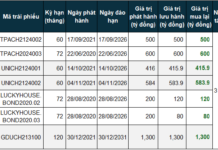

Modern Vietnam Joint Stock Commercial Bank (MBV) recently announced new deposit interest rates, effective from November 12, 2025.

According to MBV’s online deposit interest rate chart for individual customers, the 1-2 month term rate increased from 4.1%/year to 4.6%/year; the 2-month term rose to 4.7%/year.

Notably, MBV’s 3-month savings interest rate climbed from 4.4%/year to 4.75%/year. The 4-5 month term rates also increased from 4.7%/year to 4.75%/year, reaching the maximum cap set by the State Bank for deposits under 6 months.

MBV’s 6-11 month deposit rates rose by 0.1-0.2%/year to 5.7%/year. The 12-36 month terms saw similar adjustments, reaching 6%/year.

Source: MBV

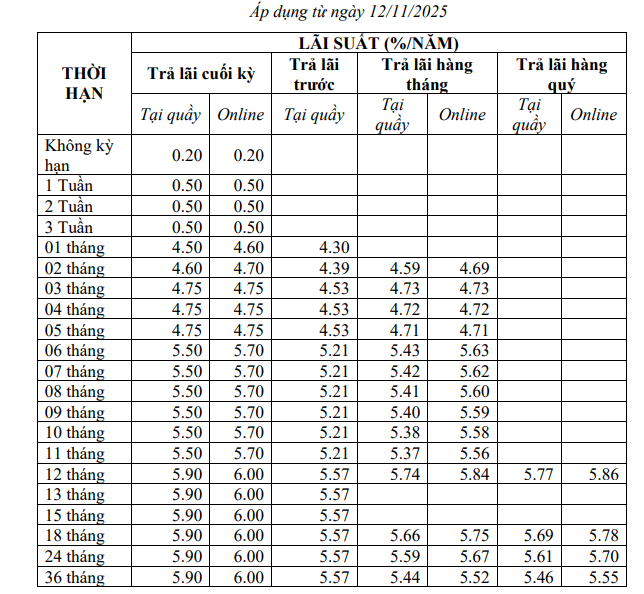

Loc Phat Vietnam Joint Stock Commercial Bank (LPBank) also adjusted its deposit rates across multiple terms. Specifically, 1-5 month terms increased by 0.3 percentage points/year; 6-11 month terms rose by 0.2 percentage points/year; while longer terms from 18-60 months saw a slight 0.1 percentage point/year increase. The 12-16 month terms remained unchanged.

After adjustments, LPBank’s online savings rates with end-of-term interest payments are as follows: 1-month term at 3.9%/year; 2-month term at 4%/year; 3-5 month terms at 4.2%/year. The 6-11 month terms are at 5.3%/year; 12-16 month terms at 5.4%/year; and the highest rate is for 18-60 month terms at 5.5%/year.

Source: LPBank

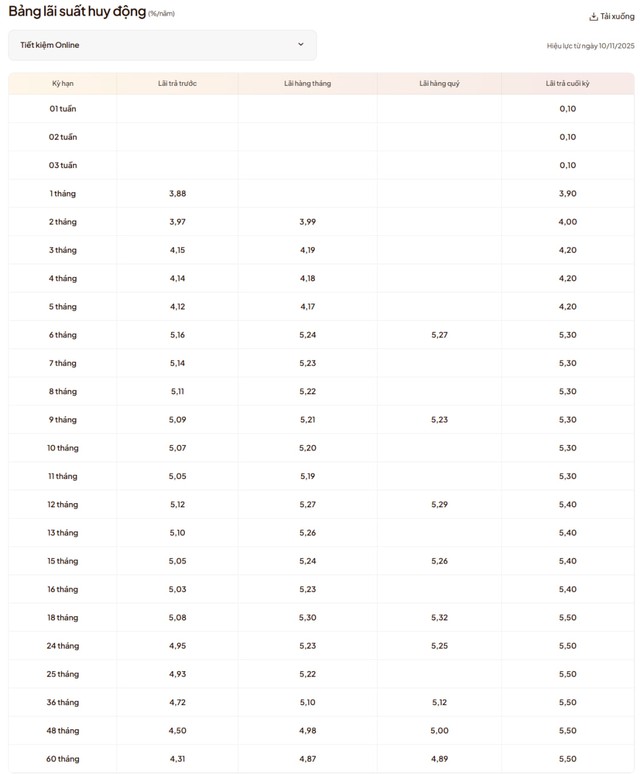

On the morning of November 11, Kien Long Commercial Joint Stock Bank (KienlongBank) adjusted its deposit interest rates after nearly 8 months of keeping them unchanged. According to the latest update, deposit rates for 1-4 month terms increased by 0.2 percentage points/year; similarly, 6-7 month terms also saw a 0.2 percentage point/year increase.

