Prospective buyers exploring a development project on the eastern outskirts of Ho Chi Minh City.

Catalyzing Growth Through Strategic Mergers and Public Investment

Following a historic administrative merger, Ho Chi Minh City and Dong Nai Province have emerged as dynamic growth hubs within the Southeast region of Vietnam.

The formation of the new Ho Chi Minh City metropolitan area (encompassing Ho Chi Minh City, Ba Ria – Vung Tau, and Binh Duong) and the new Dong Nai Province (including Dong Nai and Binh Phuoc) represents more than mere boundary expansion. It signifies a strategic consolidation of strengths to create a pivotal economic zone. Post-merger, Ho Chi Minh City’s GRDP soared to over VND 2.7 quadrillion in 2024, leading the nation, while Dong Nai secured the fourth position with over VND 609 trillion.

The border region between Dong Nai and Ho Chi Minh City is characterized by low population density and abundant, affordably priced land, offering vast potential for urbanization. Additionally, accelerated public investment has become a key driver of economic growth. As of September 2025, Ho Chi Minh City has disbursed 50% of its public investment capital, while Dong Nai has achieved 35%.

Infrastructure development fuels Dong Nai’s transformation.

Dong Nai occupies a strategic position in the expanding urban and logistics landscape east of Ho Chi Minh City. A series of critical infrastructure projects are reshaping the Eastern region, including Long Thanh International Airport, Cai Mep – Thi Vai Port, Bien Hoa – Vung Tau Expressway, Ho Chi Minh City – Long Thanh – Dau Giay Expressway, Cat Lai Bridge, Phu My 2 Bridge, Dong Nai 2 Bridge, and the Thu Thiem – Long Thanh railway line.

Dong Nai: The Epicenter of Eastern Investment Flows

The synergy of regional planning, infrastructure development, and rapid urbanization is channeling investment capital toward the eastern corridor.

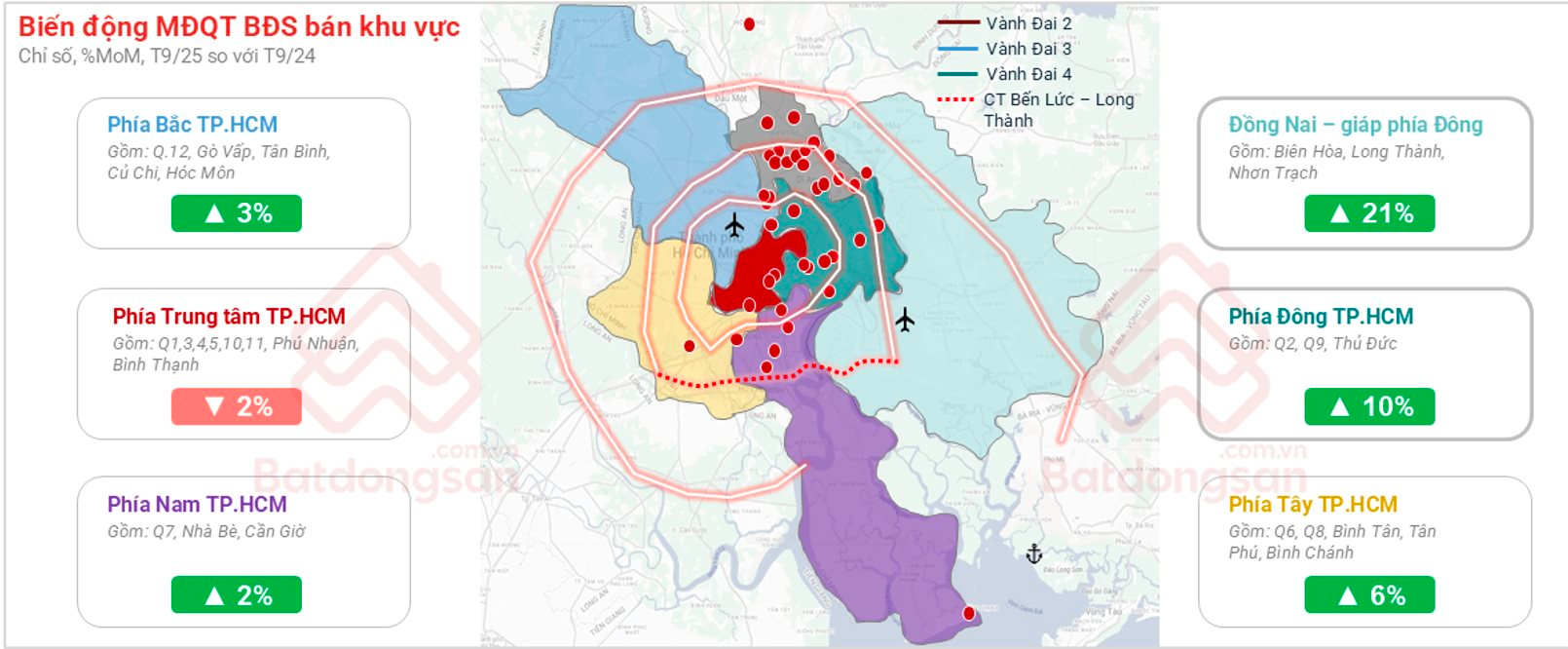

According to Batdongsan.com.vn, as of September 2025, interest in Dong Nai’s real estate market surged by 21%, doubling that of eastern Ho Chi Minh City and outpacing other regions.

