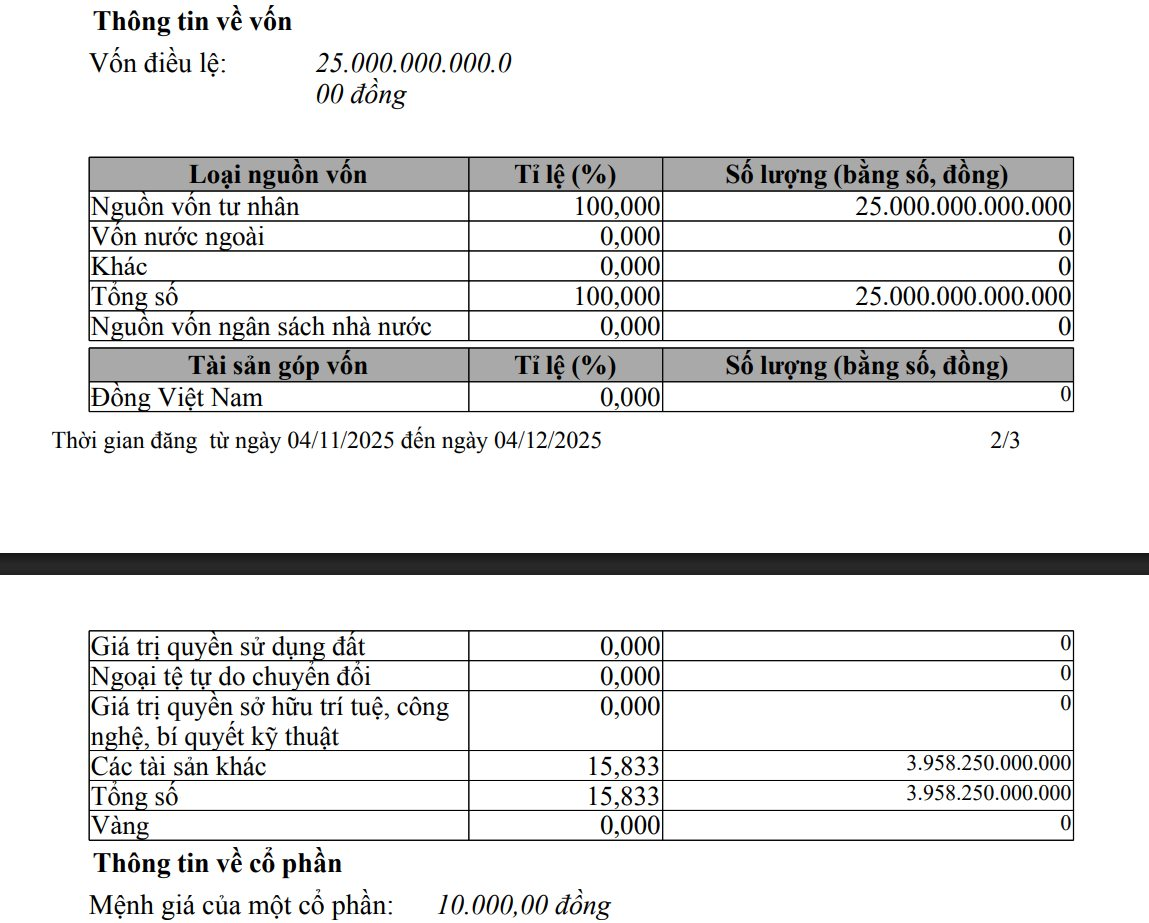

Green and Smart Mobility Corporation (GSM), a company founded by billionaire Pham Nhat Vuong, has recently updated its registered capital. The company’s charter capital increased by 39%, from VND 18 trillion to VND 25 trillion. Notably, “other assets” account for 15.8% of this total.

Established in March 2023, GSM operates in two main sectors: electric taxis and electric vehicle rentals, including cars and motorcycles. With an initial investment plan of 10,000 electric cars and 100,000 electric motorcycles, GSM aims to make electric vehicles more accessible and flexible for all customers.

At its inception, GSM had a charter capital of VND 3 trillion. The largest shareholder is Pham Nhat Vuong, holding 95% of the shares, followed by Pham Thu Huong with 3%, and Vietnam Investment Group Corporation (CTCP Tập đoàn Đầu tư Việt Nam) with 2%. Vietnam Investment Group is also the largest shareholder in Vingroup (HoSE: VIC).

Recently, several entities within the Vingroup ecosystem have increased their capital.

In November 2025, VinMetal increased its charter capital from VND 10 trillion to VND 15 trillion. The company did not disclose any changes in its shareholder structure.

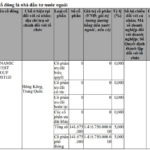

In October 2025, VinEnergo significantly raised its capital from VND 10 trillion to VND 28.335 trillion. Of this, 44.59% (VND 12.1339 trillion) was contributed in cash, while other assets accounted for 55.41% (VND 15.7011 trillion). In November, the company announced that Dynamic Invest Group Limited, a foreign investor based in Hong Kong, China, acquired a 5% stake in the company, equivalent to VND 1.4168 trillion.

Also in November, VinSpeed, a subsidiary of Vingroup, increased its charter capital from VND 31.2 trillion to VND 33 trillion. Previously, VinSpeed had raised its capital from VND 15 trillion to VND 31.2 trillion through the merger with Hung Long Real Estate Investment and Management Corporation.

Additionally, Vingroup is seeking shareholder approval for a plan to issue shares to increase its equity capital from retained earnings. Currently, Vingroup has 3.853 billion shares outstanding and plans to issue an additional 3.853 billion shares, at a 1:1 ratio. This would double Vingroup’s charter capital to VND 77.335 trillion, with 7.73 billion shares in circulation.

Vingroup, Masterise Group, Sun Group Enter the Race to Develop Railways, Highways, and Seaports, Transforming Infrastructure into a Powerful Tool to Boost Project Value

Real estate giants like Vingroup, Masterise Group, and Sun Group are forging a new frontier by investing in transformative infrastructure projects. From high-speed rail networks and a $8.5 billion airport to the $13 billion Red River Avenue, these developments are poised to redefine Vietnam’s property landscape.

VinEnergo, the $1.2B Energy Giant Backed by Billionaire Pham Nhat Vuong, Welcomes New Shareholder with 5% Stake

Founded in March 2025, VinEnergo Energy Joint Stock Company is the dedicated renewable energy arm within the Vingroup ecosystem.