|

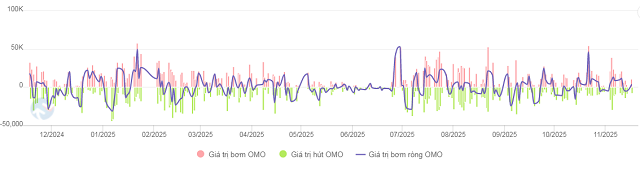

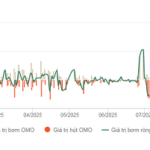

Trends in Net OMO Operations Over the Past Year. Unit: Billion VND

Source: VietstockFinance

|

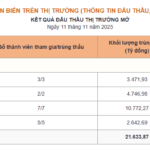

Specifically, through the collateralized lending channel, the State Bank of Vietnam (SBV) injected 70,379 billion VND with terms ranging from 7 to 105 days at an interest rate of 4% per annum. Notably, since the session on November 11, the SBV has introduced a new move by offering open market operations with terms of up to 105 days.

According to MB Securities (MBS), extending the term will help maintain liquidity support for a longer period, thereby stabilizing interbank liquidity and interest rates in the near future.

With maturing capital in the period reaching 56,921 billion VND, the regulator netted 13,458 billion VND in the past week, a 66% decrease compared to the previous week’s net injection. The outstanding volume on the collateralized channel as of November 17 stands at 303,518 billion VND.

|

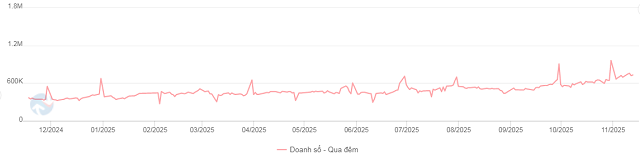

Average Overnight Interbank Transaction Value. Unit: Billion VND

Source: VietstockFinance

|

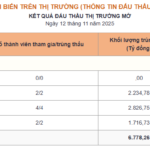

Interbank interest rates have cooled but remain elevated. The overnight rate rose from 5.82% per annum at the end of the week of November 7 to 6.1% on November 11, before dropping to 5.4% on November 13. The average overnight transaction value increased by 5%, reaching over 730 trillion VND per day.

|

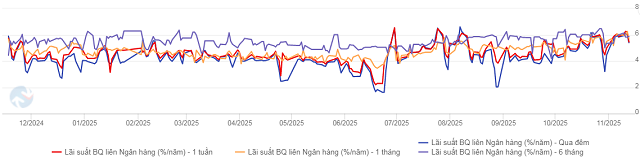

Interbank Interest Rate Trends Over the Past Year

Source: VietstockFinance

|

Interbank interest rates for 1-week and 1-month terms fluctuated between 5.46% and 5.73% per annum, decreasing by 41 basis points and 29 basis points, respectively, compared to the previous week. The 6-month term rate fell by 11 basis points to 5.88% per annum on November 13.

|

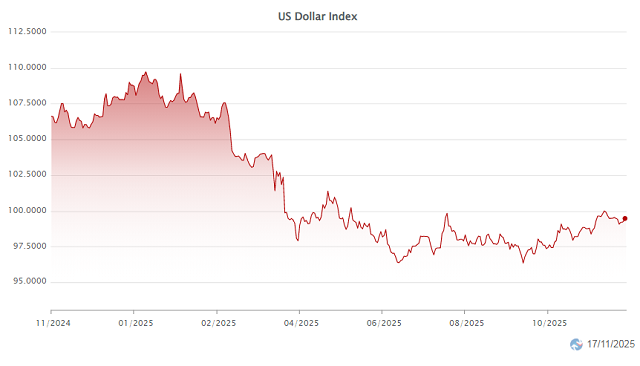

DXY Trends from the Beginning of 2025 to November 17

Source: VietstockFinance

|

In the international market, the USD Index (DXY) closed at 99.2 points on November 14, down 0.3 points from the previous week.

The USD continued to weaken after U.S. President Donald Trump signed a bill to reopen the federal government, ending the longest shutdown in history. The absence of pay for over 1 million federal employees and the paralysis of many public services created a significant data gap, prompting the U.S. Federal Reserve (Fed) to maintain a cautious stance on monetary policy easing.

Domestically, Vietcombank listed the USD/VND exchange rate at the end of the week of November 14 at 26,128-26,378 VND/USD (buy – sell), increasing by 40 dong and 20 dong, respectively, compared to the previous week.

– 11:43 18/11/2025

Central Bank Maintains Net Injection in Open Market Operations

During the week of November 3–10, the State Bank of Vietnam (SBV) continued its fourth consecutive week of net injection into the open market operations (OMO), with a total value exceeding 39 trillion VND, significantly higher than the 854 billion VND recorded in the previous week.