VVS – A Promising Stock Officially Lists on HoSE After Stable Growth on UPCoM

The Ho Chi Minh City Stock Exchange (HoSE) has officially approved the listing of 21,525,000 VVS shares of Vietnam Machinery Development Investment Joint Stock Company (VIMID), with a par value of 10,000 VND per share.

Prior to its HoSE debut, VVS shares were listed on the UPCoM system from October 7, 2022. During this period, the company maintained stable business operations and sustained growth. Notably, on August 28, 2025, three years after becoming a public company, VIMID distributed its first cash dividend at a rate of 10%. This marks a positive signal of financial strength and commitment to shareholder value.

The official listing on HoSE is a strategic move in VIMID’s development journey. This transition enhances the company’s credibility, broadens access to abundant capital from domestic and international investors, and facilitates further expansion. It also improves production efficiency and strengthens investment in manufacturing projects, optimizing the supply chain and increasing localization in the truck sector.

VIMID Surpasses Targets, Poised for Breakthrough Ahead of HoSE Listing

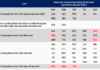

In the lead-up to the listing, VIMID’s business performance has been robust. In Q3/2025 alone, the company reported net revenue from sales and services of 2,230 billion VND, a 2.7-fold increase compared to Q3/2024.

As of September 30, 2025, VIMID’s cumulative net revenue for the first nine months reached 5,444 billion VND, up 2,763.7 billion VND (103.1%) year-on-year. Pre-tax profit for the same period hit nearly 213 billion VND, a 173.7% increase from the previous year.

For 2025, VIMID set a revenue target of 4,200 billion VND and a pre-tax profit goal of 90 billion VND. By the end of Q3/2025, the company had exceeded its revenue target by 30% and achieved 137% of its pre-tax profit goal.

This strong performance ahead of VVS’s HoSE listing underscores VIMID’s solid financial foundation and business momentum. Surpassing key targets not only bolsters existing shareholder confidence but also positions the company favorably for expanded growth and new investment opportunities.

Maintaining operational efficiency amid market volatility highlights VIMID’s thorough preparation for its HoSE listing. It also reflects the company’s sustainable development strategy, focusing on transparency and scalability in the coming years.

With a long-term vision, VIMID continues to prioritize sustainable growth, emphasizing green truck development, comprehensive digital transformation, strategic investments, operational optimization, and enhanced customer experiences.

Notably, during the 2025 Annual General Meeting on April 19, 2025, shareholders approved Resolution No. 01/2025/NQ-ĐHĐCĐTN-VIMID, which includes plans for a Truck Assembly and Production Project. Additionally, on September 30, 2025, VIMID’s Board of Directors established VMASS Motor Company Limited, a subsidiary specializing in automobile and motor vehicle production, along with related industries. These initiatives are pivotal in mastering the supply chain, increasing localization, and strengthening VIMID’s production capabilities and competitive edge in the truck industry.

Amid rising logistics demand, the shift toward green logistics, increased public investment, and Vietnam’s automotive industry development strategy, VIMID is well-positioned for a breakthrough. The HoSE listing will serve as a critical catalyst, propelling VIMID’s growth and solidifying its market leadership domestically and regionally.

Chapter Yang Corp Plans to Offer Nearly 53 Million Shares to Double Its Chartered Capital

Chương Dương Corp is set to offer nearly 52.8 million shares to existing shareholders at a price of 10,000 VND per share, aiming to raise its chartered capital to approximately 1,055.5 billion VND.

Fastest Capital-Raising Real Estate Firm Set to List on HoSE

The Ho Chi Minh City Stock Exchange (HoSE) has recently received the listing application for 200 million RGG shares from Regal Group Joint Stock Company. Prior to this, Regal Group successfully offered 20 million shares to existing shareholders at a price of 10,000 VND per share, increasing its chartered capital from 1.8 trillion VND to 2 trillion VND.