After a scorching two-year growth streak, Chinese car exports to Russia are plummeting, marking a sudden end to the “easy money” era in this market.

According to the China Passenger Car Association (CPCA), from January to September 2025, China exported only 357,700 complete vehicles to Russia, a staggering 58% drop compared to the same period last year. This shift means Russia is no longer the top destination for Chinese cars. Mexico now holds that title with 410,700 units, followed by the UAE with 367,800.

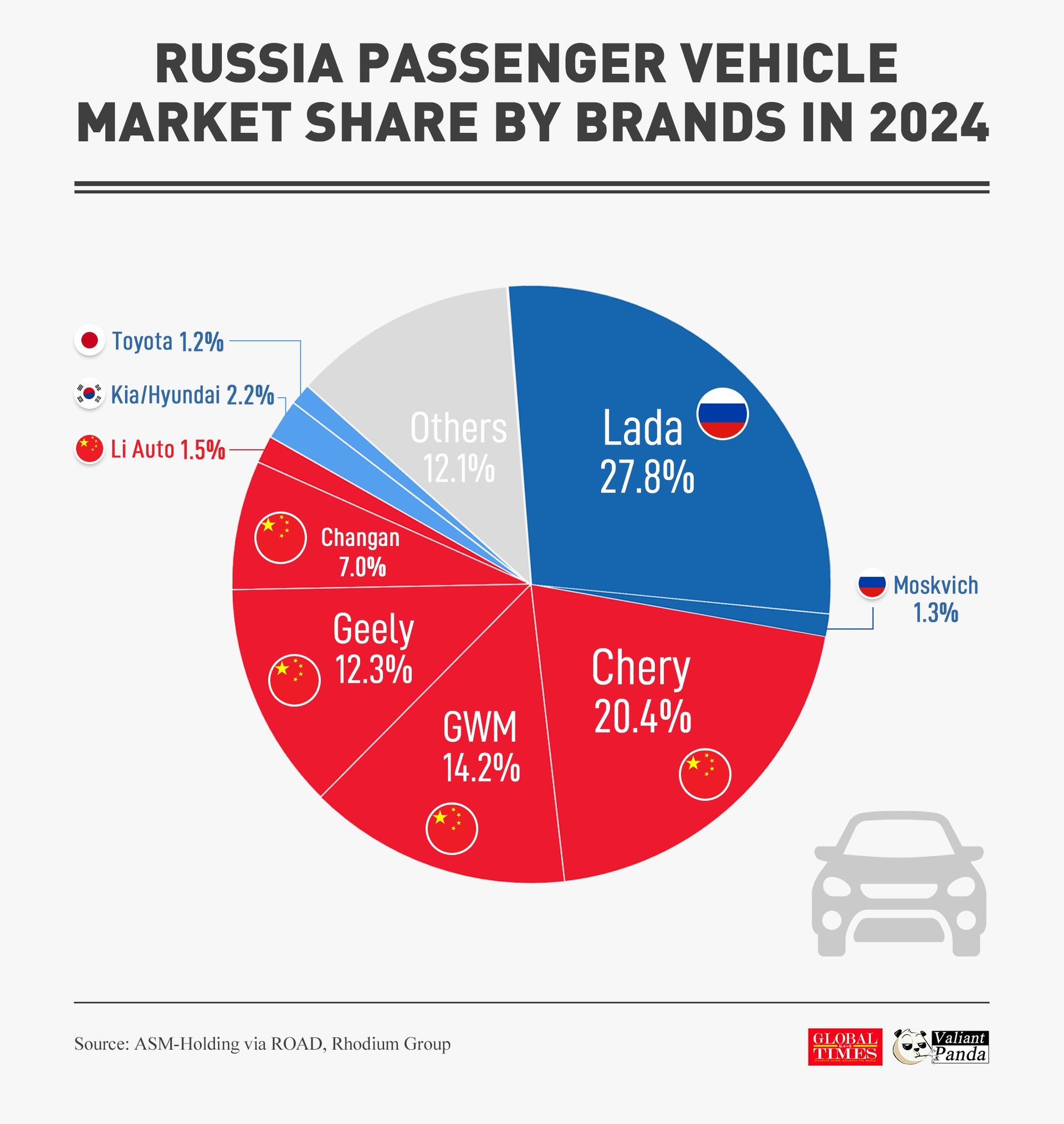

In 2021, Chinese car sales in Russia were a mere 115,700 units, capturing just 7% of the market. However, regional conflicts led to the withdrawal or suspension of operations by many European, American, Japanese, and South Korean brands. This vacuum paved the way for Chinese automakers to dominate the market.

Within two years, exports from China to Russia skyrocketed from 163,000 units in 2022 to 950,000 in 2023, reaching 1.158 million in 2024. Chinese brands’ sales in Russia surpassed 500,000 units, claiming nearly 50% market share. But this “high-growth era” ended abruptly in 2025 as Russia implemented policies that significantly increased import costs.

Chinese brands dominated Russia’s market share in 2024.

The Golden Age Fades for Chinese Autos

A pivotal moment came in October 2024 when Russia raised the recycling fee for imported cars from 70% to 85%. This hike significantly increased costs: the recycling fee for used cars with 2–3 liter engines, over three years old, jumped from 1.3 million rubles to 2.37 million rubles (approximately $29,300). Profit margins for businesses and distributors were immediately squeezed.

In January 2025, Russia further increased import tariffs from 20% to 38%, pushing clearance costs even higher. The cumulative effect of these taxes and fees eroded the price advantage—Chinese cars’ strongest selling point.

Additionally, tighter controls on “gray channels” heavily impacted the market. During the new car shortage, many Chinese companies re-exported cars through third countries like Kazakhstan, labeling them as “0 km used cars” to evade high taxes.

