Financial Solutions Emerge as Year-End Housing Market Heats Up

Year-End Financial Solutions for Homebuyers

Following administrative mergers, new housing supply in Ho Chi Minh City has increased with additional projects in the former Binh Duong area. However, apartments priced around $2,174 per square meter are becoming scarce, indicating rapid price growth over the past two years.

CBRE Vietnam’s Q3 2025 data shows primary apartment prices in former Ho Chi Minh City range from $4,348 to $5,319 per square meter, with some new luxury projects reaching $6,087 to $7,059 per square meter. In the former Binh Duong area, prices have risen by 15% annually, with no signs of slowing. Units once priced at $1,325–$1,767 per square meter now range from $2,174–$3,043 per square meter, still one-third to one-half the cost of Ho Chi Minh City properties.

According to Savills experts, owning a home is increasingly difficult for young people and young families without family support, developer incentives, or suitable credit packages. Demand remains high among those with modest savings of $13,254–$21,739, but rising prices are a significant barrier.

Developer-led financial solutions enable young buyers with limited savings to own homes. (Illustrative image)

In Ho Chi Minh City, few projects offer apartments priced around $2,174 per square meter, and even fewer developers provide long-term financial solutions for young buyers.

Recently, several projects have introduced affordable units with attractive sales policies.

For instance, the Risa by La Pura tower (part of the La Pura project) by Phat Dat Group has gained attention for its 10% down payment option (starting at approximately $11,000) for apartments in Northeast Ho Chi Minh City’s core area. Buyers receive 75% bank financing, a 3-year principal grace period, and 2 years of interest support. Early payments qualify for up to 10% discounts.

Similarly, Phu Dong Group’s Phu Dong SkyOne and Sky Garden projects offer competitive pricing, fixed 5.5% annual interest rates, and interior packages worth hundreds of millions of dong. TT AVIO, another project in its final sales phase, requires a 20% down payment and has attracted young buyers.

A southern real estate developer noted that offering attractive financial packages involves careful profit margin considerations. Amid a slow market recovery, developers are prioritizing buyer support over profit maximization.

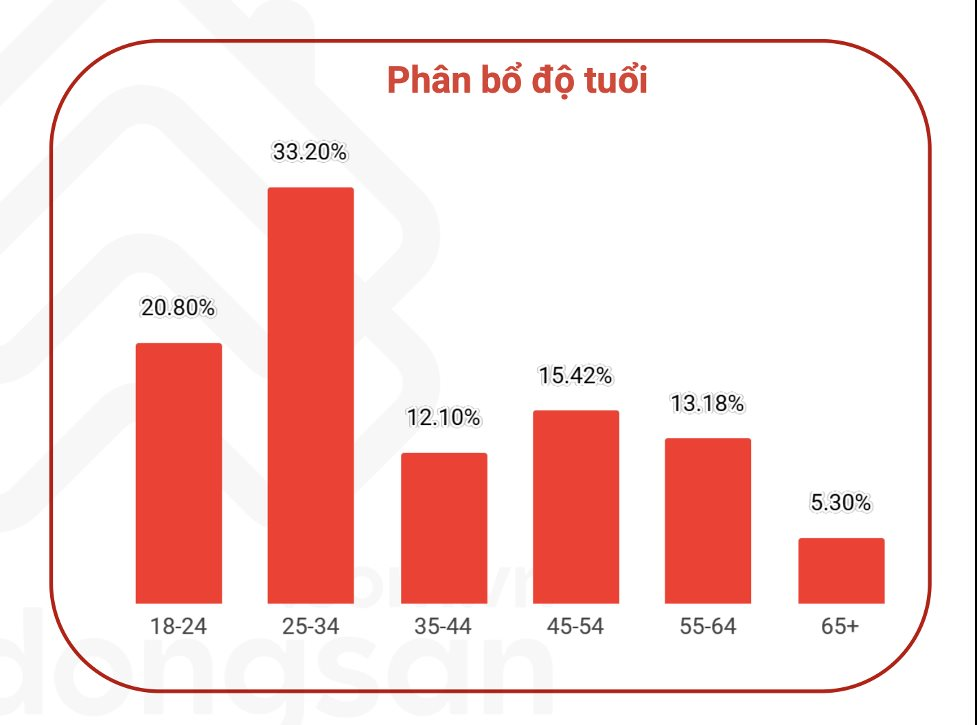

Real estate agencies report that young buyers aged 25–35 now account for over 40% of transactions, with some projects reaching 70%.

Many young buyers rely on family support, developer incentives, or first-time homebuyer loans. Extended benefits like interest-free periods, principal grace periods, flexible payments, and bank subsidies enable them to purchase homes sooner rather than waiting to save.

New Generations Reshape Real Estate Dynamics

Research from the Vietnam Real Estate Market Assessment Institute (VARS IRE) shows that young buyers are increasingly active, with distinct preferences compared to previous generations. Unlike their parents, they prioritize affordable, well-connected apartments over long-term savings for land or central townhouses.

Ages 24–35 dominate real estate searches. Source: Batdongsan.com.vn

Avison Young researchers highlight that Millennials (born 1980–1995) and Gen Z (born 1996–2010) will soon dominate the real estate market. Their unique values and tech-savvy preferences are reshaping housing and commercial space design, usage, and management.

These generations, comprising 44% of Vietnam’s population, prioritize health, environment, and social issues. As their purchasing power grows, their diverse lifestyles are influencing market trends, with 70% becoming potential buyers, renters, or investors.

Exclusive Acquisition: Phát Đạt Secures Billion-Dollar Project in the Heart of Ho Chi Minh City

Through its acquisition of a 50% stake in AKYN, Phat Dat Real Estate has announced plans to develop a multi-billion-dollar project.

Vingroup, Masterise Group, Sun Group Enter the Race to Develop Railways, Highways, and Seaports, Transforming Infrastructure into a Powerful Tool to Boost Project Value

Real estate giants like Vingroup, Masterise Group, and Sun Group are forging a new frontier by investing in transformative infrastructure projects. From high-speed rail networks and a $8.5 billion airport to the $13 billion Red River Avenue, these developments are poised to redefine Vietnam’s property landscape.