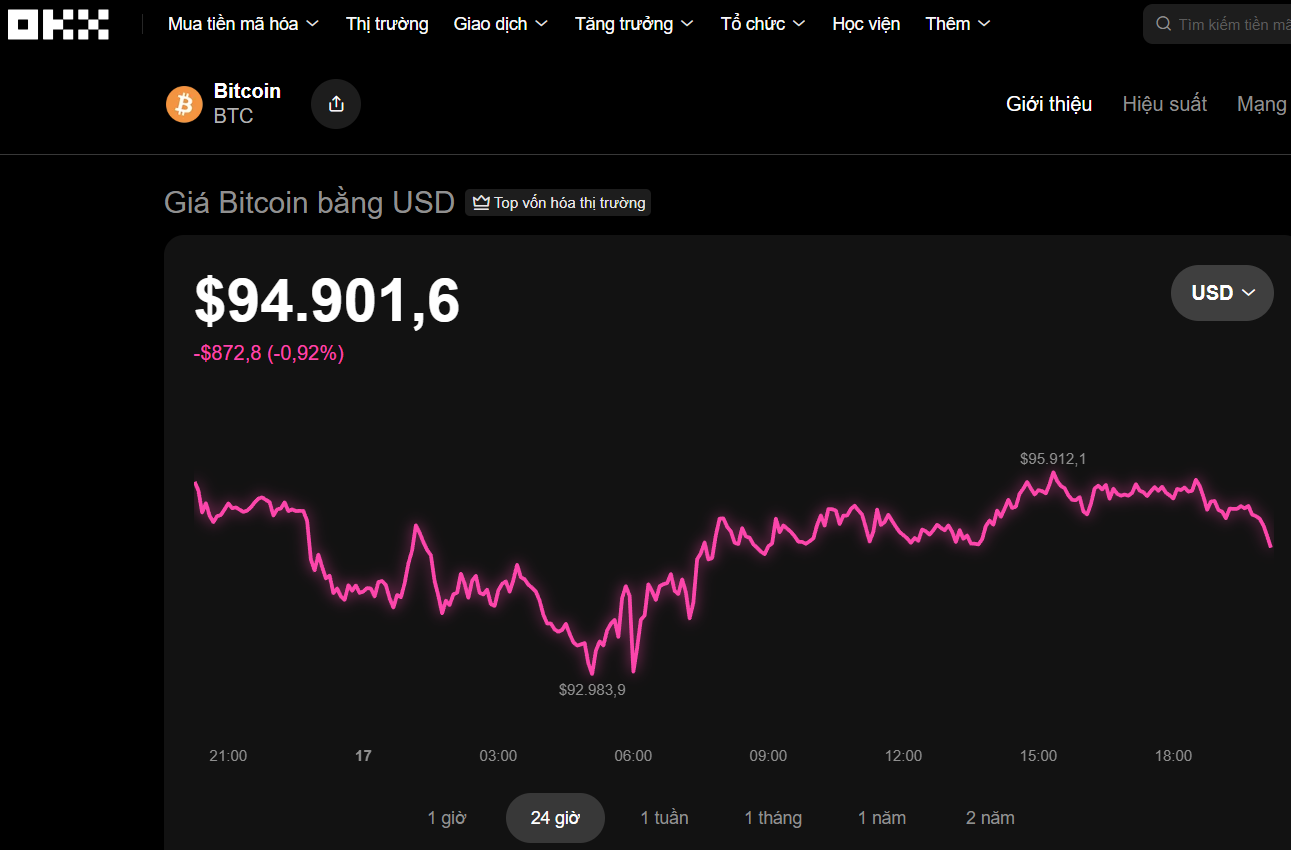

On the evening of November 17th, the cryptocurrency market experienced a widespread decline. Data from the OKX exchange revealed that Bitcoin lost nearly 1% of its value in the past 24 hours, trading at $94,900.

Other major cryptocurrencies also saw slight fluctuations, with Ethereum dipping 0.1% to $3,160 and BNB falling 0.7% to $925. In contrast, XRP gained 1% to reach $2.20, and Solana rose 0.5% to $140.

According to Cointelegraph, Bitcoin briefly dropped below $93,000 over the weekend, a level not seen since the beginning of the year. This decline has caused significant market sentiment polarization.

Some traders report that large investors are accumulating Bitcoin in the $88,500–$92,000 range, viewing it as a strong support level. However, warnings persist that prices could retreat further to the $88,000–$90,000 zone before any recovery.

Bitcoin is currently trading around $94,900. Source: OKX

Despite the sharp decline, market data indicates that buying pressure intensified overnight, preventing prices from falling further. Analysts suggest that if Bitcoin swiftly regains its upward momentum and establishes a higher low, the market could enter a new recovery phase.

Many investors anticipate that Bitcoin needs to return to the $98,000 level to strengthen the bottoming signal. Another notable price range is between $91,800 and $92,700.

Markets often revisit these levels, leading some to predict that Bitcoin may dip into this range before rebounding. However, upward momentum could be limited due to selling pressure at higher levels.

More concerning is Bitcoin’s loss of a long-term support level that had held firm through multiple growth cycles.

Closing the week below this threshold is seen as a bearish signal, increasing the risk of a medium-term downward trend, especially if prices breach the $88,000 and $74,500 levels.

On a macro level, the cryptocurrency market’s performance contrasts sharply with other assets. While the crypto market cap shed over $100 billion in a few days, U.S. stocks rose, gold advanced, and bond yields ticked higher.

Experts attribute the recent decline primarily to liquidations and selling pressure within the crypto market, rather than broader economic factors.

Investor sentiment has also weakened significantly. The Fear and Greed Index has plummeted to its lowest level this year, indicating heightened market caution. Discussions about Bitcoin surged as prices fell, reflecting anxiety among retail investors.

Some analysts note that such a spike in interest often occurs near price bottoms.

Will the Stock Market Explode Next Week After a Deep Circuit Breaker Halt?

The stock market has rebounded, instilling optimism among investors for a positive trend in the upcoming week.