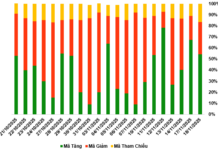

According to VietstockFinance, 25 listed seaport enterprises recorded consolidated revenue of approximately VND 12.5 trillion, a 21% increase year-on-year. Net profit reached nearly VND 2 trillion, up 11%; excluding PAP’s VND 131 billion loss, the industry’s profit growth surged to 18%.

VIMC’s Ports Shine

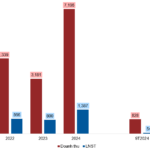

The port segment of Vietnam Maritime Corporation (VIMC, UPCoM: MVN) stood out this quarter, with many units achieving record-high results.

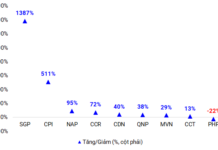

In the South, Saigon Port (UPCoM: SGP) led with a net profit of over VND 168 billion, nearly 15 times higher than the same period last year and the highest in many years. Port service revenue rose 35% to VND 330 billion, with gross margin soaring from 14% to 40.3%. SGP also benefited from VND 68 billion in profits from joint ventures, nearly double the previous year.

In the North, Cai Lan Port (UPCoM: CPI) saw a sixfold profit increase to VND 754 million, with revenue up 82% to over VND 15 billion due to strong port throughput growth. Nghe Tinh Port (HNX: NAP) doubled its profit to VND 5.1 billion, thanks to robust operations in Cu Lao and Ben Thuy.

Central Vietnam also saw highlights. Cam Ranh Port (HNX: CCR) reported a 72% profit increase to VND 7 billion, with revenue up 60% to nearly VND 57 billion, the highest since 2021. Da Nang Port (HNX: CDN) set a new record with VND 112 billion in profit and VND 416 billion in revenue, driven by higher throughput. Gross margin jumped to 42.3%.

Quy Nhon Port (HOSE: QNP) saw a nearly 40% profit increase to VND 35 billion, while Can Tho Port (UPCoM: CCT) reported a 13% profit rise and 42% revenue growth. Hai Phong Port (UPCoM: PHP) saw net profit drop 23% to VND 261 billion due to the absence of other income, but gross profit hit a historic high, with gross margin rising from 38.9% to 51.1%.

Consequently, MVN‘s consolidated revenue reached nearly VND 5.3 trillion, with net profit at VND 669 billion, up 30%. Gross margin also hit a three-year high.

|

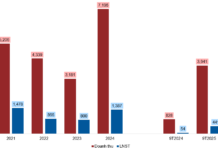

VIMC System Achieves Impressive Q3 Results

Source: Author’s compilation

|

Northern and Southern Enterprises Set New Peaks

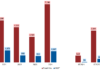

In the North, Vip Green Port (UPCoM: VGR) had its best quarter ever with a VND 125 billion profit, up 1.5 times year-on-year, and VND 304 billion in revenue, up 16%. Gross margin surged to 54%, a rare high for the industry. VGR benefited from reduced repair costs, higher domestic rates, lower depreciation, and insurance compensation from Typhoon Yagi.

VGR‘s strong performance boosted Vietnam Container’s (HOSE: VSC) consolidated profit by nearly 50% to VND 79 billion. Nam Hai Dinh Vu Port also contributed positively.

Dinh Vu Petroleum Port (UPCoM: PSP) and Quang Ninh Port (UPCoM: CQN) reported higher profits due to strong cargo handling activity.

In the South, Dong Nai Port (HOSE: PDN) set a revenue record of VND 399 billion, with profit at VND 128 billion, both up 20%. Throughput rose 14-16%, solidifying its position as a key regional port. Cat Lai Port (HOSE: CLL) also reported its highest-ever profit of VND 29 billion, up 42%, mainly from its transportation segment.

Southern Warehousing (HOSE: STG) earned VND 82 billion, up 50%, despite flat revenue. Gross margin improved significantly from 14.3% to 21%, marking its best-ever result.

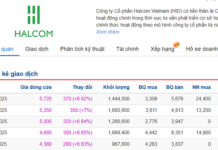

| PDN‘s Revenue Peaks, Profit Just Below Previous Quarter |

Industry Leaders and Rare Exceptions

As an industry leader, Gemadept (HOSE: GMD) maintained steady growth. In Q3, revenue rose 23% to nearly VND 1.6 trillion, the highest ever. Despite a 6% profit decline to VND 315 billion, the result was positive due to significant contributions from joint ventures, especially Gemalink Port in Cai Mep – Thi Vai.

In contrast, Dinh Vu Port Investment (HOSE: DVP) saw profit drop 37% to VND 81 billion and revenue fall 28% to VND 129 billion, marking the sixth consecutive quarterly decline. Another VSC subsidiary, VSC Green Logistics (HNX: GIC), reported a 33% profit decline to VND 3.5 billion due to lower yard throughput.

Phuoc An Port Investment (UPCoM: PAP) remained the sole underperformer, losing over VND 131 billion as the new port’s revenue failed to cover costs.

| Gemalink Port Significantly Contributes to GMD‘s Profit |

Abundant Bank Deposits

Improved profits boosted cash reserves for many seaport enterprises. By Q3-end, bank deposits hit new highs across the board.

CCR held over VND 50 billion in deposits, its highest ever. Similarly, CDN had VND 809 billion in term deposits, up over VND 200 billion since year-start. CPI increased deposits to nearly VND 13 billion, MVN accumulated over VND 9.2 trillion, PDN held VND 880 billion, and SGP doubled deposits to over VND 1.1 trillion in two years, following strong Q3 profits.

VGR also grew its reserves to VND 848 billion, setting new multi-year highs. Enterprises like PSN, CMP, and GIC saw similar trends, with deposits rising continuously since last year.

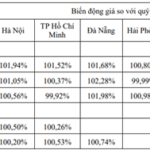

| CDN‘s Bank Deposits Rise Each Quarter |

– 13:00 18/11/2025

How Did Residential Real Estate Businesses Perform in Q3?

Despite numerous businesses experiencing profit surges, the residential real estate sector listed on the stock exchange witnessed a decline in Q3 2025 performance compared to the same period last year.

Egroup Case: Prosecution Recommended for Shark Thuy and 28 Suspects

The Investigative Police Agency of the Ministry of Public Security has proposed prosecuting Shark Thuy and 28 other defendants on three charges: Fraudulent Appropriation of Property, Bribery, and Receiving Bribes.