However, from April 2024, Russia mandated that cars imported from the Eurasian Economic Union must pay the full tax difference to circulate. This regulation immediately closed the tax loophole, driving up prices and exposing a significant after-sales service gap: many cars imported through this channel lacked official warranties or repairs, damaging Chinese brands’ reputation.

Consumer demand in Russia also weakened significantly. To curb inflation, the Central Bank of Russia maintained a high benchmark interest rate of 21% for an extended period. Car loan rates soared to around 30%, making car ownership prohibitively expensive. Combined with new taxes and import fees, the average car price in Russia surged to 3.35 million rubles (approximately $41,400). As a result, demand plummeted.

Another factor slowing the market is consumer wait-and-see sentiment. As regional stability improves, international brands like Toyota, Renault, Hyundai, and Kia are signaling their return to Russia.

This has led many customers to delay purchases, causing sales to drop. Russian Ministry of Industry and Trade data shows that from January to September 2025, new car sales in Russia fell 25% to 1.014 million units. During the same period, Chinese brands’ sales nearly halved to 576,000 units.

Facing this situation, many Chinese companies are scaling back their presence in Russia. In Q1 2025, Russia recorded 274 car dealership closures, with 213—nearly 80%—belonging to Chinese brands. Even major players are adjusting strategies.

In its 2025 Hong Kong IPO prospectus, Chery announced plans to reduce its Russian operations due to shrinking profit margins caused by new taxes and fees. The company sold part of its assets and distribution channels in Russia in April 2025 and expects further downsizing until 2027.

After a period of rapid expansion, the Russian market is now testing Chinese automakers’ resilience. Despite maintaining a large market share, they face challenges like rising costs, declining demand, and business models reliant on price advantages that are no longer as effective.

Chinese Cars Continue to Slash Prices in Vietnam’s Automotive Market

In a bid to challenge the market dominance of established Japanese and Korean automakers, Chinese car manufacturers and their dealerships have recently rolled out aggressive discount programs, offering substantial price reductions to attract buyers.