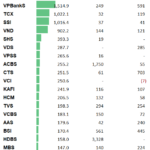

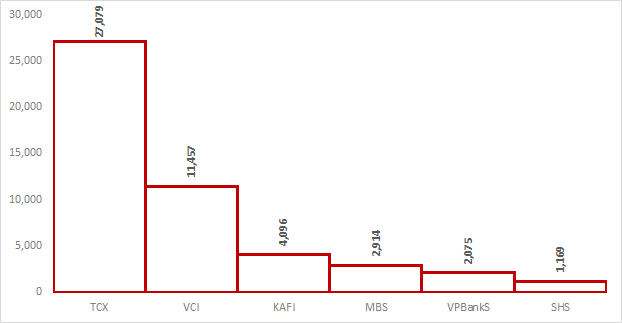

Q3 Proprietary Trading Profits Surge Significantly

According to VietstockFinance data, securities companies recorded proprietary trading profits exceeding 11.6 trillion VND, doubling the previous quarter’s results and more than 3.2 times higher than the same period last year.

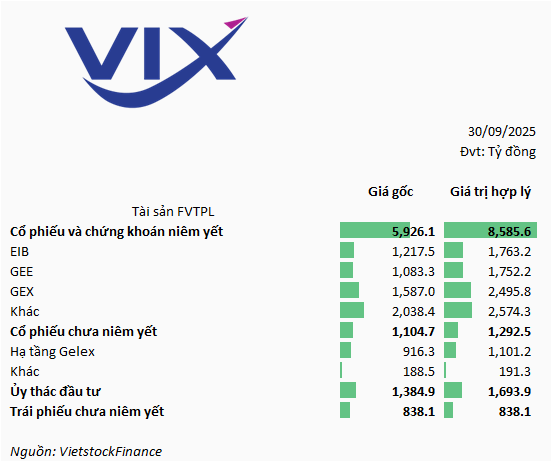

Q3 witnessed a remarkable surge in proprietary trading profits for VIX Securities, reaching over 2.7 trillion VND. 2025 has been a breakout year for VIX’s proprietary trading division. The unit earned 1.4 trillion VND in Q2 and 330 billion VND in Q1. In the first nine months, proprietary trading generated a total of 4.5 trillion VND, compared to just 360 billion VND in the same period last year.

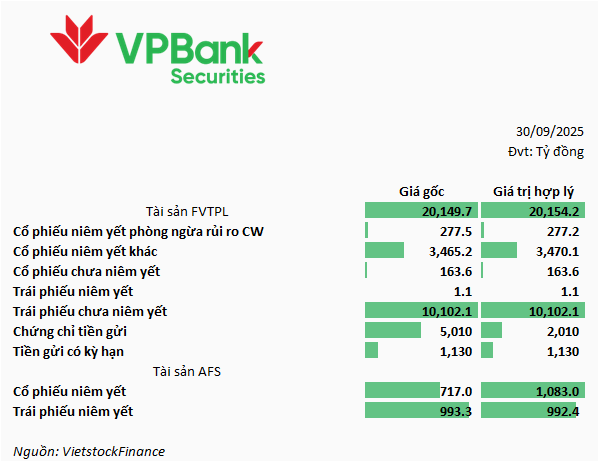

Additionally, several new players reported strong profit growth. VPBankS recorded 1.5 trillion VND in proprietary trading profits, marking the first quarter surpassing the one-trillion-VND milestone. This result is more than three times higher than the previous quarter and seven times higher year-over-year.

