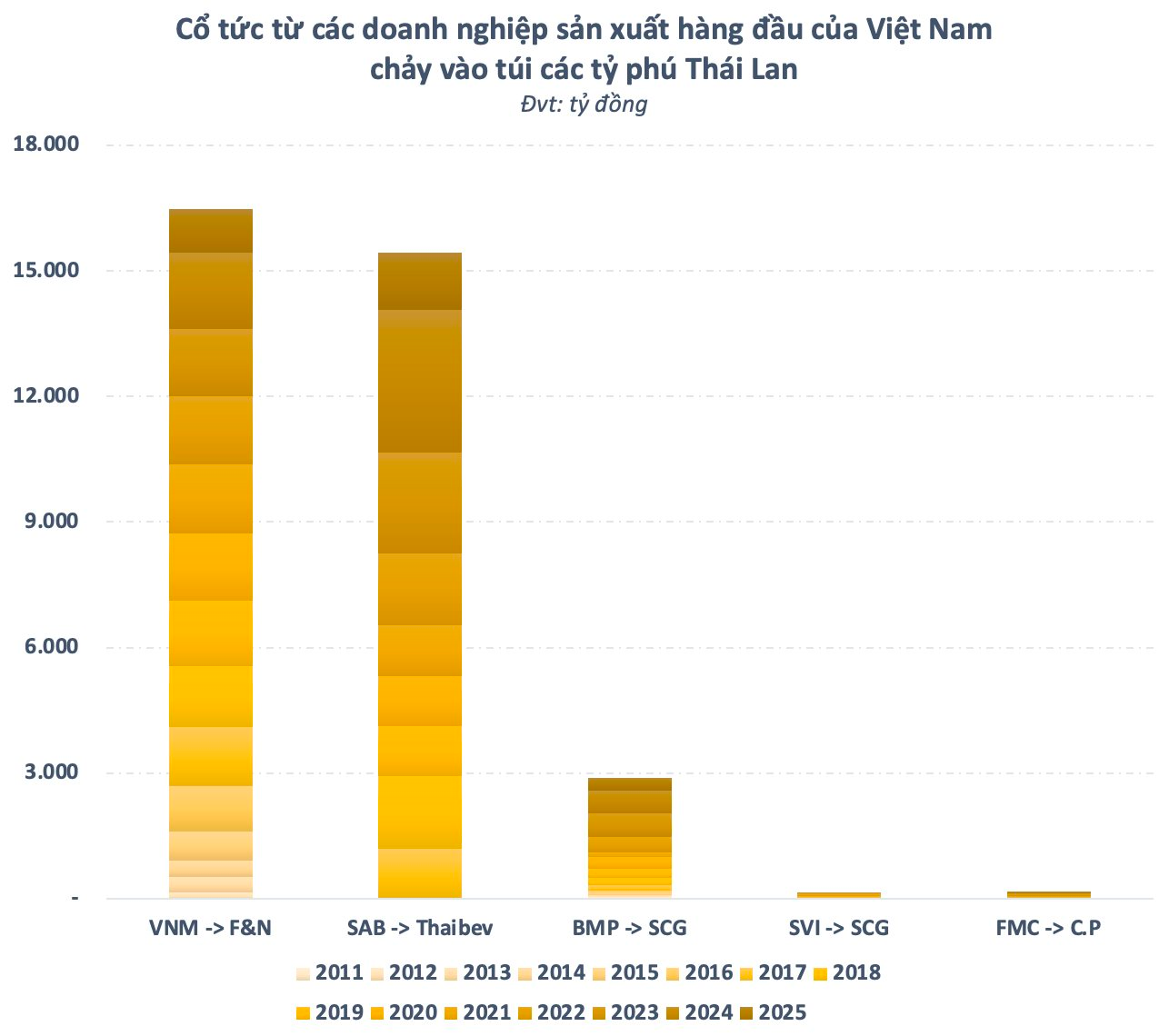

As the year-end approaches, Thailand’s billionaires are once again reaping substantial dividends from Vietnam’s leading enterprises. Companies like Vinamilk, Sabeco, and Binh Minh Plastics are distributing massive dividends, funneling billions of dollars into the pockets of these Thai tycoons.

