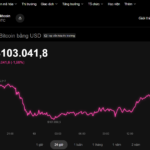

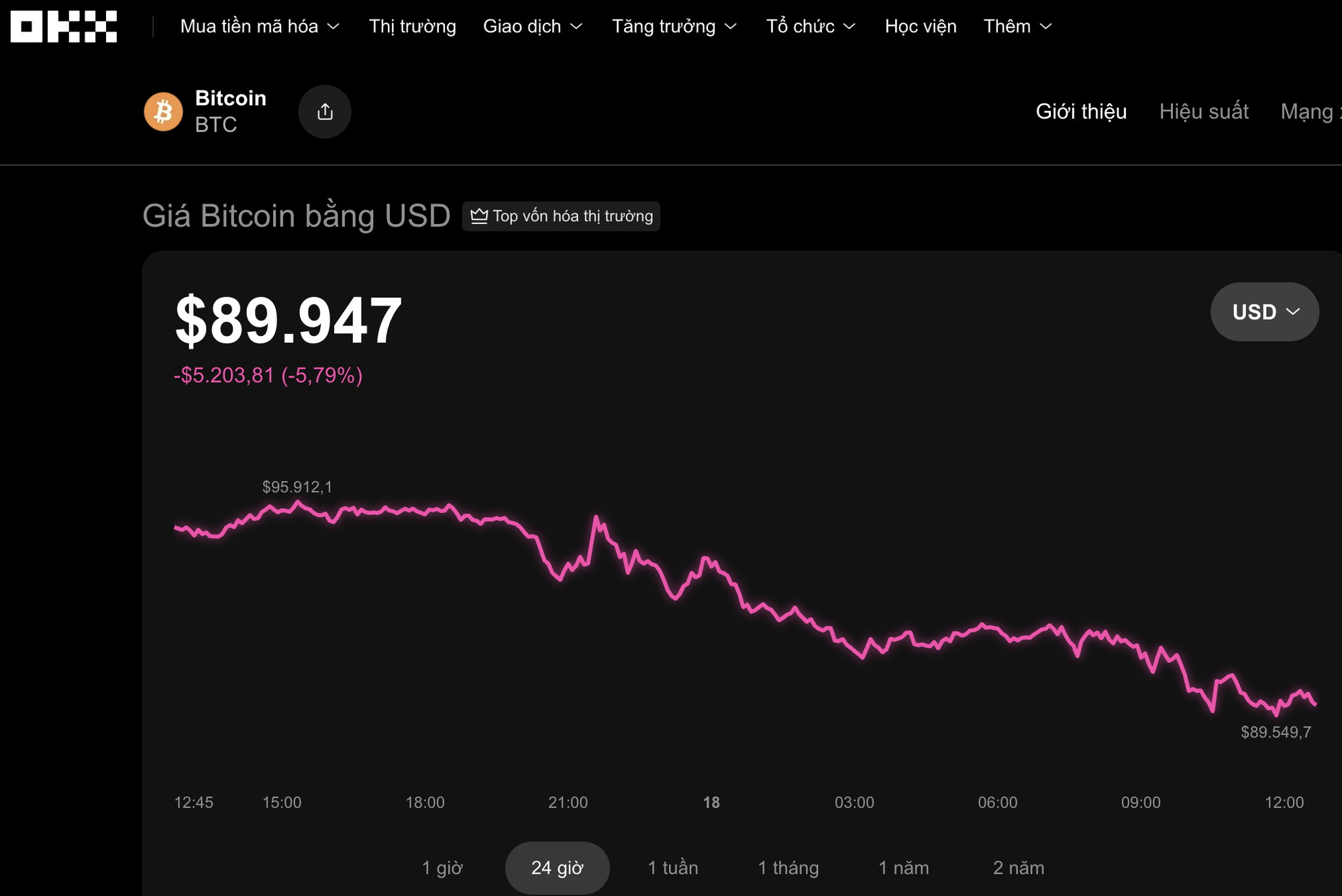

As of midday on November 18, the cryptocurrency market experienced a significant downturn, with Bitcoin breaching the psychological threshold of $90,000, dropping to $89,540—a decline of over 5% in the past 24 hours.

Other major cryptocurrencies followed suit, with Ethereum falling more than 5% to $3,010, XRP shedding nearly 4% to $2.10, and both BNB and Solana dropping approximately 3% to $908 and $136, respectively.

According to BitMine Chairman Tom Lee and Bitwise Chief Investment Officer Matt Hougan, Bitcoin could reach its bottom this week after hitting a seven-month low.

In an interview with CNBC, Tom Lee noted that the market is still reeling from the massive sell-off on October 10, while investor sentiment remains clouded by uncertainty over potential U.S. interest rate cuts in December.

However, he suggested that downward pressure is easing, with early signs indicating Bitcoin may establish a bottom within days.

Bitcoin briefly dipped below $90,000 on November 19, marking its lowest point since April.

“Investors remain cautious following the largest liquidation event on record from October 10. Concerns about underlying systemic vulnerabilities persist,” said Jake Ostrovskis, Head of Trading at Wintermute.

Bitcoin trading below $90,000. Source: OKX

Industry leaders attribute the decline to multiple factors, including outflows from investment funds, substantial selling pressure from long-term holders, and escalating geopolitical tensions.

Matt Hougan believes the market is nearing its bottom, with current prices presenting a rare opportunity for long-term investors.

He cited economic concerns, tech sector volatility, and U.S. tax policies as contributing factors to market turbulence. Nonetheless, he predicts Bitcoin will be among the first assets to rebound after its sharp decline.

Bitcoin has now fallen nearly 30% from its early October peak of over $126,000.

Tom Lee forecasts a swift recovery for Bitcoin, potentially setting new records by year-end as equity markets rally and capital returns to digital assets.

Silent Power Unloads Nearly $1.7 Billion in Bitcoin Just Before $90,000 Milestone

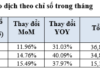

Bitcoin ETF inflows have witnessed a consistent net outflow trend over the past four consecutive sessions, spanning from November 12th to 17th.

Bitcoin Plummets to $92,500, Shedding 27% from Peak

Bitcoin plummeted to a fresh six-month low on November 17th, extending its multi-week decline as sentiment in the cryptocurrency market continued to sour.