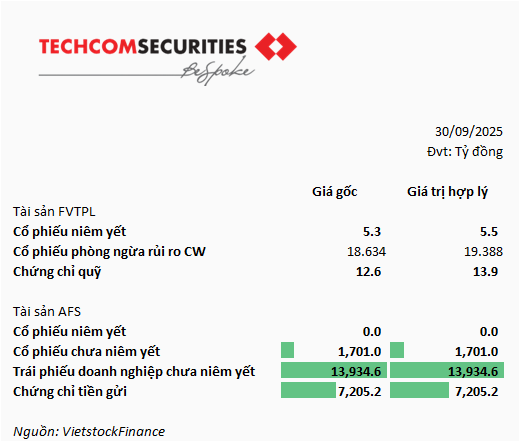

Following closely, Technocom Securities (TCBS) and SSI Securities both achieved profits exceeding 1 trillion VND, showing significant growth compared to the same period last year and the previous quarter.

VNDIRECT Securities also reported profits of over 900 billion VND, a substantial increase from both the previous quarter and the same period last year.

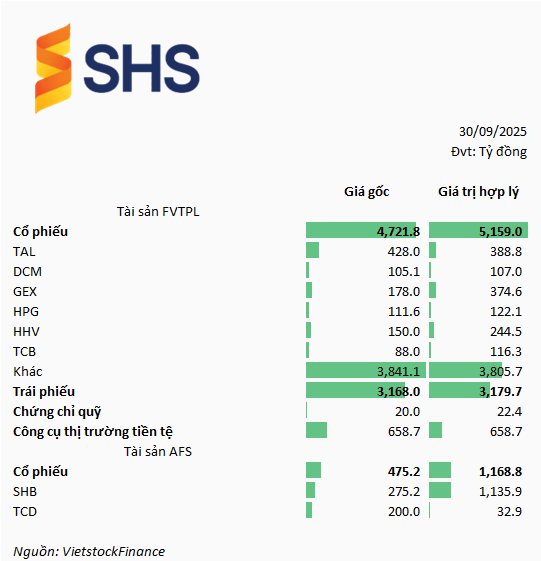

The top 5 leaders in proprietary trading profits demonstrated a clear gap from the following group. In sixth place, SHS Securities recorded profits of over 393 billion VND.

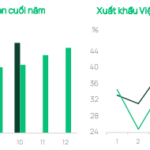

Amid the positive market conditions in Q3, the VN-Index experienced a prolonged rally, surging over 20% to reach 1,661.7 points. Most securities companies engaged in proprietary trading were profitable.

However, some companies faced negative outcomes. Tan Viet Securities reported a loss of over 61.3 billion VND. FTS Securities incurred a loss of nearly 7 billion VND, and HAC Securities lost 6.5 billion VND.