Collectively, Thai conglomerates have pocketed nearly VND 35,000 billion (USD 1.3 billion) in dividends from Vietnam’s top-tier listed companies.

Vinamilk: The Dividend Cash Cow

Vinamilk stands out as the most lucrative dividend source for Thai billionaire Charoen Sirivadhanabhakdi. Despite not holding a controlling stake, the F&N group has reaped substantial dividends from Vinamilk, thanks to the dairy giant’s consistent annual payouts of 40-60%.

Since acquiring an indirect stake in Vinamilk, the Thai conglomerate has amassed approximately VND 16,500 billion in dividends.

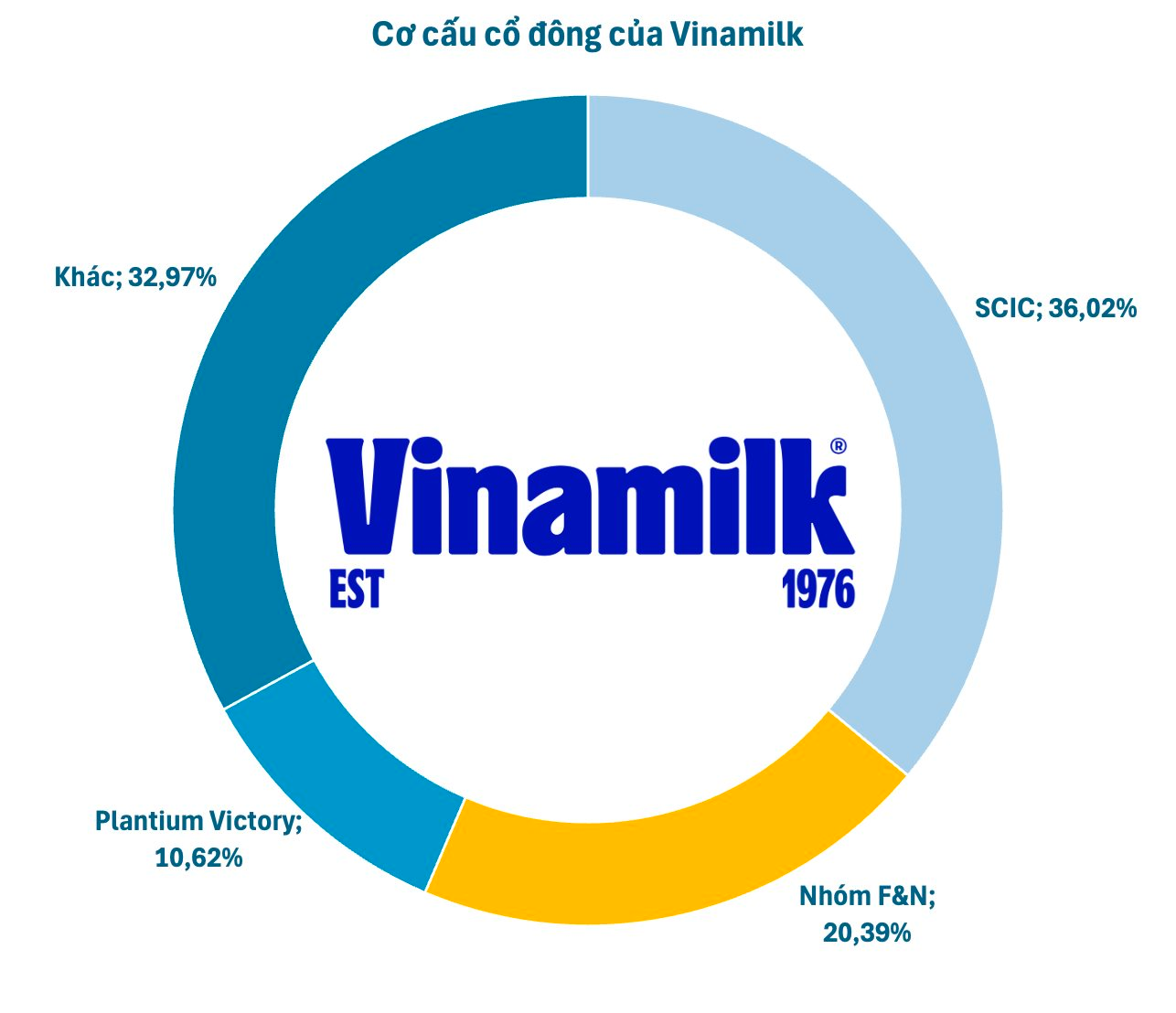

Thai influence at Vinamilk began when TCC Holding acquired Singapore-based Fraser & Neave in 2013 for USD 11.2 billion. At that time, F&N Dairy Investment, a Fraser & Neave subsidiary, was already a major shareholder in Vietnam’s leading dairy company.

Fraser & Neave’s entities have been Vinamilk investors for years, but their presence gained significant attention in 2017 following SCIC’s divestment. After multiple stake increases, the group now holds over 20% of Vinamilk’s shares, second only to the state’s 36% stake. The Thai investors’ Vinamilk holdings are currently valued at around USD 1 billion.

