sibling” VHM, Vincom Retail (HOSE: VRE) saw a 52% increase in net profit in Q3, reaching nearly VND 1.4 trillion. This result was driven by a sustained recovery in occupancy rates across its shopping center network and stable contributions from newly opened centers in the second half of 2024 and 2025. Consequently, visitor numbers to Vincom shopping centers in Q3 increased by 18% year-on-year.

Sunshine Group (HNX: KSF) was the other company to achieve a net profit of over VND 1 trillion in the quarter. However, this result was not from its core real estate business but from the consolidation of financial results from DIA Investment JSC and Sunshine Homes JSC after these two companies were added to its list of subsidiaries in Q3.

|

Top 20 real estate companies with the highest net profits in Q3/2025. Unit: Billion VND

Source: VietstockFinance

|

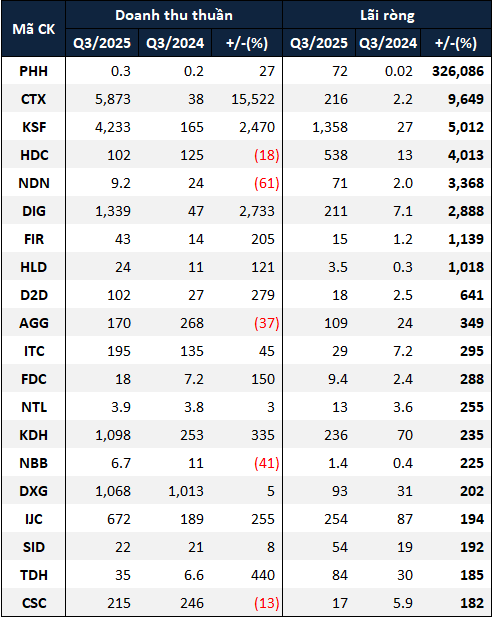

Several companies saw surging profits from financial revenues

While the industry’s overall performance declined, Q3 witnessed several companies reporting sharply increased net profits, with some surging by dozens of times compared to the same period last year.

Most notably, Hong Ha Vietnam (UPCoM: PHH) reported a Q3 net profit of nearly VND 72 billion, compared to a mere VND 22 million in the same period last year. The majority of this profit came from the transfer of nearly 8.2 million shares in its affiliate Tu Hiep Hong Ha Petroleum JSC. The transaction was valued at VND 134.6 billion, equivalent to VND 16,500 per share, with Mr. Le Dinh Tien as the recipient.

Two other companies, Ba Ria – Vung Tau Housing (Hodeco, HOSE: HDC) and Da Nang Housing (HNX: NDN), also saw surging profits from financial revenues. While HDC earned over VND 696 billion from the sale of shares in Ocean Entertainment Construction Investment JSC, NDN‘s financial revenue increased primarily due to profits from securities investments. Profitable securities trading also allowed NDN to reverse over VND 53 billion in provisions for securities depreciation.

Alongside companies profiting from financial activities, some achieved growth through their core real estate business. A prime example is Vietnam Construction and Trade Investment Corporation (UPCoM: CTX), whose net profit of VND 216 billion (97 times higher than the same period last year) was driven by nearly VND 5.9 trillion in real estate revenue recognized in Q3.

The company stated that this revenue was generated from the transfer of the investment project for the construction of a commercial center, apartment, and office complex on land plot A1-2 (Project A1). The recipient of the transfer was Vietnam Minh Hoang Construction and Real Estate Investment JSC.

Notably, before the transfer, the project’s unfinished construction costs surged dramatically in the first six months, from over VND 464 billion at the beginning of the year to nearly VND 5.4 trillion by the end of June 2025.

|

Top 20 real estate companies with increased net profits in Q3/2025. Unit: Billion VND

Source: VietstockFinance

|

Novaland still tops the list of loss-making companies

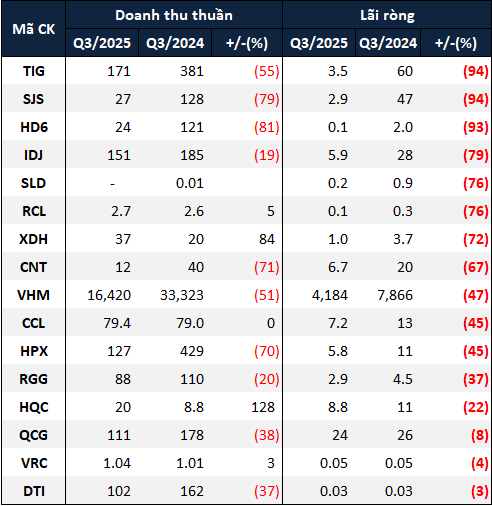

In contrast to the group of companies with profit increases, some saw declining or even negative net profits. The two companies with the largest profit declines were Thang Long Investment Group (HNX: TIG) and SJ Group (HOSE: SJS), with rates of over 94%.

TIG‘s net profit fell to nearly VND 4 billion because Q3 was a period of increased capital investment, acquisitions, and construction investments in several real estate projects, which delayed sales launches, leading to reduced revenue from sales and services. Additionally, decreased financial revenue coupled with increased expenses further impacted Q3 profits.