|

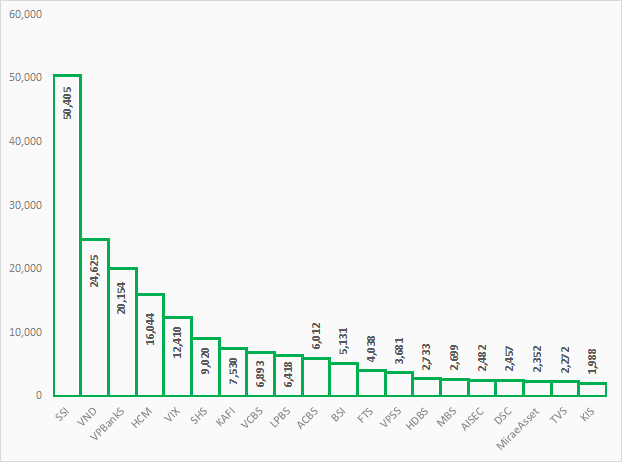

Top 20 Securities Companies with Highest Proprietary Trading Profits in Q3/2025

Unit: Billion VND

Source: VietstockFinance

|

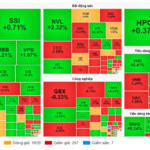

Analyzing Securities Companies’ Proprietary Portfolios

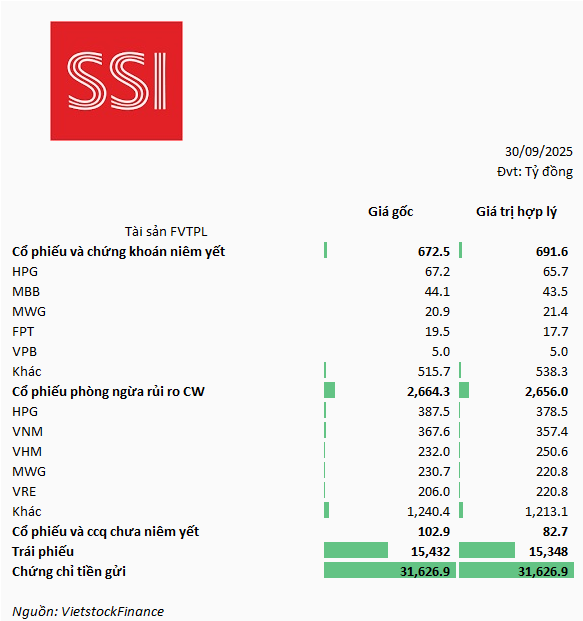

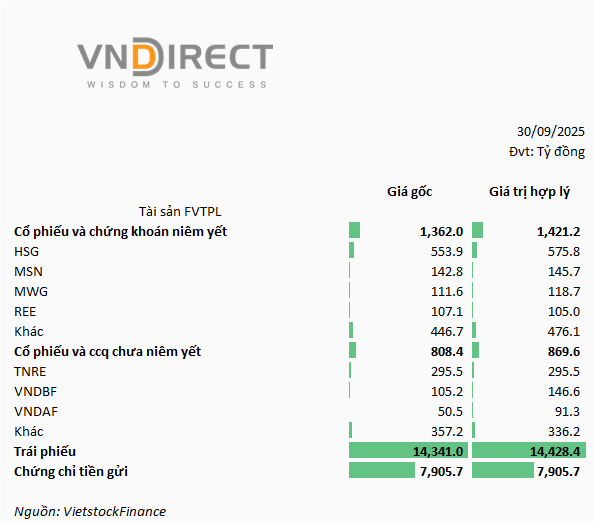

The value of FVTPL assets held by securities companies continued to rise, reaching nearly 212 trillion VND. Among them, the top 5 companies held FVTPL assets exceeding 10 trillion VND. SSI led the group with FVTPL assets surpassing 50 trillion VND. VNDIRECT and VPBankS followed with 24 trillion VND and 20 trillion VND, respectively.

In fourth place, HSC Securities held assets worth over 16 trillion VND. VIX recorded assets totaling more than 12 trillion VND.

