I. MARKET TRENDS IN WARRANTS

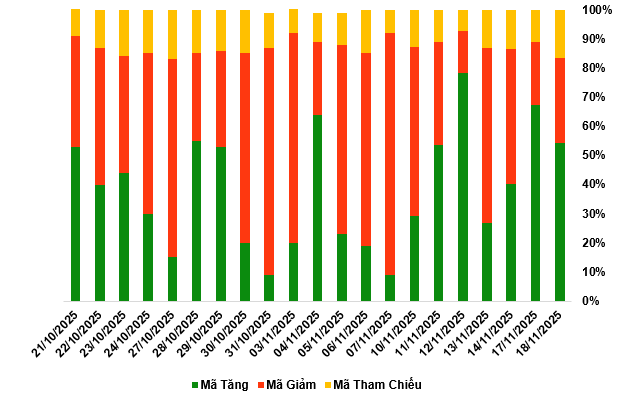

By the close of trading on November 18, 2025, the market saw 156 gainers, 84 decliners, and 48 unchanged securities.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

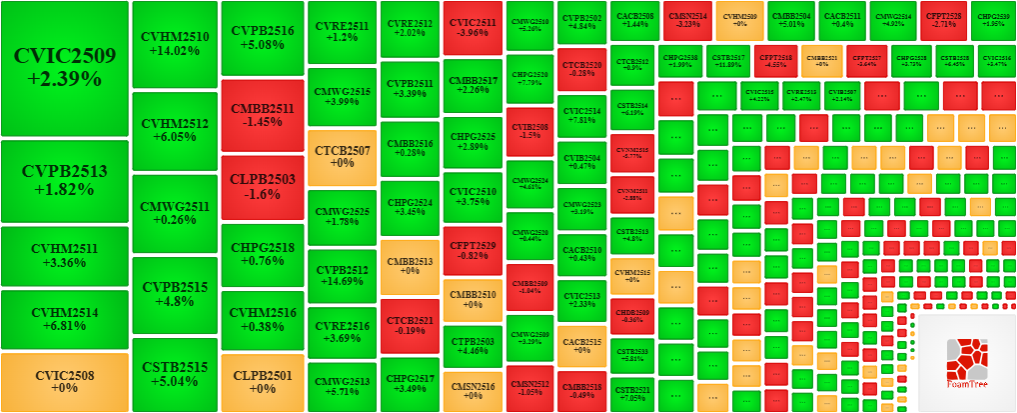

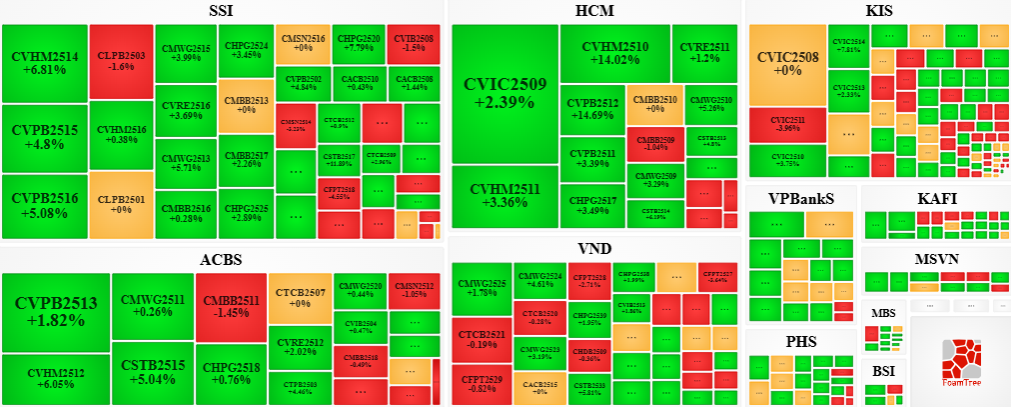

During the November 18, 2025 session, buyers continued to dominate, driving most warrant prices higher. Notable gainers included CVIC2509, CVPB2513, CVHM2511, and CMWG2511.

