A recent analysis report by MBS Securities highlights that the profits of listed Industrial Zone (IZ) enterprises in Q3/2025 have shown robust growth, despite the impact of U.S. tariff policies. The IZ market has demonstrated positive signs of recovery following the U.S. announcement of reciprocal tariffs for trading partners.

Specifically, the profits of listed IZ enterprises in Q3/2025 and the cumulative nine-month period of 2025 increased by 24% and 51%, respectively, compared to the same period last year.

According to the report, 65% of enterprises in the sector recorded positive profit growth in the quarter, primarily driven by industrial land leasing activities.

The Industrial Real Estate Sector Overcomes Tariff Shocks and Enters Recovery Phase

MBS notes that the IZ group, which faced negative impacts from the U.S. tariff shock earlier in April, is now seeing diminished concerns regarding the adverse effects of U.S. reciprocal tariffs.

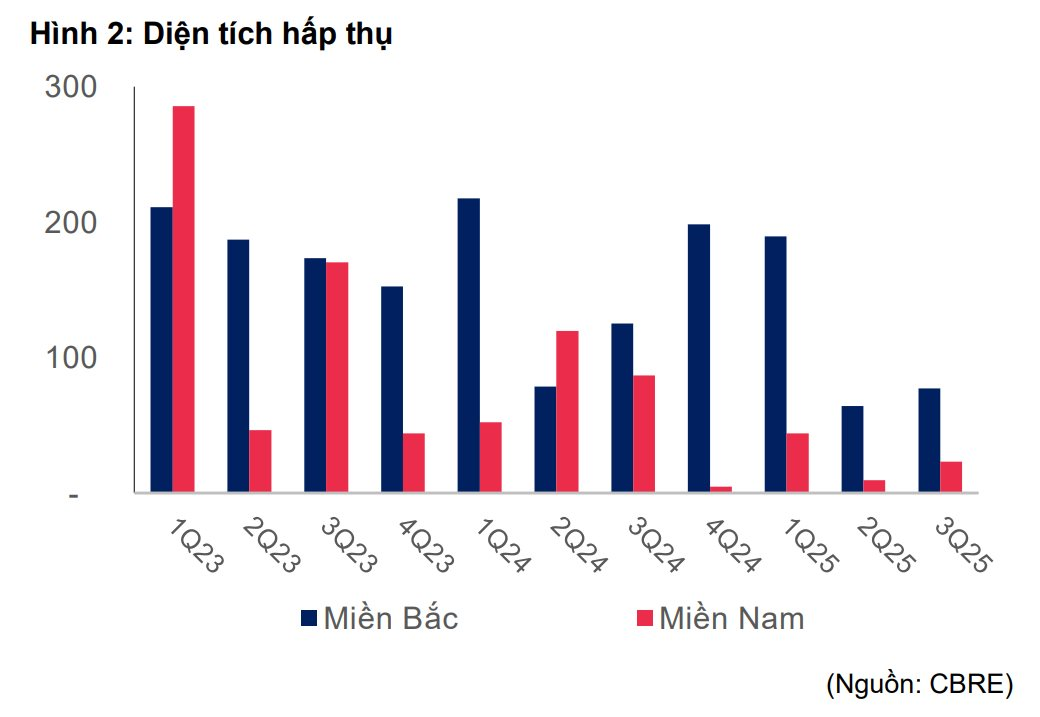

In reality, during Q3, the IZ market showed signs of recovery after a sharp decline in the previous quarter. According to CBRE, rental prices increased by approximately 2% quarter-on-quarter and 4% year-on-year. Absorption rates have rebounded compared to the previous quarter, indicating recovery, although they remain lower than the same period last year in both the Northern and Southern markets.