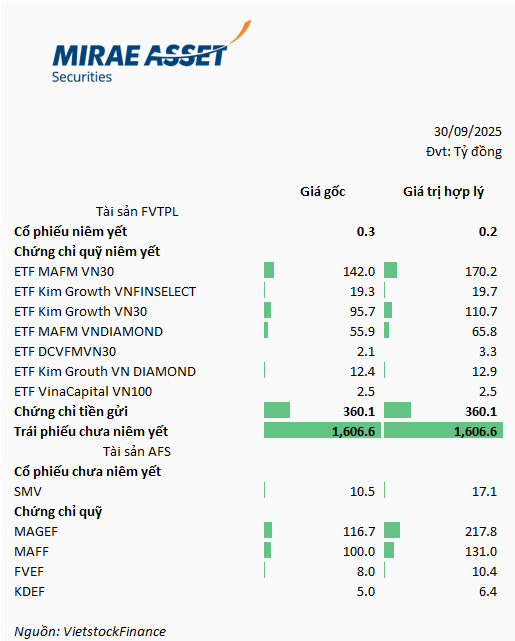

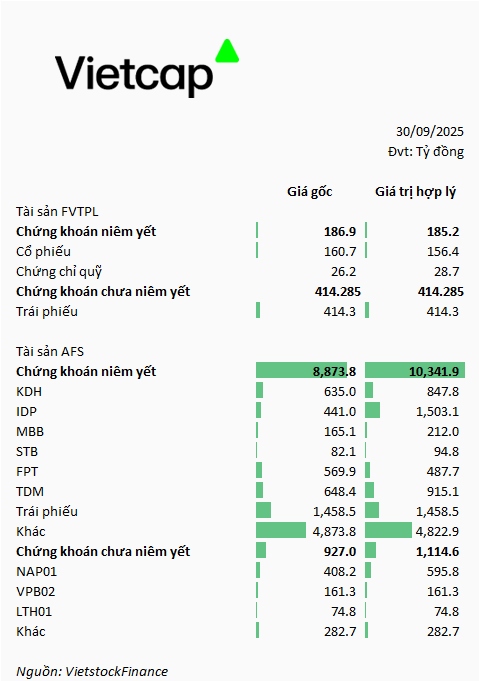

Additionally, several securities companies, such as TCBS and Vietcap, held significant AFS financial assets.

|

Securities Companies with the Largest FVTPL Assets

|

|

Securities Companies with the Largest AFS Assets

Unit: Billion VND

Source: VietstockFinance

|

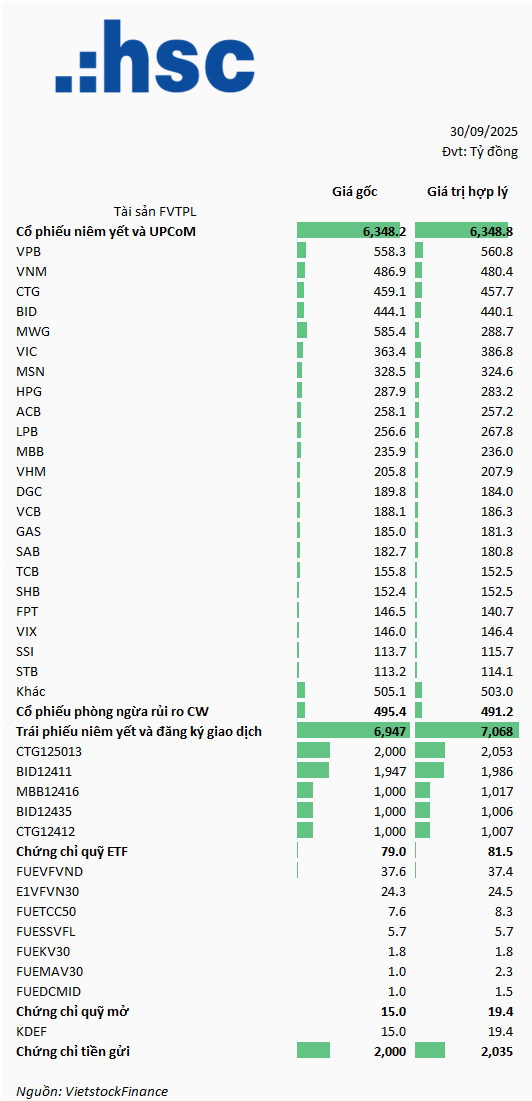

In detail, SSI’s FVTPL assets were primarily concentrated in deposit certificates (over 31 trillion VND). Bonds ranked second in the portfolio, valued at more than 15.4 trillion VND.

VNDIRECT focused on bonds, holding over 14.3 trillion VND, and deposit certificates worth nearly 8 trillion VND. For its equity portfolio, the company concentrated on stocks such as HSG, MSN, MWG, and REE.

VPBankS also focused on unlisted bonds. Additionally, the company held significant allocations in listed equities and deposit certificates.