SJS ended Q3 with a net profit of nearly VND 3 billion, the lowest in 12 quarters (since Q4/2022). The main reason was the absence of revenue from real estate transfers, which had contributed over VND 108 billion in the same period last year, resulting in a 79% decline in net revenue to nearly VND 27 billion.

Dat Xanh’s “newcomer,” Regal Group (UPCoM: RGG), also reported lackluster results in Q3, with net revenue and net profit declining by 20% and 37% respectively, to VND 88 billion and VND 3 billion. In its financial statements, RGG recorded over VND 85 billion in revenue from real estate transfers, up 24% year-on-year, but reported no revenue from brokerage activities, which had contributed nearly VND 38 billion in Q3/2024.

The company explained that due to restructuring efforts since late 2024, it no longer recorded business results from certain subsidiaries in Q3/2025.

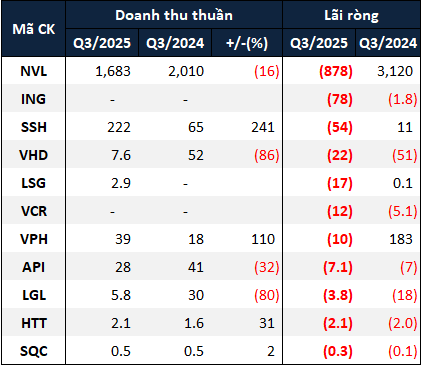

|

16 real estate companies with declining net profits in the first half of 2025. Unit: Billion VND

Source: VietstockFinance

|

Although profits declined, these companies still retained earnings, which is more favorable than the 11 companies that reported losses.

The real estate company with the largest loss was still Novaland (HOSE: NVL), with a loss of VND 878 billion in Q3 (compared to a profit of over VND 3.1 trillion in the same period last year). The loss was attributed to a 16% decline in net revenue and an 88% drop in financial revenue, while financial expenses surged 4.5 times to over VND 1.4 trillion due to a VND 712 billion increase in foreign exchange losses compared to the previous year.

A positive note for NVL in Q3 was the handover and operation of the Golf Villas and Florida 3.7 subdivisions within the NovaWorld Phan Thiet mega-project. To date, 1,500 real estate products have been handed over at this project, with 750 fully furnished units put up for rent. At Aqua City, over 1,000 products have been handed over.

Conversely, Van Phat Hung (HOSE: VPH), despite doubling its net revenue to VND 39 billion year-on-year, still reported a net loss of VND 10 billion. This was due to a 3.3-fold increase in cost of goods sold. Simultaneously, financial revenue plummeted by 99% to just over VND 5 billion, compared to the previous year’s unusually high figure of nearly VND 350 billion from the transfer of subsidiary shares.

VPH explained the disparity between the increase in net revenue and cost of goods sold by stating that during the period, the company did not record real estate business activities, and revenue was primarily from construction activities. However, the construction segment did not generate profits because the construction work was designated to be carried out by a third party.

|

12 real estate companies reporting losses in Q3/2025. Unit: Billion VND

Source: VietstockFinance

|

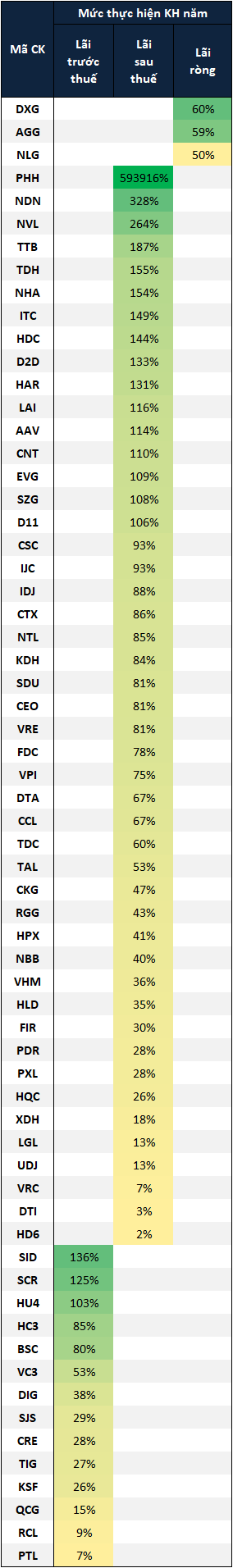

19 companies exceeded annual plans

With many companies reporting sharply increased profits in Q3, data from VietstockFinance shows that 19 listed real estate companies have already exceeded their full-year profit targets after just nine months.

|

2025 plan fulfillment rates for select real estate companies

Source: VietstockFinance

|

– 07:58 18/11/2025

Industrial Real Estate Profits Surge 51% Year-on-Year: Are Opportunities Still Available?

MBS believes the industrial park sector is entering a recovery phase, with several businesses rapidly expanding their land holdings.

Accelerating Reforms: Ministry of Industry and Trade Brings Resolution 66 to Life

At the online seminar titled *”The Ministry of Industry and Trade Innovates Mindsets, Breakthroughs in Legal Frameworks,”* representatives from regulatory bodies shared insightful perspectives on the implementation of initiatives and solutions outlined in Resolution 66, effectively linking the resolution to real-life applications.