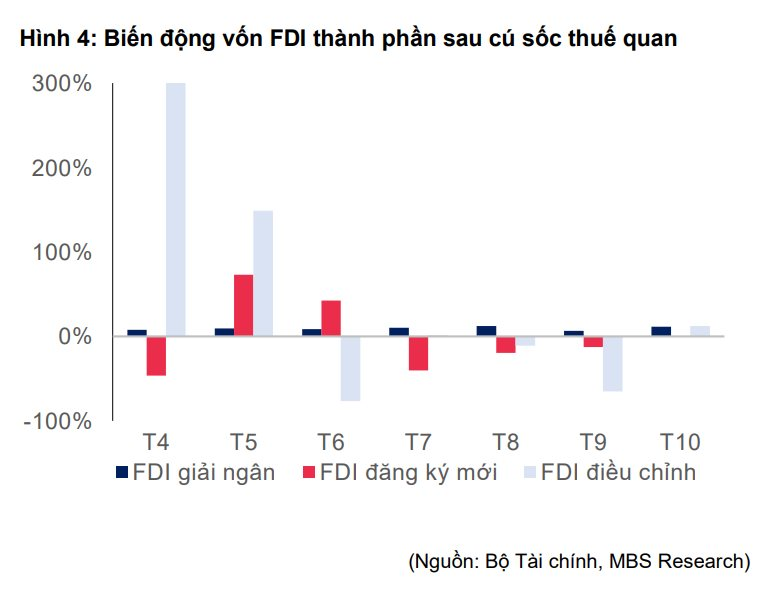

Disbursed FDI capital has shown consistent month-on-month growth since the beginning of the year, with a cumulative 10-month increase of 9% year-on-year, reaching a five-year high.

Newly registered FDI capital for the first 10 months of 2025 decreased by 8% year-on-year, but this decline has gradually narrowed and reached parity with the same period last month.

Adjusted FDI capital for the first 10 months of 2025 surged by 45% year-on-year, indicating that foreign investors remain committed to their production investment plans in Vietnam.

The U.S. tariff rates on imported goods from Vietnam do not significantly differ from those applied to other regional countries such as Thailand, Indonesia, the Philippines, and Malaysia, all at 19%. In contrast, India, a competitor to Vietnam in attracting FDI, faces tariffs as high as 50%. While U.S.-China trade tensions have eased, the average tariff rate imposed by the U.S. on Chinese goods remains high, at approximately 47%.

However, Vietnam and the U.S. are still negotiating the origin of “transhipped” goods. If goods are classified as transhipped, the tariff rate could reach 40%. Additionally, the U.S. is conducting an investigation under Section 232 of the Trade Expansion Act of 1962. Some products, such as automobiles, semiconductors, wood, and furniture, may face challenges.

The investigation period can last up to nine months. While no final conclusions have been reached, there will likely be negative impacts on investment flows into these sectors in the near future.

New Opportunities from Provincial Mergers and Legal Framework Improvements

MBS believes that provinces are presenting significant opportunities for IZ development following mergers:

– Bac Ninh Province has approved adjustments to its provincial planning. The new plan includes several key projects, such as the Gia Binh International Airport, road connections to major cities (Hanoi, Haiphong), the addition of four new IZs, and expanded areas for three existing IZs.

– Under the Haiphong-Haiduong merger plan, several road connections will be constructed post-merger, particularly the transport corridor linking former Haiduong areas with western Haiphong localities and the Dinh Vu-Cat Hai Economic Zone, the Southern Haiphong Coastal Economic Zone, and the Lach Huyen International Gateway Port.

The Lao Cai-Hanoi-Haiphong railway line, from the Lao Cai border gate through Hanoi, Hung Yen, and Haiduong to the Lach Huyen port station (Haiphong City), will enhance travel convenience for residents and meet the transportation needs of enterprises, providing advantages for local IZs.

– Ho Chi Minh City is drafting an adjusted planning proposal following its merger. Key projects linking HCMC with former Binh Duong and BRVT provinces will be expedited, such as the HCMC-Thu Dau Mot-Chon Thanh project, the expansion of National Highway 13, and connecting roads to National Highway 13. We anticipate the formation of an IZ hub within a megacity.

The approval process for legal frameworks has accelerated following the implementation of Law No. 57/2024/QH15, resulting in a more abundant new supply in the market.

MBS maintains a positive outlook for the IZ sector in Q4/2025 and 2026, as the impact of U.S. tariff policies gradually diminishes and the IZ market shows renewed positive signs following the U.S. announcement of reciprocal tariffs. Vietnam remains an attractive destination for FDI investors, despite higher tariff rates compared to previous periods.