Notably, KienlongBank reduced rates for 8-9 month terms by 0.1 percentage points/year, while other terms remained unchanged.

In KienlongBank’s latest online savings interest rate chart for individual customers, 1-5 month terms are listed at 3.9%/year. The 6-7 month terms are at 5.3-5.4%/year; while 8-9 month terms dropped to 5.1%/year. Online rates for 10-11 month terms are set at 5.3%/year, with the highest rate of 5.5%/year for 12-month terms. For longer terms from 13-36 months, rates remain stable at 5.45%/year.

Source: Kienlongbank

Last week, Vietnam Public Joint Stock Commercial Bank (PVCombank) adjusted its savings interest rates for the first time in over a year (since August 2024).

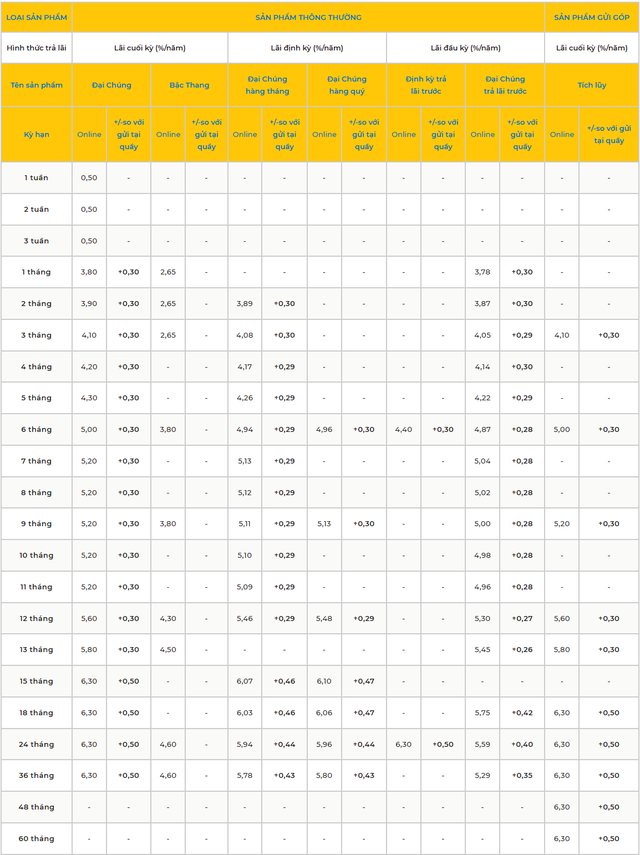

According to the online deposit interest rate chart for individual customers, PVCombank increased rates by 0.5%/year across all terms from 1 to 36 months. Specifically: 1-month term to 3.80%/year; 2-month term to 3.90%/year; 3-month term to 4.10%/year; 4-month term to 4.20%/year; 5-month term to 4.30%/year; 6-month term to 5.00%/year; 7-11 month terms to 5.20%/year; 12-month term to 5.60%/year; 13-month term to 5.80%/year.

The highest deposit rate at PVCombank is 6.3%/year, applicable to online deposits with terms from 15-36 months.

Source: PVComBank

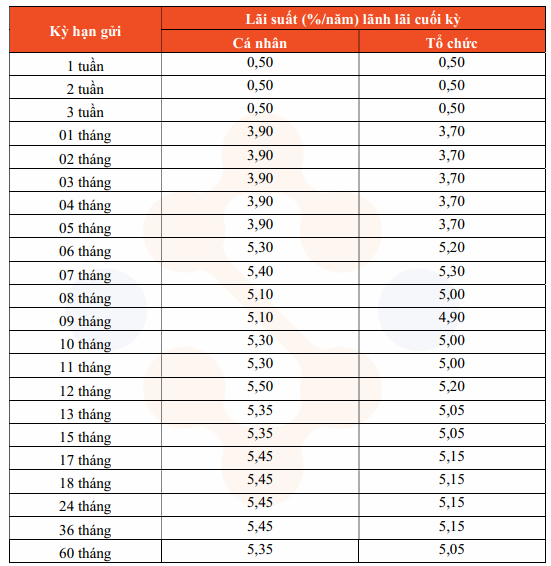

Bao Viet Joint Stock Commercial Bank (BaoViet Bank) also increased its deposit rates after more than 7 months of keeping them unchanged.

