Launchpad from Consolidation and Public Investment Strategies

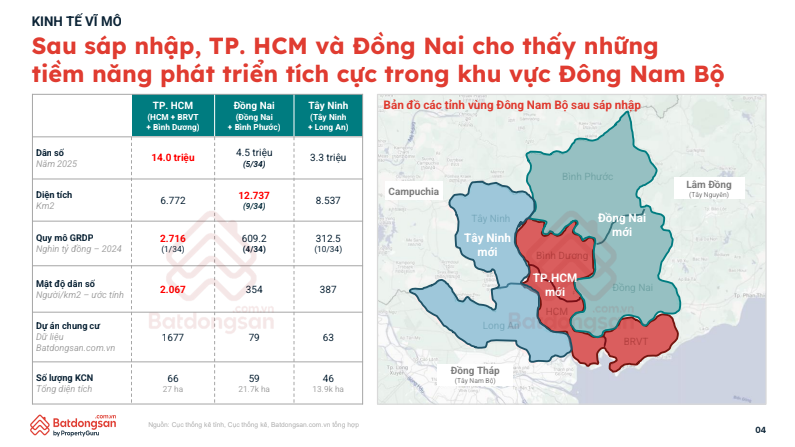

Following the historic administrative merger, Ho Chi Minh City (HCMC) and Dong Nai are showcasing significant development potential in the Southeast region of Vietnam.

The formation of the new HCMC (comprising HCMC, Ba Ria – Vung Tau, and Binh Duong) and the new Dong Nai (including Dong Nai and Binh Phuoc) is more than just an administrative boundary expansion. It’s a strategic consolidation of strengths to create a key economic zone. Post-merger, HCMC’s GRDP reached over 2.7 quadrillion VND (in 2024), leading the nation, while Dong Nai ranked fourth with over 609 trillion VND.

The border area between Dong Nai and HCMC has a low population density, ample land with affordable prices, providing significant room for urbanization. Additionally, public investment is being accelerated as a driver of economic growth. As of September 2025, HCMC has disbursed 50% of its public investment capital, while Dong Nai has achieved 35%.

Dong Nai holds a strategic position in the expanded urban and logistics landscape of Eastern HCMC. A series of key infrastructure projects are transforming the Eastern region, including Long Thanh International Airport, Cai Mep – Thi Vai Port, Bien Hoa – Vung Tau Expressway, HCMC – Long Thanh – Dau Giay Expressway, Cat Lai Bridge, Phu My 2 Bridge, Dong Nai 2 Bridge, and the Thu Thiem – Long Thanh railway line.

Soaring Interest in Dong Nai Real Estate

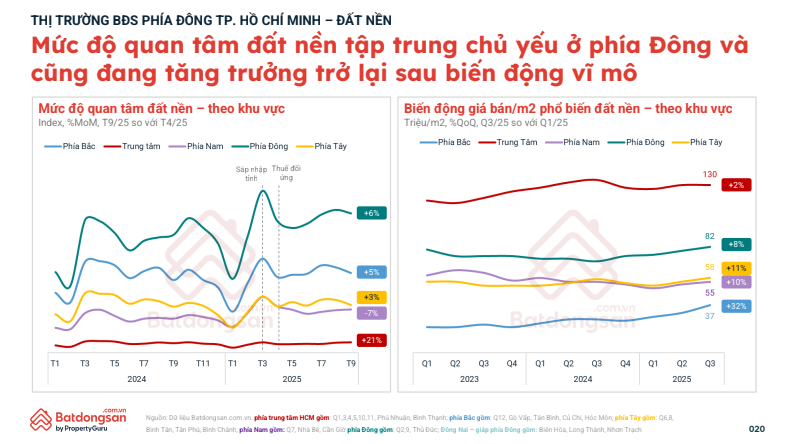

According to data from Batdongsan.com.vn, as of September 2025, interest in Dong Nai real estate surged by 21%, double that of Eastern HCMC and far outpacing other areas.

Another highlight in the real estate market bordering Eastern HCMC is the rental yield for apartments. While District 2 offers a yield of 2.1%, District 9 around 2.7%, and Thu Duc 3.3%, Bien Hoa leads with 4.4%, followed by Nhon Trach at 3.2%.

This underscores the real profit potential in Bien Hoa, Dong Nai, not only for long-term investment but also for short-term cash flow through rentals—a factor attracting investor attention in a market seeking high liquidity.

In the land plot segment, the Eastern HCMC market is also recovering. Interest in this area increased by 6% in September 2025 compared to April 2025, higher than the West (3%) and the North (5%), contrasting with the decline in the South.

In Bien Hoa and Long Thanh, the average asking price in Q3/2025 ranged from 16 to 23 million VND/m², up 5-7% from Q1/2025. Compared to the average price of 130 million VND/m² in central HCMC, this gap highlights significant growth potential.

For low-rise properties in urban areas, interest in Bien Hoa—the region bordering Eastern HCMC—surged by 58% in Q3/2025 compared to the previous quarter.

In central HCMC, low-rise property prices are slightly declining, stabilizing at 248 million VND/m². Meanwhile, in Dong Nai’s border area with Eastern HCMC, prices hover around 55 million VND/m², still up 6% from Q1/2023.

Some urban areas still offer attractive pricing, such as Izumi City (Long Hung, Dong Nai), spanning nearly 170 hectares, with prices around 45 million VND/m².

According to Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, in the short term, investors should prioritize areas with well-established urban developments, suitable for rental exploitation or real housing needs. Long-term, infrastructure progress and urbanization speed will determine the true value of the Eastern region in the next development cycle.

“In reality, as land prices in central HCMC rise and land becomes scarce, population decentralization and investment expansion to the outskirts are inevitable. Dong Nai, as the gateway to the Southeast region, offers a ‘three-in-one’ advantage: low land prices, accelerated infrastructure, and high rental yields,” Quoc Anh noted.

Exclusive Acquisition: Phát Đạt Secures Billion-Dollar Project in the Heart of Ho Chi Minh City

Through its acquisition of a 50% stake in AKYN, Phat Dat Real Estate has announced plans to develop a multi-billion-dollar project.

Ho Chi Minh City Selects Investors for Two Urban Areas Spanning Over 516 Hectares

The new urban areas of Bình Quới – Thanh Đa (Bình Quới Ward) and Cù Lao Bến Đình (Vũng Tàu Ward), spanning a combined total of over 516 hectares, are poised to revolutionize the urban development of both central and coastal regions.

Vingroup, Masterise Group, Sun Group Enter the Race to Develop Railways, Highways, and Seaports, Transforming Infrastructure into a Powerful Tool to Boost Project Value

Real estate giants like Vingroup, Masterise Group, and Sun Group are forging a new frontier by investing in transformative infrastructure projects. From high-speed rail networks and a $8.5 billion airport to the $13 billion Red River Avenue, these developments are poised to redefine Vietnam’s property landscape.