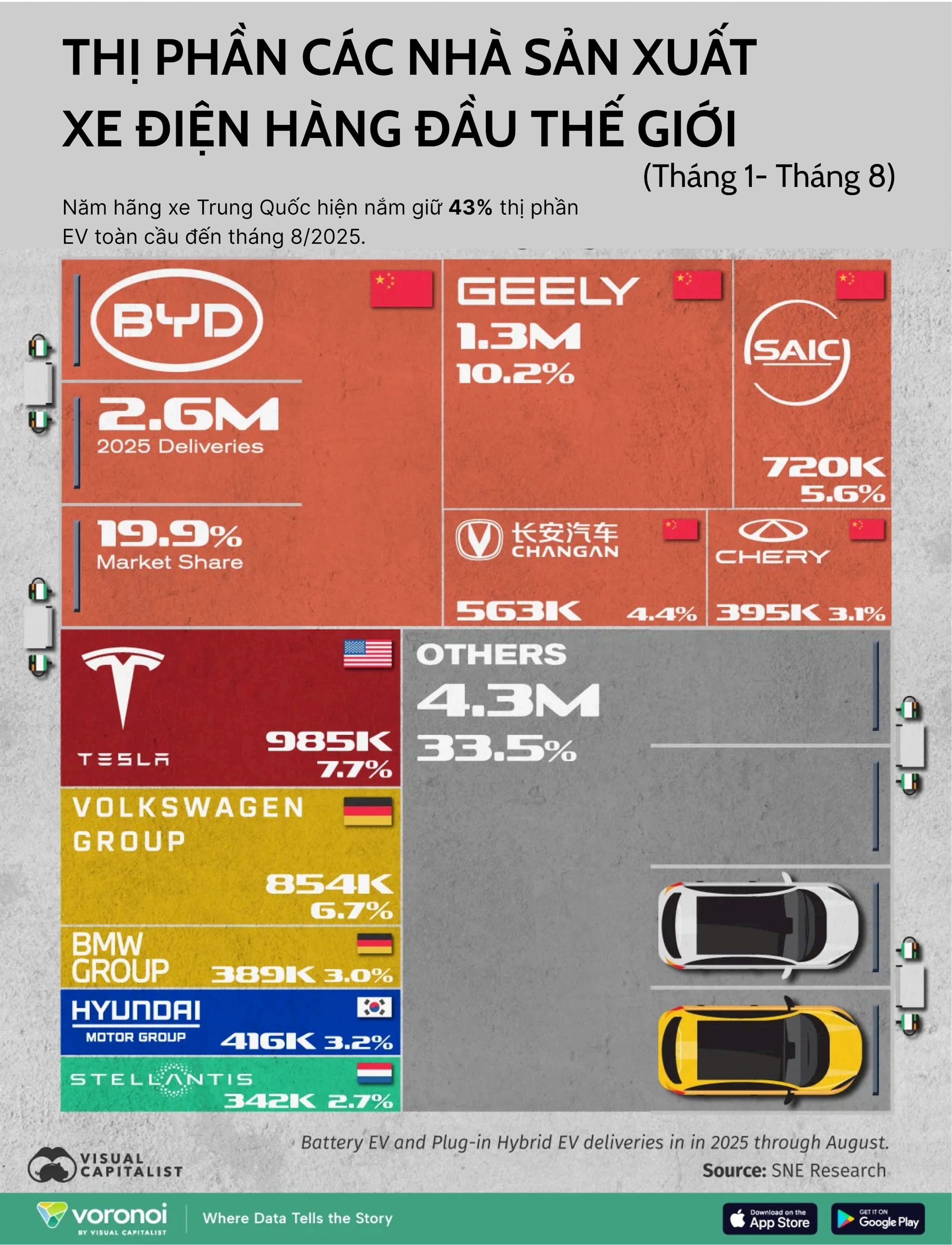

The global electric vehicle (EV) market continued its explosive growth in 2025. From January to August, deliveries reached 12.8 million units, reflecting an unprecedented expansion in the zero-emission automotive industry. This surge is accompanied by a significant shift in market share, with Chinese manufacturers emerging as dominant players, leading in both growth rates and scale.

BYD Maintains Its Crown with Nearly 20% Market Share

Leading the global market is BYD, delivering 2.6 million vehicles, equivalent to 19.9% market share. The Shenzhen-based company continues to expand its influence beyond borders, aggressively penetrating markets in Europe, Brazil, and Mexico. In the UK alone, September sales reached 11,271 units, soaring 880% compared to the same period in 2024—a testament to the brand’s appeal in Western markets.

BYD’s success stems from its diversified product portfolio, encompassing both pure electric and plug-in hybrid vehicles, coupled with full control over its battery supply chain—a critical factor in maintaining competitive pricing and technological advantages.

Geely and Chery Accelerate, Emerging as Market Dark Horses

In second place is Geely, with 1.3 million deliveries and a 10.2% market share. Notably, Geely recorded a 68% growth rate, the fastest among leading automakers. This year, the group expanded its operations to nearly 90 markets, including Australia, Greece, and Vietnam. Its affordable EV strategy has enabled Geely to reach a broader customer base in emerging economies.

Chery, another Chinese powerhouse, maintained its high-growth trajectory with 395,000 deliveries, up 63% year-on-year, capturing 3.1% of the global market. The company’s push into Europe and Latin America is driving continued sales growth.

Together with SAIC and Changan, these five Chinese automakers now hold 43% of the global EV market, spearheading the automotive industry’s energy transition.

Tesla Struggles to Keep Pace

As Chinese competitors accelerate, Tesla—once the EV market leader—is losing ground. The company delivered 985,000 vehicles, capturing only 7.7% market share, with sales declining 11% year-on-year.

In the U.S., Tesla’s EV market share dropped to 38% in August, its lowest in eight years, down from a peak of 80% in 2020. Intensifying competition from affordable Chinese EVs and Japanese hybrids is posing significant challenges for Tesla.

European and Korean Automakers Struggle to Maintain Share

European and Korean automakers remain significant players but are losing ground to their Chinese counterparts: Volkswagen Group (854,000 units, 6.7%), Hyundai Motor Group (416,000 units, 3.2%), BMW Group (389,000 units, 3.0%), and Stellantis (342,000 units, 2.7%).

Despite strong presence in Europe and North America, these companies face mounting pressure from production costs and technological innovation compared to their Eastern rivals.

A New Era of Chinese Dominance in the EV Market

Collectively, Chinese manufacturers contributed over 5.5 million vehicles, nearly half of global EV sales. Their rapid growth, competitive pricing, and expanding export networks are solidifying their leadership in the electric vehicle era.

As EV demand continues to rise in the coming years, the battle for market share promises further upheaval. However, the current landscape is clear: China is becoming the epicenter of the global electric automotive industry, leading in both scale and development speed.

VinFast Surpasses Tesla in Asian Market, Challenging Elon Musk’s Trillion-Dollar Ambitions

To achieve his trillion-dollar dream, Elon Musk must sell 20 million electric vehicles—a staggering number surpassing Tesla’s entire 17-year sales history.