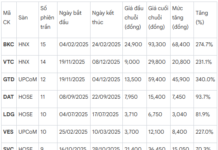

On the market, PVD shares of PV Drilling closed the session on November 17th at VND 26,700 per share. Just one month later, PVD’s stock price surged by over 40%, reaching its highest level in a year. The market capitalization of this oil and gas company rose to more than VND 14.8 trillion.

The positive growth in Q3 2025 business results supported the stock price movement. Specifically, PVD’s total revenue reached VND 2,646 billion, a 5% increase year-on-year, and after-tax profit rose by 54% year-on-year to VND 277 billion.

The increase in revenue and profit during the period was primarily due to the contribution from the PV DRILLING VIII rig, which began operations on September 1st, 2025. The volume of drilling-related services increased, and profits and dividends from joint ventures/subsidiaries significantly improved.

In the first nine months, PV Drilling’s revenue grew by approximately 5% year-on-year to VND 6,945 billion, while net profit surged by 46% to VND 673 billion. After nine months, PV Drilling achieved 97% of its revenue target and 127% of its after-tax profit target for 2025.

Active Investment in Rigs, Domestic Exploration, and Production Drive Growth

Currently, PV Drilling operates 7 offshore rigs, including 6 jack-up rigs and one deepwater rig. All rigs have contracts until the end of 2026, with some extending to 2028. The newly invested PV DRILLING IX rig is restarting and will begin operations in 2026.

PVD holds 100% of the shares in PVD DRILLING IX. Additionally, PV Drilling’s management confirmed that both new jack-up rigs, PVD VIII and PVD IX, will have a 15-year depreciation period.

The latest report from Vietcap Securities assumes a total investment of USD 83 million and a daily rental rate of USD 105,000 in 2027. Vietcap estimates that PVD IX will contribute approximately USD 8.5 million annually to PVD’s net profit after minority interests from 2027 to 2029.

In 2025, Vietcap forecasts PVD’s core after-tax profit (after minority interests) to reach USD 33.5 million (approximately VND 883 billion), an 11% increase year-on-year.

The growth in projected after-tax profit is driven by: (1) increased gross profit from drilling-related services, reflecting strong Q3 2025 results; (2) a 1.7% reduction in average cash operating expenses from 2025 to 2029; (3) doubled ownership in PVD IX; and (4) extended depreciation periods for PVD VIII and PVD IX rigs to 15 years (from 7 years previously).

According to Vietcap, these factors offset the 1.4% decline in average jack-up rig rental rates from 2025 to 2029.

The analysts also predict a compound annual growth rate (CAGR) of 44% in reported net profit after minority interests from 2026 to 2028, driven by: slightly higher daily rental rates, contributions from PVD VIII (Q4/2025) and PVD IX (2027), recovery in well services, and profits from joint ventures.

Meanwhile, domestic exploration and production activities continue their strong growth cycle, expected to boost PVD’s workload. The company’s management has highlighted positive drilling prospects in Vietnam for several years, estimating around 63 wells per year from 2026 to 2030. This corresponds to a demand for approximately 12 jack-up rigs, double the current 6 rigs operated by PVD. Vietcap views this as providing ample and sustainable work for PVD in the medium term.

Sustained Growth Driven by High Workload

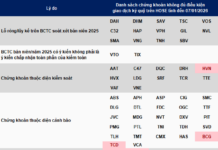

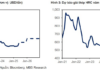

In another analysis, SSI Securities forecasts that global oil supply growth will slow to 2.1 million barrels per day in 2026, still significantly outpacing demand growth of around 700,000 barrels per day, leading to continued oversupply.

As a result, SSI Research expects weak oil price prospects, with market projections averaging Brent prices at USD 63 per barrel (-7.3% year-on-year). For gas, new LNG supplies in 2026 (from Canada, the US, and Qatar) are expected to cool LNG prices.

With oil prices remaining low, SSI Research predicts continued profit differentiation among groups. The Upstream segment (PVD, PVS) is expected to maintain growth due to high workloads. This segment also directly benefits from the B – O Mon block.

Specifically, PVD’s profit is projected to grow strongly by ~39.7% year-on-year in 2026, driven by high production capacity, increased rig rental rates, contributions from PVD XIII and IX, the end of depreciation for PVD I, and a low profit base in Q1/2025 (due to maintenance of PVD VI).

Big Group Holdings: Unlocking 2025 Profits with Three Revolutionary Business Strategies to Boost Stock Valuation

By the end of 2025, Big Group Holdings JSC (UPCoM: BIG) is set to expand its three strategic pillars through its subsidiaries: Big Expo, Big Hotel, and Big Bro. This growth trajectory is projected to drive consolidated revenue above 500 billion VND and post-tax profit exceeding 20 billion VND. These positive developments have fueled a steady rise in BIG’s stock price over recent weeks.

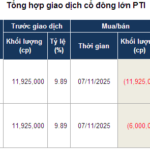

Who Spent Over $56 Million to Acquire 24.5% Stake in Postal Insurance?

Over three consecutive trading sessions from November 6th to 10th, the market witnessed the transfer of 29.5 million shares of Post and Telecommunication Joint Stock Insurance Corporation (HNX: PTI) via negotiated transactions. This volume represents 24.5% of PTI’s outstanding shares, with a total value nearing VND 1,328 billion. The average negotiated price stood at approximately VND 45,000 per share.

Strategic Partnership Signed: PVU Joins Forces with PVFCCo – Phú Mỹ and PV Drilling

On October 31, 2025, in Ho Chi Minh City, as part of the 2025 Graduation Ceremony and the 2025-2026 Academic Year Opening, Vietnam Petroleum University (PVU) signed a comprehensive cooperation agreement with Petrovietnam Fertilizer and Chemicals Corporation (PVFCCo – Phu My, HOSE: DPM) and Petrovietnam Drilling and Well Services Corporation (PV Drilling, HOSE: PVD). This event underscores the commitment of all parties to fostering high-quality human resources, seamlessly integrating education with practical production.