Source: VietstockFinance

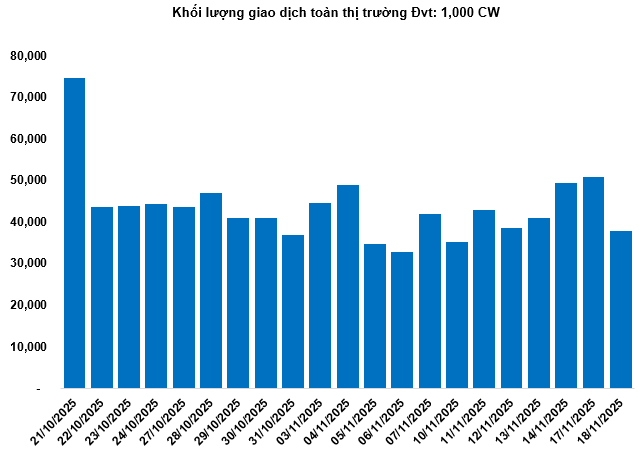

Total market volume on November 18 reached 37.74 million warrants, down 25.81%; trading value hit 70.59 billion VND, a 25.53% decline from November 17. CFPT2512 led in volume with 2.42 million warrants, while CLPB2503 topped trading value at 3.84 billion VND.

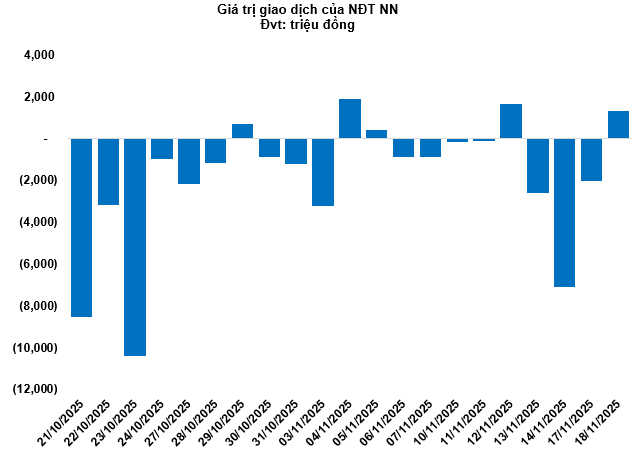

Foreign investors returned to net buying on November 18, with a total net purchase of 1.29 billion VND. CVIC2510 and CMWG2522 were the most net-bought warrants.

Securities firms SSI, ACBS, KIS, and HCM are currently the leading issuers of warrants in the market.

Source: VietstockFinance

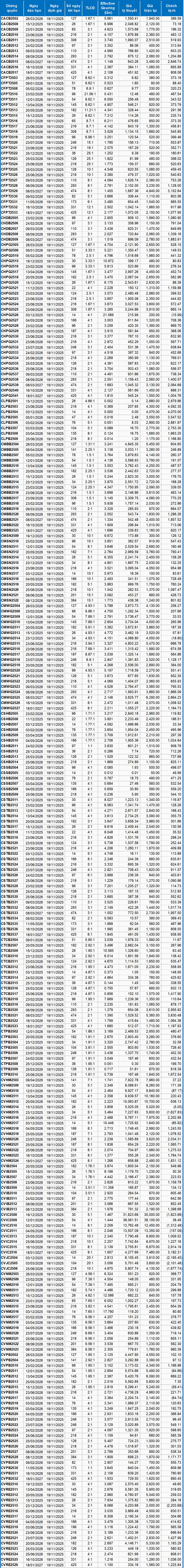

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from November 19, 2025, the fair prices of actively traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each warrant type.

According to this valuation, CVRE2515 and CVJC2504 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CHPG2526 and CVNM2516 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:58 November 18, 2025

Stock Market Update November 18: Shifting Capital to Attractive Stocks Drives Investment Flow

In the November 17th session, numerous stocks demonstrated significant upward momentum. Investors are advised to focus on those tickers currently attracting substantial capital inflows.

“Unusual Signals” from the Sudden Profit Growth Surge in Q3 Earnings Season

The primary driver of the significant growth stems from financial income streams, such as asset sales, exchange rate gains, and reserve reversals, rather than core business operations.