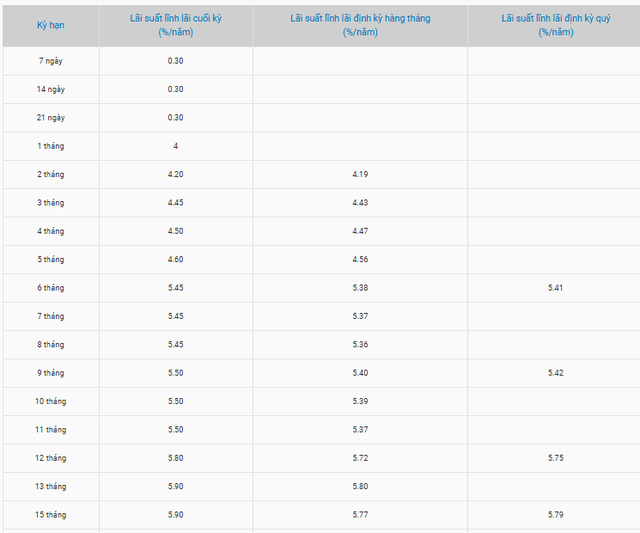

According to the latest online deposit interest rate chart for individual customers, BaoViet Bank increased the 1-month term rate by 0.5%/year to 4%/year; the 2-month term by 0.6%/year to 4.2%/year. The 3, 4, and 5-month terms all increased by 0.1%/year, reaching 4.45%/year, 4.5%/year, and 4.6%/year, respectively.

However, the bank kept rates for 6-36 month terms unchanged: 6-8 month terms at 5.45%/year; 9-11 month terms at 5.5%/year; 12-month term at 5.8%/year; and the highest at 5.9%/year for 13-36 month terms.

Source: BaoVietBank

Since the beginning of November, approximately 10 other banks have increased their savings rates. Previously, several banks had already raised savings rates in October and early November, including Sacombank, VPBank, SHB, HDBank, GPBank, NCB, BVBank, and Bac A Bank.

According to industry experts, the widespread increase in interest rates indicates that the competition for capital mobilization has intensified again in Q4/2025, particularly among joint-stock commercial banks, to meet the rising capital demand at year-end and narrow the gap between deposit and lending growth.

In a newly released macroeconomic report, Vietcombank Securities (VCBS) forecasts that deposit interest rates will trend upward by year-end, especially among joint-stock commercial banks, driven by two main factors.

First, liquidity pressure in the banking system is increasing as credit is expected to accelerate strongly in the final months of the year, with full-year growth estimated at 18-20%. As of late October, credit had grown by 13.37% compared to the end of 2025, reflecting strong capital demand in the economy.

Second, the risk of USD/VND exchange rate fluctuations remains, given the increased demand for foreign currency during the peak import season at year-end.

Consequently, VCBS predicts that deposit interest rates may rise again at some joint-stock commercial banks by year-end to meet capital needs and manage systemic risks, while remaining at a low level in line with growth support policies.

FMO and HDBank Sign MoU to Deploy $30 Million Investment for Green and Sustainable Growth in Vietnam

On November 11th, the Dutch Development Bank (FMO) and Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank, HOSE: HDB) signed a Memorandum of Understanding (MoU) on sustainable investment and finance cooperation. The signing ceremony took place during the visit of a Dutch business delegation led by Ms. Aukje de Vries, Minister for Foreign Trade and Development Cooperation of the Kingdom of the Netherlands, to Vietnam.

Latest Updates on Land Use Rights Certificates: Essential Information for All Vietnamese Citizens

Starting today, citizens can conveniently submit their land-use right certificates via the VNeID platform to government agencies, eliminating the need for physical photocopy submissions.

Mastering the 10M Consumer Price Index: Strategies for Stability and Control

Inflation was kept firmly in check throughout the first ten months of 2025, setting the stage for a year-end outcome that mirrors this stability.