Upon completion of the share transfer, PDR will own 50% of AKYN’s total charter capital. Through this deal, PDR will develop a commercial housing project on the land plot at 239 Cach Mang Thang 8, Ward 4, District 3, Ho Chi Minh City (now known as Ban Co Ward, HCMC), with AKYN as the investor.

Phat Dat plans to invest in the 239 project from 2026-2030 with an estimated total value of 5.5 trillion VND. The value of the AKYN share acquisition has not yet been disclosed by the parties involved.

Image of the land plot at 239 CMT8. Source: Google Maps

AKYN, originally named T.A.M Commercial Investment and Services JSC, was established in 2013 in the former District 8, HCMC. With an initial capital of 68 billion VND, its founding shareholders included Ms. Nguyen Thi My Kim (CEO and legal representative) with 92%, and Mr. Nguyen Huu Le and Phan Thanh Tam with 4% each. In June 2018, Ms. Nguyen Minh Thu (daughter of PDR’s Chairman Nguyen Van Dat) became the legal representative and Chairwoman of the Board. In early 2019, the company was renamed AKYN as it is known today.

In late 2022, the company unexpectedly reduced its charter capital from 2.018 trillion VND to 513 billion VND, which remains unchanged. In mid-2023, Mr. Nguyen Hoang Thue (CEO of Dai Quang Minh) became Chairman of the Board and legal representative, while Ms. Thu served as CEO and legal representative.

In early 2025, the Ho Chi Minh City Real Estate Association (HoREA) reported receiving a document from AKYN outlining the progress and proposals for the old apartment building project at 239 Cach Mang Thang Tam. The project was approved for investment and recognized as the investor for renovation and construction of the old apartment building in 2017 by the People’s Committee of District 3, with extensions granted in 2018, 2019, and 2021.

Since 2015, AKYN (formerly T.A.M Commercial Investment and Services JSC) has completed the transfer and registration of 50 land and housing ownership certificates under the company’s name for all 50 apartments in the 239 Cach Mang Thang Tam project. They have completed 10% of compensation and site clearance, and were granted land use and housing ownership certificates from 2000-2007 for the 2,987m2 land plot.

In January 2025, AKYN reported that they are “continuing to process the shared auxiliary floor area (corridors, stairs, pathways, emergency exits, etc., approximately 382.4m2) and corresponding land allocation; as well as the shared yard and grounds area. However, the Department of Construction stated that the shared auxiliary areas remain state-owned. Since 2019, the company has repeatedly attempted to purchase the shared auxiliary floor area and corresponding land allocation but has not yet received a resolution.

Dai Quang Minh currently has a charter capital of 18.2 trillion VND (increased in July 2025 from 16.62 trillion VND). The company is chaired by Mr. Tran Ba Duong, with Mr. Nguyen Hoang Thue as CEO.