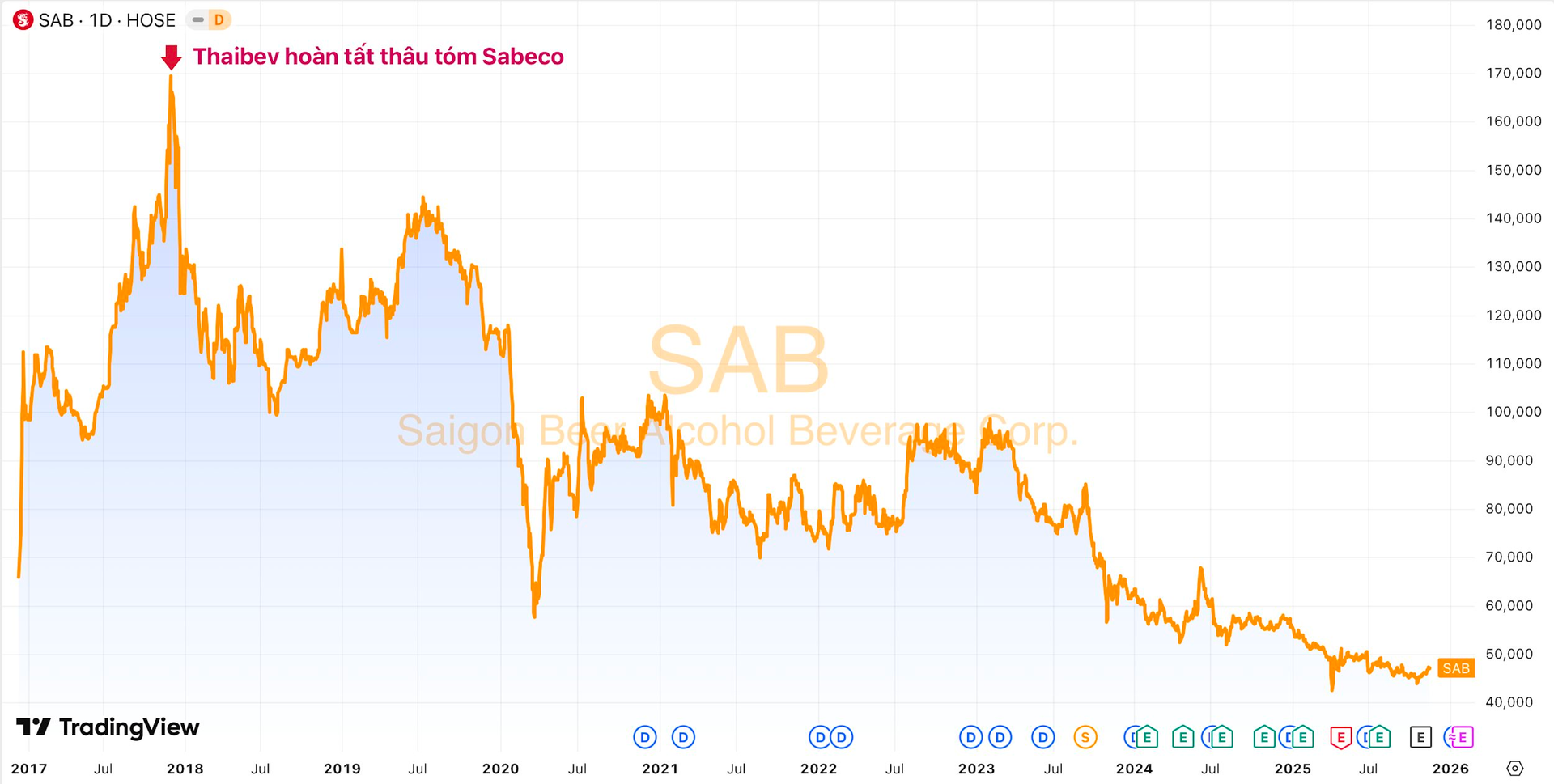

Sabeco Dividends Ease Acquisition Woes

Following Vinamilk, Sabeco has also been a dividend goldmine for Charoen Sirivadhanabhakdi, yielding an estimated VND 15,500 billion since the 2017 acquisition. These dividends have softened the blow of Sabeco’s underperformance since the landmark deal.

In late 2017, Vietnam Beverage (under ThaiBev) spent nearly USD 5 billion to acquire 53.59% of Sabeco from the state, marking Vietnam’s largest-ever state divestment.

ThaiBev’s Sabeco stake is now valued at approximately USD 1.2 billion. Despite a paper loss of USD 3.8 billion, the Thai billionaire remains committed to his long-term vision of dominating Vietnam’s beer market as a springboard to Southeast Asia. Thus, the loss is a calculated risk in his strategic playbook.

