Singapore Exchange (SGX) describes the launch of Bitcoin and Ethereum futures for institutional investors as a “game-changer” for the virtual asset market. Image: Reuters

|

On November 17th, Singapore Exchange (SGX) announced the launch of perpetual Bitcoin and Ethereum futures contracts tailored for institutional traders. This move signifies the city-state’s gradual embrace of crypto-related products while restricting retail investor participation amid a downturn in digital asset prices.

Trading is slated to commence on November 24th, marking a significant step for SGX’s derivatives unit in offering crypto trading instruments. This development comes as Hong Kong, a rival Asian financial hub, has permitted the listing of exchange-traded funds (ETFs) tracking digital tokens.

SGX’s introduction of perpetual crypto futures, based on the iEdge CoinDesk Crypto Indices, will enable professional investors in Singapore to trade based on price movements of the two largest global digital assets.

“Over two-thirds of all crypto trading occurs in the derivatives market, and perpetual futures possess unique characteristics and benefits that have made them the most popular product,” stated Andy Baehr, Product and Research Director at CoinDesk Indices, in a November 17th statement. “We are thrilled to see SGX Derivatives bring perpetual futures to the domestic market.”

SGX characterizes this move as a “game-changer” for the virtual asset market, noting that perpetual futures account for over $187 billion in average daily trading volume globally, with Asia leading the growth.

The exchange highlights that the majority of this trading volume is still priced and settled on non-Asian platforms. By bringing these trades onto a regulated exchange, SGX believes institutions can trade and access Bitcoin and Ethereum “with confidence and at scale.”

“The product launch has received positive feedback from market participants, who view it as a timely and strategic move to enhance access to the increasingly popular crypto markets,” SGX stated in its announcement.

Loh Boon Chye, CEO of Singapore Exchange (SGX) Group, speaks with Nikkei Asia in Tokyo on November 4th. (Photo: Manami Yamada)

|

Retail investors will not have access to crypto-related instruments through Singapore’s exchange. Instead, they can turn to Hong Kong’s crypto ETFs as an alternative for gaining exposure to digital assets through traditional markets, rather than directly holding tokens.

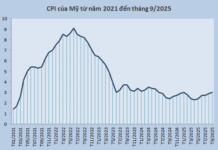

Singapore’s authorities discourage retail investors from speculating in digital currencies due to their high volatility. For instance, Bitcoin’s price recently plummeted below $93,000 over the weekend – its lowest point in nearly six months, according to Linh Tran, a market analyst at the online trading platform XS.com.

“From its peak near $125,000 in early October, Bitcoin has lost nearly 25% of its value,” the analyst wrote in a November 17th note. “The current selling pressure is not just from retail investors but also from institutional capital, which is highly sensitive to macroeconomic signals.”

In a recent interview with Nikkei Asia, SGX CEO Loh Boon Chye stated that there are no plans to offer a Bitcoin ETF on his exchange at this time.

“Market demand is centered around institutional products, or contracts on regulated exchanges,” he said. “We see demand focused on derivative products like perpetual futures. As for ETFs, I think that will really depend on market reception and demand.”

Quốc An (According to Nikkei Asia)

– 13:23 19/11/2025

Bitcoin Investors’ Worst Fear Materializes on November 18th Midday

Bitcoin’s recent downturn stems from a confluence of factors, including significant outflows from investment funds, substantial selling pressure, and escalating geopolitical tensions.

Today’s Crypto Market, November 17: Investors in Panic Mode

Should Bitcoin swiftly regain its upward momentum and establish a higher low, certain analyses predict a potential new market recovery phase.