VVS, established in 2010 in Hanoi with an initial charter capital of 1.8 billion VND, specializes in trading semi-trailers, tanker trucks, and refrigerated vehicles. The company’s capital has grown steadily, reaching 100 billion VND by 2015 and 205 billion VND by 2021. Alongside this growth, VVS has expanded its distribution network to over 25 branches nationwide.

The company directly imports medium and heavy-duty trucks, as well as specialized vehicles, from China through northern border gates. These vehicles are then distributed through its branch network and warranty stations. To further enhance market penetration, VVS has developed an additional dealer channel, capitalizing on the growing demand for transportation solutions.

VVS is an authorized dealer of Sinotruk, China’s third-largest truck manufacturer and owner of the HOWO brand. According to VVS, Sinotruk holds a consistent 30%-35% market share in Vietnam’s medium and heavy-duty truck segment, with VVS being a key distributor for many years.

VVS distributes Sinotruk’s HOWO-branded trucks – Image: VVS

|

Over the past two years, VVS’s business results have accelerated significantly, driven by nationwide infrastructure investments. In 2024, the company reported a net profit of 68 billion VND, four times higher than the previous year.

This momentum continued in the first nine months of 2025, with profits reaching 170 billion VND, 2.7 times higher year-on-year. Management attributed this growth to surging demand for trucks as numerous key projects were launched and inaugurated across 34 provinces and cities on August 19, fueling transportation and construction needs.

Ownership is concentrated within the family of Chairman Nguyễn Vũ Trụ, who holds 44.7%, and his wife, Vice Chairwoman Nguyễn Thị Thu Huyền, who owns 10.3%.

CTCP M&A Holding Việt Nam, associated with Nguyễn Thanh Bình—the Chairman’s father-in-law and a Board member—holds 8.36%. Hoàng Thị Vân, the Chairman’s mother-in-law and also a Board member, owns 2.79%. As founding shareholders, the family group maintains controlling interest in the company.

Mr. Nguyễn Vũ Trụ, Chairman of VVS – Image: Hanoiba

|

By the end of Q3, VVS’s total assets surged to 5.2 trillion VND, more than doubling since the year’s start. This increase was primarily driven by payables to Sinotruk International (3.7 trillion VND) and collateral deposits for loans (3.3 trillion VND). In contrast, equity stood at approximately 500 billion VND.

In September, VVS established VMASS, a subsidiary with a charter capital of 50 billion VND in Hai Phong, focused on truck assembly. The company has deposited over 33 billion VND for a 10-hectare site to build an assembly plant with a projected investment of 1.3 trillion VND and a capacity of 10,000 vehicles annually.

Strong business performance has propelled VVS’s stock price. As of November 17, it closed at 66,500 VND, up 220% since mid-August and 350% year-to-date, with liquidity improving ahead of its HOSE listing.

| VVS stock price surges from mid-July |

– 18:30 17/11/2025

Vietnam’s Pioneer in Frozen Agricultural Exports to Europe, US, Japan: Record 9-Month Profit, Stock Hits All-Time High

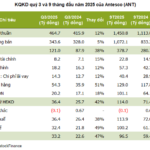

With nearly 50 years of expertise, Antesco (ANT), Vietnam’s pioneer in frozen vegetable exports, has released its Q3 2025 financial report.

Western Region’s Fruit & Vegetable Enterprises Hit Record Profits, Expanding 1,500 Workforce Ahead of Market Upgrade

Ahead of its upcoming listing on HOSE, An Giang Fruit and Vegetable Processing Joint Stock Company (Antesco, UPCoM: ANT), a leading player in the Mekong Delta’s processed fruit and vegetable sector, reported a staggering 63% surge in nine-month profits, surpassing its entire 2024 earnings. This remarkable growth is complemented by a significant workforce expansion, now exceeding 1,500 employees.

Real Estate Firms Reap Massive Profits Through Strategic Stock Market Investments

Despite a slowdown in its core business, Da Nang Housing Development Investment Corporation (HDIC) reported a remarkable post-tax profit of over VND 145 billion in the first nine months, a 3.5-fold increase compared to the same period last year. This impressive performance was largely driven by gains from its stock portfolio, which includes 23 stocks with investments ranging from a few hundred million to under VND 100 billion, such as HPG, VHM, DGC, FPT, VPB, VCG, EIB, and CTG.