I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

On November 18, 2025, all VN30 futures contracts saw gains. Specifically, 41I1FB000 (I1FB000) rose by 0.15% to 1,898 points; VN30F2512 (F2512) increased by 0.25% to 1,895.9 points; 41I1G3000 (G3000) climbed 0.11% to 1,883 points; and 41I1G6000 (I1G6000) advanced 0.19% to 1,881.3 points. The underlying index, VN30-Index, closed at 1,898.07 points.

Additionally, VN100 futures contracts also experienced widespread gains on the same day. Notably, 41I2FB000 (I2FB000) gained 0.26% to 1,810.7 points; 41I2FC000 (I2FC000) surged 0.89% to 1,809.4 points; 41I2G3000 (I2G3000) rose 0.83% to 1,794.2 points; and 41I2G6000 (I2G6000) edged up 0.01% to 1,785.2 points. The VN100-Index closed at 1,810.72 points.

During the November 18, 2025 session, the 41I1FB000 contract faced significant selling pressure from the opening bell. Despite buyers’ efforts to push it back near the reference level, short sellers dominated by the end of the morning session. In the afternoon, selling pressure intensified, causing the contract to plummet. However, buyers quickly stepped in, halting the decline and enabling the contract to close at the session high of 1,898 points.

Intraday Chart of 41I1FB000

Source: https://stockchart.vietstock.vn/

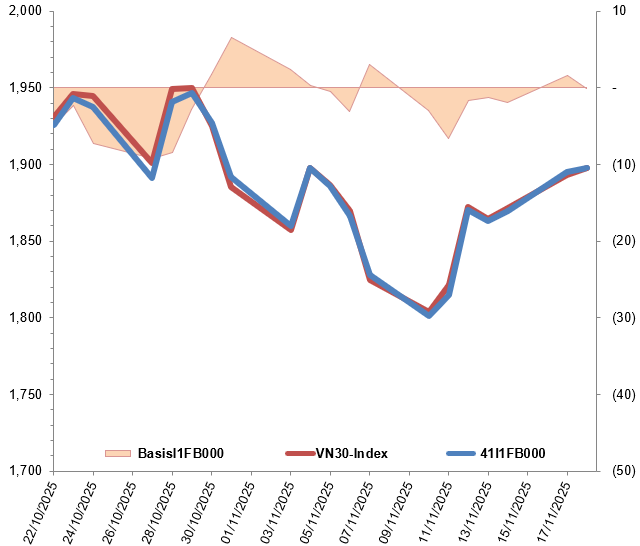

By the close, the basis of the 41I1FB000 contract reversed from the previous session, settling at -0.07 points. This reversal indicates a return to bearish sentiment among investors.

Fluctuations of 41I1FB000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

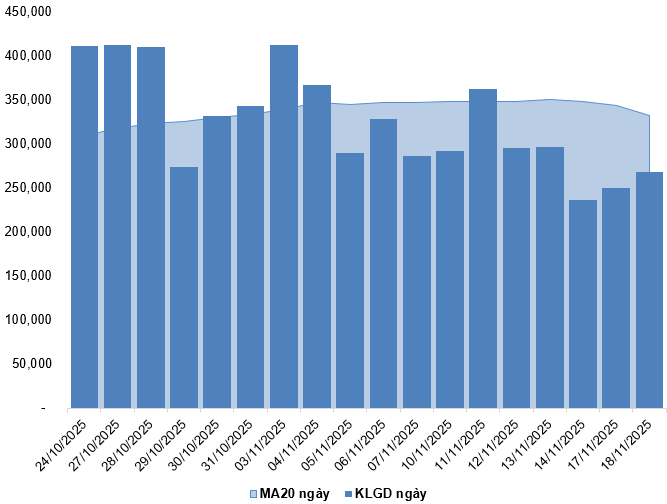

Trading volume and value in the derivatives market increased by 7.14% and 6.87%, respectively, compared to the November 17, 2025 session. Specifically, the trading volume of I1FB000 rose by 6.05%, with 262,399 contracts matched. I2FB000’s trading volume reached 74 contracts, a 19.35% increase.

Foreign investors continued to buy net, with a total net purchase volume of 624 contracts on November 18, 2025.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

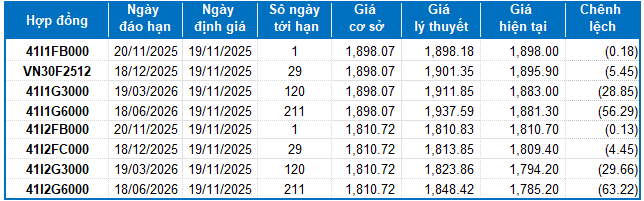

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of November 19, 2025, the reasonable price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) has been replaced by the average deposit rate of major banks, with maturity adjustments tailored to each futures contract.

I.3. Technical Analysis of VN30-Index

On November 18, 2025, the VN30-Index continued its upward trend, forming a Hammer-like candlestick pattern, signaling optimistic investor sentiment. Trading volume increased from the previous session but remained below the 20-session average. Improved liquidity in upcoming sessions would enhance the sustainability of the recovery.

Currently, the Stochastic Oscillator continues to rise after generating a buy signal, further supporting the short-term outlook.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

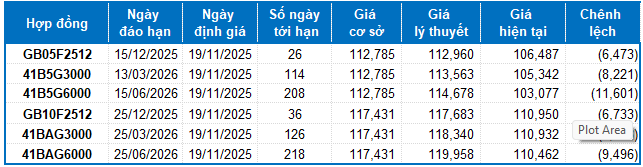

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of November 19, 2025, the reasonable price range for actively traded bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) has been replaced by the average deposit rate of major banks, with maturity adjustments tailored to each futures contract.

According to the above valuation, contracts GB05F2512, 41B5G3000, 41B5G6000, GB10F2512, 41BAG3000, and 41BAG6000 are currently attractively priced. Investors should focus on these contracts and consider buying in the near term, as they offer compelling value in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:28 18/11/2025

Derivatives Market Outlook for November 18, 2025: Short-Term Prospects Continue to Improve

On November 17, 2025, both the VN30 and VN100 futures contracts surged during the trading session. The VN30-Index continued its upward trajectory, forming a small-bodied candlestick pattern. However, trading volume remained below the 20-session average, indicating investor hesitation and uncertainty in the market.

Derivatives Market on November 14, 2025: Mixed Signals Emerge

On November 13, 2025, the VN30 and VN100 futures contracts diverged in their performance. The VN30-Index exhibited a tug-of-war pattern, forming a small-bodied candlestick accompanied by declining trading volume, which remained below the 20-session average. This suggests a cautious sentiment among investors.