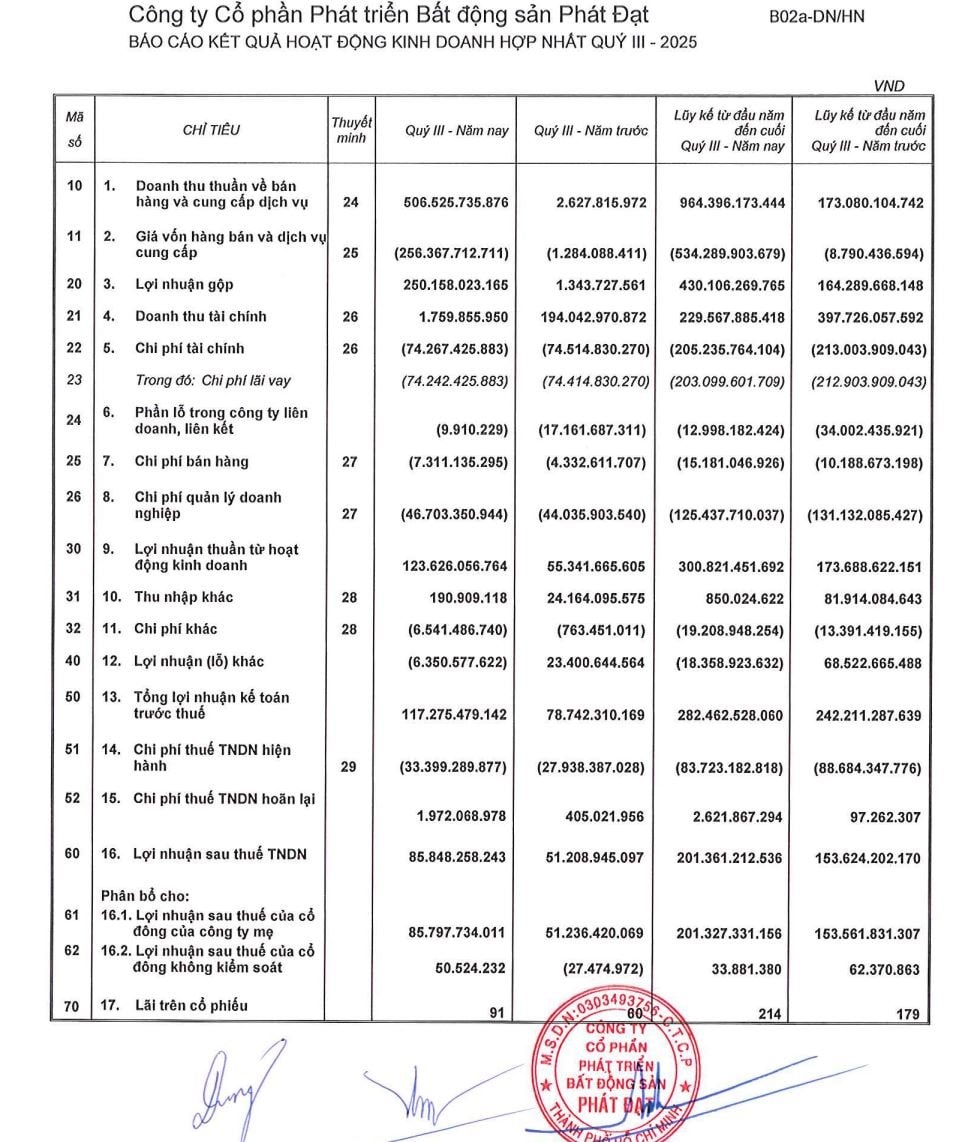

Business Performance: According to the consolidated financial statements released by Phat Dat, in Q3/2025, the company recorded net revenue from sales and services of over 506.5 billion VND, significantly surpassing the mere 2.6 billion VND in the same period in 2024.

In the first 9 months of 2025, PDR recorded over 964.3 billion VND in net revenue from sales and services, a substantial increase compared to the 173 billion VND in the same period in 2024.

Net profit after tax reached over 85.8 billion VND, a positive increase from the 51.2 billion VND in the same period in 2024.

In the first 9 months, PDR’s net profit was over 201.3 billion VND, up from the 153.6 billion VND in the same period in 2024.

Source: Consolidated Q3/2025 financial statements self-prepared by PDR

Growth was primarily driven by revenue from the transfer of the Bac Ha Thanh project (Quy Nhon, Gia Lai) and the Ky Dong project (HCMC). Additionally, the company recorded 190 billion VND in other income from asset liquidation and other items, contributing to the overall improvement in results.

However, Phat Dat remains under financial cost pressure with interest expenses of approximately 74 billion VND, although the company has restructured its capital more positively by reducing short-term debt and increasing long-term debt.

Cash flow from operating activities remains negative at over 131.8 billion VND, but has significantly improved compared to the negative 1,189.4 billion VND in the same period last year. With inventory of over 14,977 billion VND, accounting for more than 60% of total assets, Phat Dat is in the process of restarting projects to capitalize on the market’s recovery momentum.

Airports, Seaports Boom Propel Top 4 GRDP Province into “Golden” Cycle, Unveiling 2 Most Investable Hotspots

Nestled within the economic powerhouse of Southeast Vietnam’s “Golden Triangle,” this province boasts an impressive GRDP of 609 trillion VND.

Free Health Insurance for Students and Seniors Over 65 in Ho Chi Minh City

At its 5th session on November 14th, the Ho Chi Minh City People’s Council passed a resolution outlining financial support for health insurance premiums for both seniors and students residing in the city. This initiative allocates nearly 2 trillion VND to provide free health insurance coverage for over 2 million students and more than 530,000 individuals aged 65 and above.