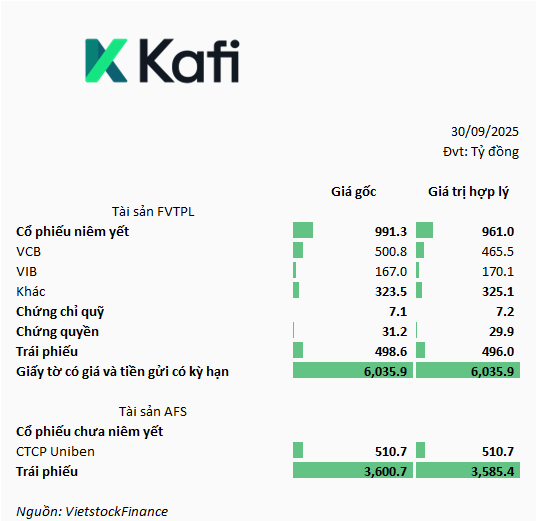

Most leading securities companies in terms of proprietary portfolio size favored bonds and deposit certificates. Kafi Securities held a substantial amount of marketable securities (over 6 trillion VND) in its FVTPL portfolio and more than 3.6 trillion VND in bonds within its AFS portfolio.

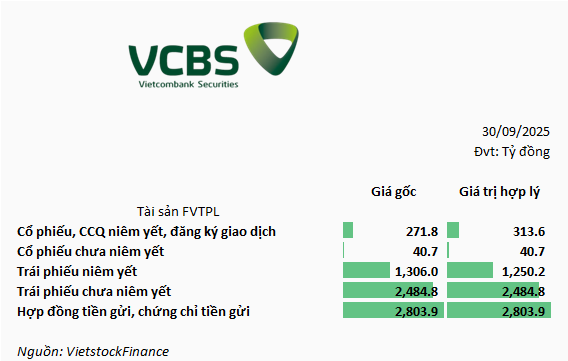

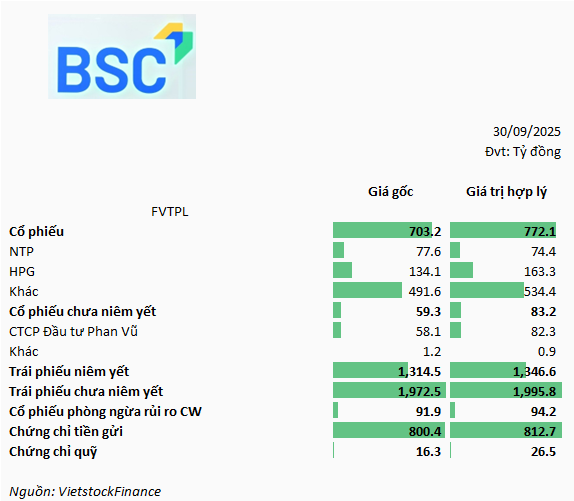

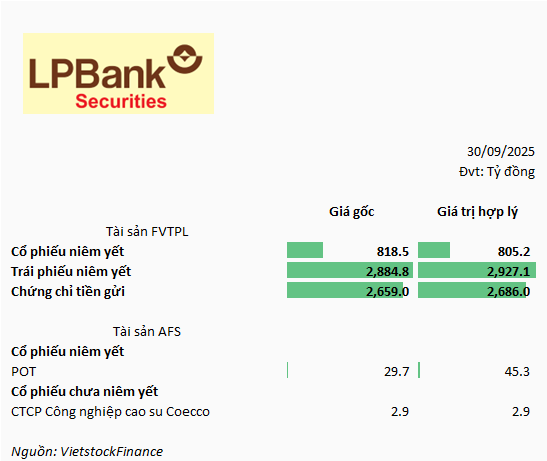

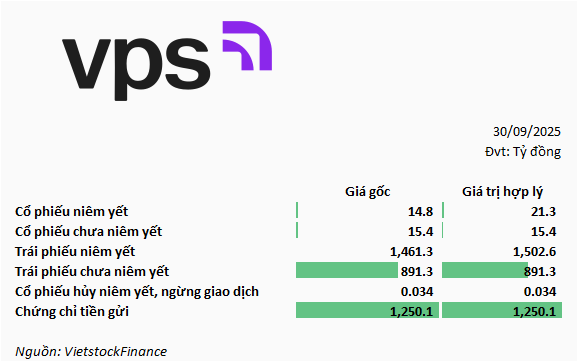

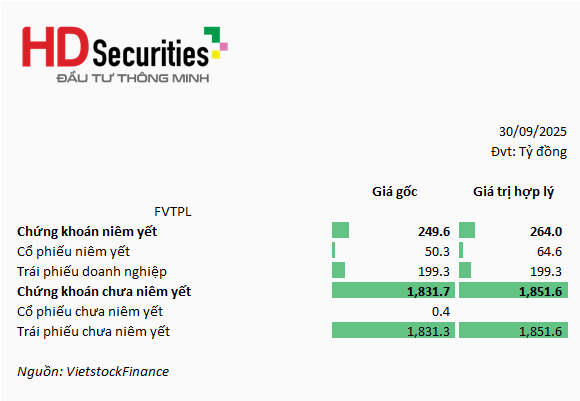

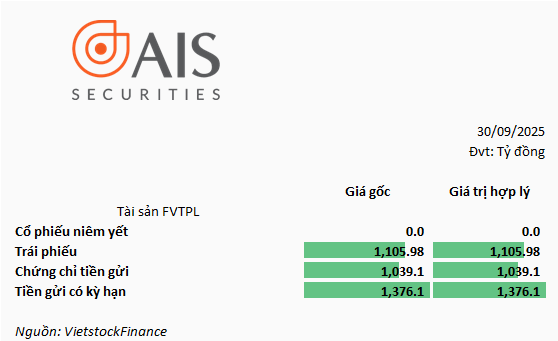

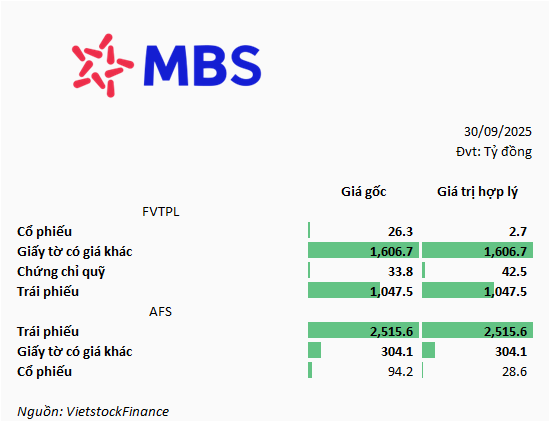

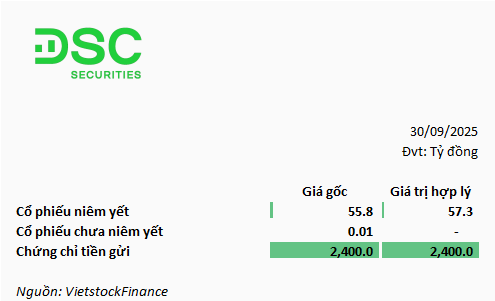

Similarly, VCBS primarily held low-risk assets such as bonds and term deposits. BSC also concentrated heavily on bonds and deposit certificates. Numerous securities companies, including LPBS, VPS, HDS, AIS, MBS, DSC, Mirae Asset, and TCBS, followed this portfolio strategy.

FPTS adopted a conservative approach, focusing mainly on bonds, term deposits, and deposit certificates. The company continues to hold MSH, generating substantial profits.

Some securities companies maintained a balanced portfolio between equities and bonds. SHS Securities allocated its portfolio evenly between equities (4.7 trillion VND) and bonds (nearly 3.2 trillion VND). Notable stocks in its FVTPL portfolio included TAL, DCM, GEX, HPG, HHV, and TCB. In its AFS portfolio, the company held SHB and TCD, with SHB generating profits four times higher than its cost.