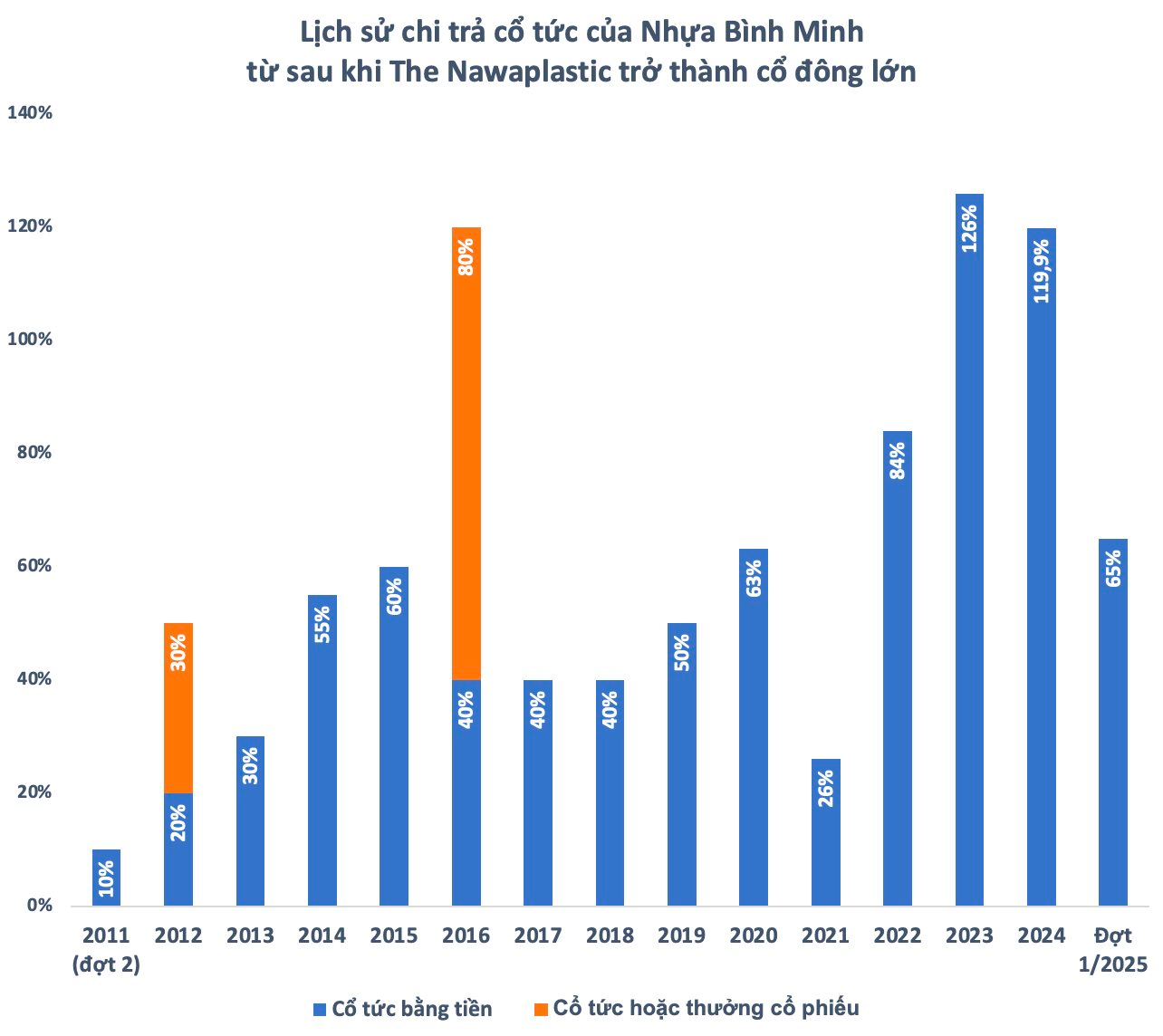

Binh Minh Plastics Dividends Offset Acquisition Costs

Binh Minh Plastics is another dividend powerhouse for Thai investors. Since Nawaplastic (part of Thailand’s SCG Group) became a major shareholder in 2012, the company has consistently paid cash dividends. Total dividends to Thai investors are estimated at nearly VND 3,000 billion.

Nawaplastic has steadily increased its stake in Binh Minh Plastics, culminating in the 2018 acquisition of 24.13 million shares from SCIC. The Thai group now controls nearly 55% of Vietnam’s leading plastics company.

With an estimated investment of VND 2,750 billion, the dividends alone have made the acquisition profitable. Additionally, the shares are trading at record highs, valuing Nawaplastic’s stake at nearly VND 7,500 billion.

Beyond these flagship investments, Thai conglomerates hold significant stakes in other Vietnamese companies, such as TCG Solutions Pte.Ltd (94% of Sovi) and C.P. Group (25% of Fimex), both of which provide steady annual dividends.

Breaking News: Company Set to Allocate Nearly $230 Million to the Ministry of Industry and Trade

The Ministry of Industry and Trade currently stands as the largest shareholder of the Vietnam Engine and Agricultural Machinery Corporation (VEAM), holding nearly 1.18 billion shares, which equates to an 88.5% stake in VEAM’s chartered capital. From the upcoming dividend distribution, the Ministry is set to receive approximately VND 5.5 trillion.

Sabeco (SAB) Struggles as Business Closures Mount, Seeks New Distribution Channels

Sabeco’s net revenue in Q3/2025 declined by 16% year-over-year, yet gross profit margins strengthened due to stringent cost control measures projected through 2026, solidifying its market-leading position.

Unlocking the Secret: Vinamilk’s Award-Winning Asian Technology in Dairy Innovation

Vinamilk has made a groundbreaking impact at the Asian Technology Excellence Awards 2025, unveiling an unprecedented duo of technologies in the Southeast Asian dairy industry. The secret behind the high-quality Vinamilk Green Farm High-Protein Milk goes beyond nutrition—it lies in the seamless integration of cutting-edge technology across every stage of production, from sourcing raw materials to processing.