Eastern region real estate gains traction, with Dong Nai leading the charge.

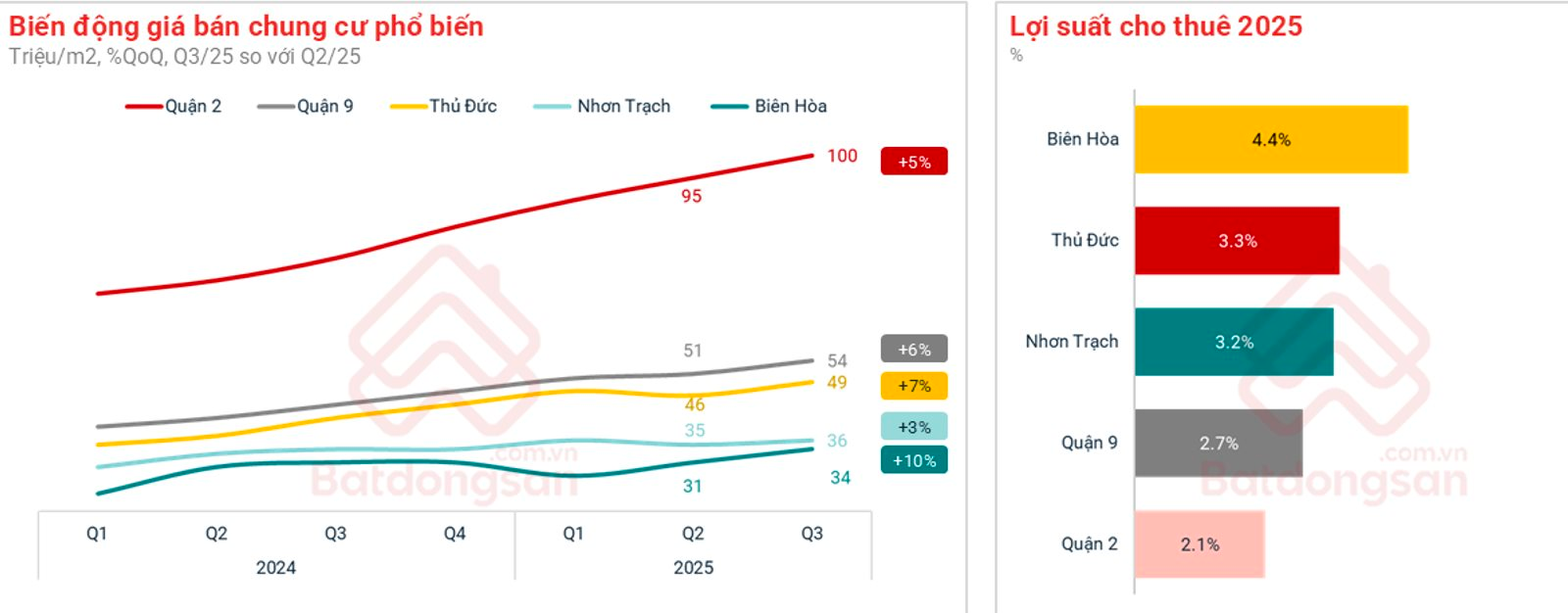

Another highlight of the eastern border market is the rental yield for apartments. While District 2 yields 2.1%, District 9 offers 2.7%, and Thu Duc reaches 3.3%, Bien Hoa takes the lead with 4.4%, followed by Nhon Trach at 3.2%.

Bien Hoa leads eastern rental yields.

This underscores Bien Hoa’s potential for both long-term investment and short-term rental income, a factor increasingly valued by investors seeking liquidity in today’s market.

In the land plot segment, the eastern market is also rebounding. Interest in this area rose by 6% in September 2025 compared to April 2025, outperforming the West (+3%) and North (+5%), and contrasting with the South’s decline.

In Bien Hoa and Long Thanh, Q3 2025 asking prices ranged between VND 16-23 million/m², up 5-7% from Q1 2025. Compared to Ho Chi Minh City’s average of VND 130 million/m², this gap highlights significant growth potential.