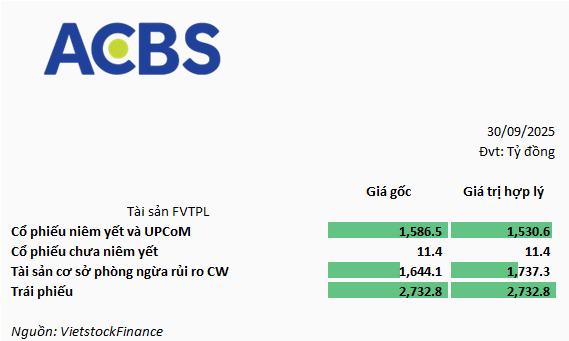

ACBS Securities maintained a well-balanced portfolio, focusing on equities, hedged equities for CW, and bonds.

HSC Securities held a listed equity portfolio valued at over 6.3 trillion VND, along with bonds worth nearly 7 trillion VND.

As the top proprietary trading profit leader in Q3, VIX concentrated its portfolio primarily on equities. Notable stocks included EIB, GEE, and GEX. Additionally, the company held unlisted equities from the Gelex Group, such as Gelex Infrastructure.

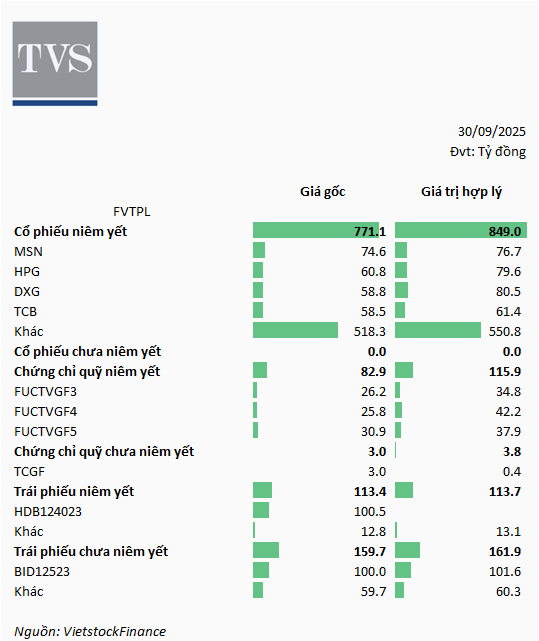

The trend of focusing on equities was also observed in other securities companies. TVS Securities allocated a significant portion of its proprietary trading to various equities. Notable stocks included MSN, HPG, DXG, and TCB.

VCI Securities held numerous equity investments in its AFS portfolio. Notable holdings included KDH, IDP, MBB, FPT, and TDM. The company also invested in unlisted companies such as NAPAS (Nap01) and FE Credit (VPB02).

– 08:00 19/11/2025

Market Pulse November 18: Balanced Buying-Selling Pressure, VN-Index Edges Up on Vingroup Stocks

The market equilibrium persisted until the close of today’s session. Overall, buying and selling pressures remained balanced. Late-session gains in several large-cap stocks propelled the VN-Index to end above the reference level.

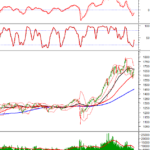

Vietstock Daily November 19, 2025: Sustaining the Green Momentum

The VN-Index extended its winning streak to a third consecutive session, poised to retest the 50-day SMA. Both the Stochastic Oscillator and MACD continue their upward trajectory, reinforcing the earlier buy signals. Should this momentum persist in upcoming sessions, the short-term outlook remains decidedly bullish.

Dragon Capital: Robust Profits Amid Market Corrections

Vietnam’s stable macroeconomic foundation provides long-term support for its stock market. However, in the short term, the market may face pressure from foreign investor sentiment and domestic liquidity absorption capacity, particularly if external factors take an unfavorable turn. The next phase of growth will hinge significantly on the pace at which set goals and expectations are realized.

Technical Analysis for the Afternoon Session on November 18th: Entering the Third Consecutive Bullish Session

The VN-Index extended its winning streak to a third consecutive session, decisively breaching the Bollinger Bands’ Middle line. This level is poised to act as a key support in the near term. Meanwhile, the HNX-Index paused its upward momentum, forming an Inverted Hammer pattern.

Chí Kiên

Chí Kiên