In the first ten months of 2025, Vietnam witnessed a remarkable surge in entrepreneurial activity, with 162,900 new businesses established. These enterprises collectively registered a capital of VND1,590 trillion ($61.2 billion) and created 967,600 jobs, as reported by the National Statistics Office under the Ministry of Finance.

Key indicators showcased significant year-on-year growth: a 19.7% increase in new businesses, 21.4% in registered capital, and 18.6% in job creation. The average registered capital per enterprise stood at VND9.8 billion ($377,000), reflecting a modest 1.4% rise, indicating a stable business formation rate.

A Dynamic Business Landscape

The period also saw an unprecedented VND5,200 trillion ($200 billion) injected into the economy as additional registered capital, including new registrations and capital increases from existing firms. This 98.2% year-on-year surge highlights growing business confidence in investment and expansion.

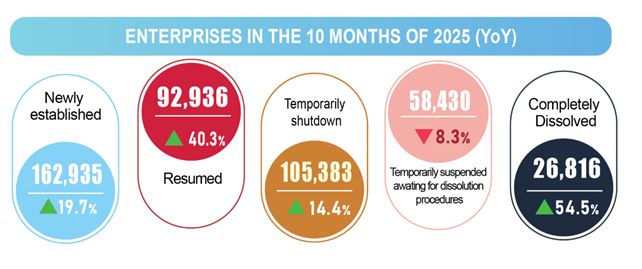

Alongside new enterprises, 92,900 businesses resumed operations after suspension, a 40.3% increase. In total, 255,900 new and returning enterprises entered the market, marking a 26.5% year-on-year rise. On average, 25,600 businesses joined or re-entered the market monthly.

Sector-wise, services led with 124,800 new enterprises (up 21%), followed by industry and construction (36,600, up 16%), and agriculture, forestry, and fisheries (1,534, up 11.7%).

Despite these positive figures, the business environment remained fiercely competitive. During this period, 105,400 enterprises temporarily suspended operations (up 14.4%), 26,800 completed dissolution (up 54.5%), and 58,400 halted operations pending dissolution (down 8.3%). On average, 19,100 enterprises exited the market monthly. In October alone, 6,065 suspended operations, 6,771 awaited dissolution, and 4,536 completed dissolution, a 128.3% increase compared to October 2024.

These contrasting trends reveal that while entrepreneurial spirit remains robust, intense competition and persistent business environment challenges continue to force many enterprises out of the market.

Navigating Challenges for Sustainable Growth

Vietnamese businesses face a myriad of challenges, from long-standing structural issues to emerging legal hurdles. The Vietnam Industrial Park Finance Association (VIPFA) highlights overlapping and inconsistent regulations across key laws such as Investment, Land, Construction, and Environmental Protection. These inconsistencies often lead to redundant paperwork and delayed approvals, particularly in land access, environmental assessments, and fire safety certifications.

Operational challenges persist, with unclear tax incentives and prolonged VAT refunds straining cash flow, especially for new FDI projects. Customs reforms are ongoing, but inconsistent goods classification and HS code application still cause disputes and potential tax arrears. Overlapping inspections further delay port clearances, increasing logistics costs.

Even in the food and health sectors, concerns have been raised. EuroCham’s Nutritional Foods Group Sector Committee warns that proposed amendments to Decree No. 15/2018/ND-CP could significantly increase procedural complexity, requiring up to 600% more documentation and extending appraisal times by 1,400%. These changes risk exposing proprietary information and causing product spoilage, as seen with fresh milk requiring a 21-day review despite a 10-day shelf life.

Internally, many small and medium-sized enterprises struggle with financial transparency and compliance, particularly during digital transformation. These challenges often stem from business owners’ attitudes toward governance and legal responsibility.

To achieve the ambitious GDP growth targets of over 8% this year and double-digit growth in subsequent years, with 2 million active enterprises contributing 55-58% of GDP by 2030 (as outlined in Politburo Resolution No. 68-NQ/TW), addressing these bottlenecks is crucial.

The business community prioritizes a coherent and predictable legal framework. Harmonizing laws on land, investment, and construction to eliminate overlaps is essential. Administrative reforms should aim for a seamless, interconnected digital process, reducing face-to-face interactions and paperwork.

Enterprises advocate for a shift from pre-approval to post-inspection based on risk management, a widely adopted international approach. Instead of complex pre-checks, the State should establish clear technical standards, grant businesses greater autonomy, and focus on surprise audits and strict penalties for violations.

Simultaneously, companies must strengthen their management and financial systems. The digital transformation in the tax sector exemplifies this shift. In the first nine months of 2025, inspections decreased by 21.6% due to AI and big data, while tax revenue increased by 22.1%. This highlights the growing need for transparency, proactive compliance, and internal risk control in areas like invoicing, transfer pricing, and contractor taxation.

For businesses to thrive, a clear roadmap and robust institutional support are essential to modernize operations, ensure legal compliance, and build long-term competitiveness in an increasingly demanding environment.

Ministry of Home Affairs Debunks Rumors of Further Merging 16 Provinces and Cities

The Ministry of Home Affairs representative emphasized that the policy of reorganizing administrative units has undergone meticulous research and careful consideration prior to implementation, aiming for the long-term stability of the administrative unit system.

Unveiling the Secrets: Mailisa’s Lucrative Chinese Cosmetics Imports and the Unusual Details of Doctor Magic Products

Mailisa beauty clinic chain has come under scrutiny, raising questions about the true origin of its massive imports of Doctor Magic cosmetics. Marketed as Hong Kong products, these items are, in fact, manufactured by a Chinese company under an OEM arrangement.