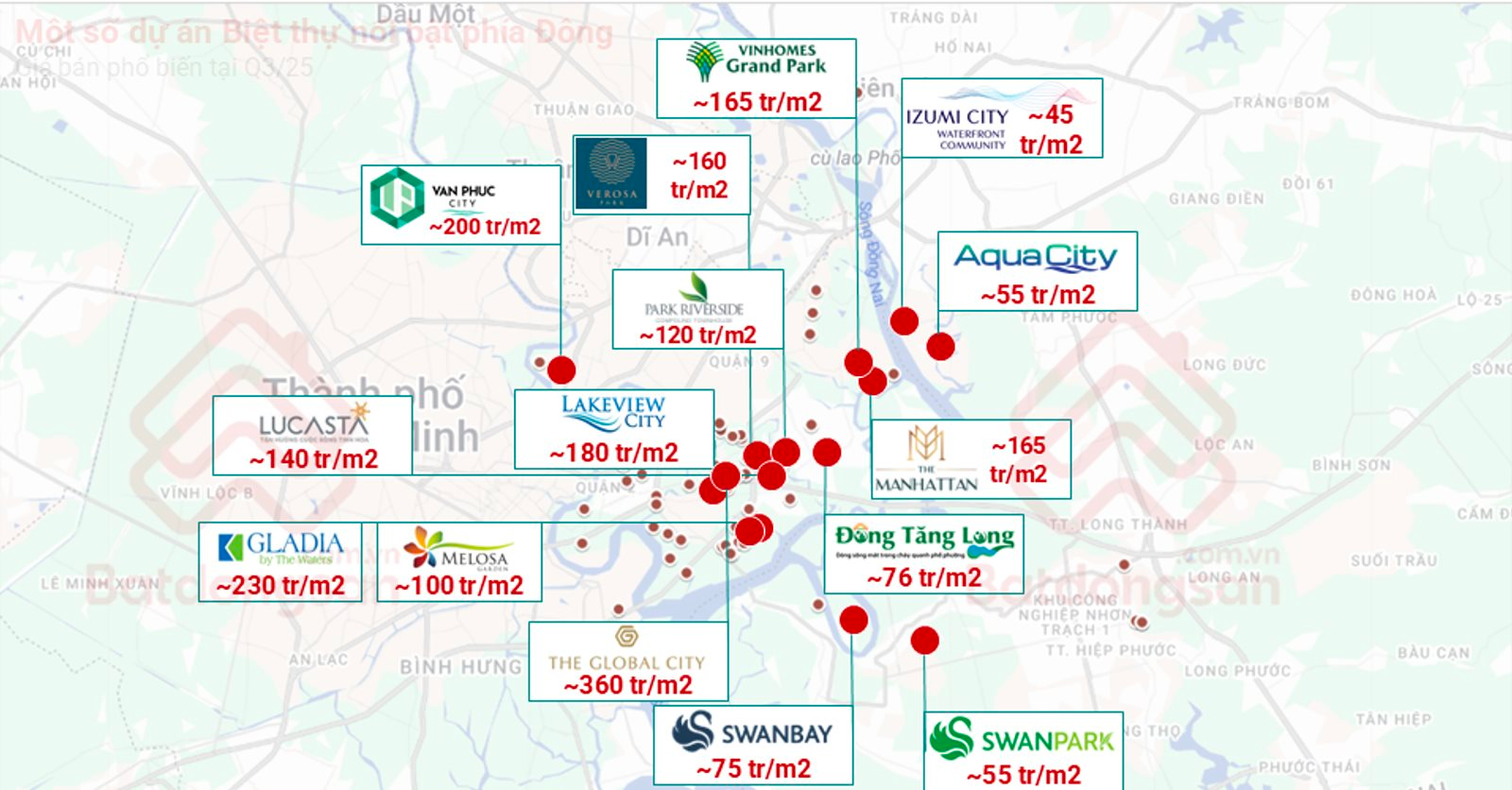

Pricing trends in Dong Nai’s eastern projects.

For low-rise urban properties, interest in Bien Hoa—Ho Chi Minh City’s eastern border—surged 58% in Q3 2025 compared to the previous quarter.

While central Ho Chi Minh City prices for low-rise properties have softened to VND 248 million/m², Dong Nai’s eastern border prices hover around VND 55 million/m², still up 6% from Q1 2023.

Some urban developments remain attractively priced, such as Izumi City in Long Hung, Dong Nai, spanning nearly 170 hectares with prices around VND 45 million/m².

According to Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, investors should prioritize areas with established urban developments suitable for rental or residential use in the short term. Long-term value will hinge on infrastructure progress and urbanization rates in the eastern region.

“As central Ho Chi Minh City faces rising prices and limited land availability, population decentralization and outward investment are inevitable. Dong Nai, as the gateway to the Southeast region, offers a unique trifecta: affordable land, accelerating infrastructure, and high rental yields,” Quoc Anh concluded.

Prime Commercial Spaces for Rent in Ho Chi Minh City Still Seeking Tenants

Prime real estate in Ho Chi Minh City is languishing on the market, with many properties remaining vacant for 5-6 months despite significant price reductions by landlords.