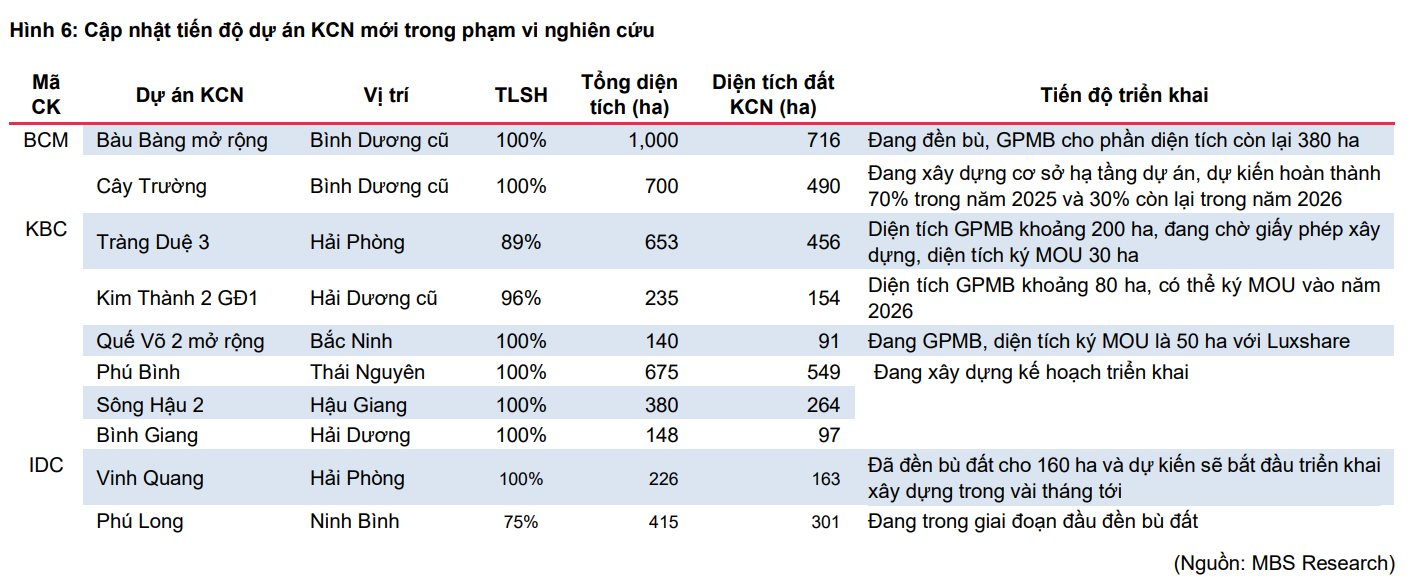

MBS believes the IZ sector is entering a recovery phase, with several enterprises rapidly expanding their land banks.

Stock Market Update November 18: Shifting Capital to Attractive Stocks Drives Investment Flow

In the November 17th session, numerous stocks demonstrated significant upward momentum. Investors are advised to focus on those tickers currently attracting substantial capital inflows.

Accelerating Reforms: Ministry of Industry and Trade Brings Resolution 66 to Life

At the online seminar titled *”The Ministry of Industry and Trade Innovates Mindsets, Breakthroughs in Legal Frameworks,”* representatives from regulatory bodies shared insightful perspectives on the implementation of initiatives and solutions outlined in Resolution 66, effectively linking the resolution to real-life applications.

Vietnam’s Economy Sets New Records, Ushering in an Era of ‘Dream Big, Achieve Bigger’ on the Cusp of the ‘Age of Ascent’

After 40 years of Renovation, Vietnam has entered the “Era of National Aspiration,” a spirit affirmed by the 13th National Congress and materialized through seven pivotal resolutions issued by the Politburo in 2025. Spanning international integration, private sector development, education, healthcare, and energy, these directives are vividly reflected in every economic indicator: growth surpassing expectations, macroeconomic stability, deep global integration, and an unwavering drive to surge ahead.