I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

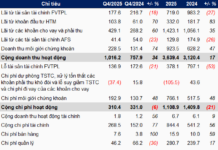

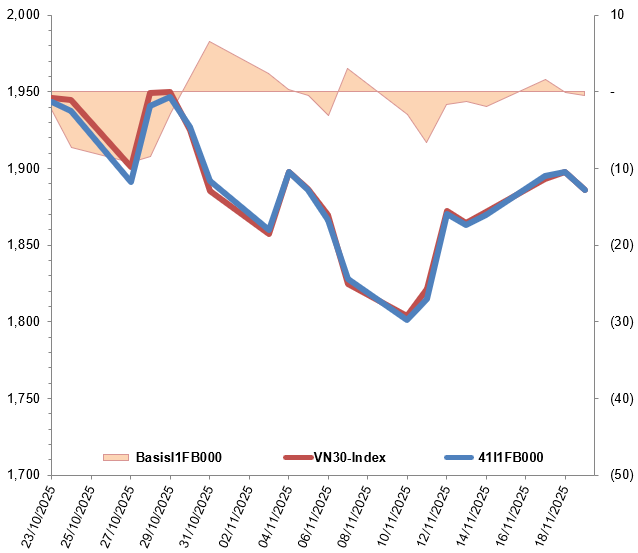

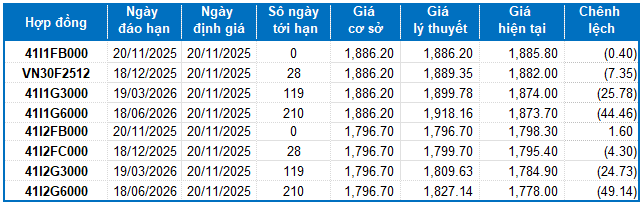

On November 19, 2025, all VN30 futures contracts experienced declines. Specifically, 41I1FB000 (I1FB000) dropped by 0.64% to 1,885.8 points; VN30F2512 (F2512) fell by 0.73% to 1,882 points; 41I1G3000 (G3000) decreased by 0.48% to 1,874 points; and 41I1G6000 (I1G6000) declined by 0.4% to 1,873.7 points. The underlying index, VN30-Index, closed at 1,886.2 points.

Additionally, most VN100 futures contracts also saw declines on the same day. Notably, 41I2FB000 (I2FB000) decreased by 0.68% to 1,798.3 points; 41I2FC000 (I2FC000) dropped by 0.19% to 1,795.4 points; 41I2G3000 (I2G3000) fell by 0.3% to 1,784.9 points; and 41I2G6000 (I2G6000) rose by 0.43% to 1,778 points. The underlying index, VN100-Index, closed at 1,796.7 points.

During the November 19, 2025 session, the 41I1FB000 contract declined from the opening and fluctuated throughout the morning session. In the afternoon, the Long position weakened, and sudden selling pressure intensified, causing I1FB000 to plummet below 1,880 points and close in the red, down 12.2 points.

Intraday Chart of 41I1FB000

Source: https://stockchart.vietstock.vn/

Source: https://stockchart.vietstock.vn/

At the close, the basis of the 41I1FB000 contract widened compared to the previous session, reaching -0.4 points. This indicates increased investor pessimism.

Fluctuations of 41I1FB000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

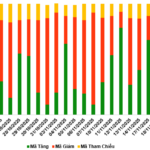

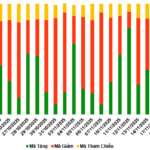

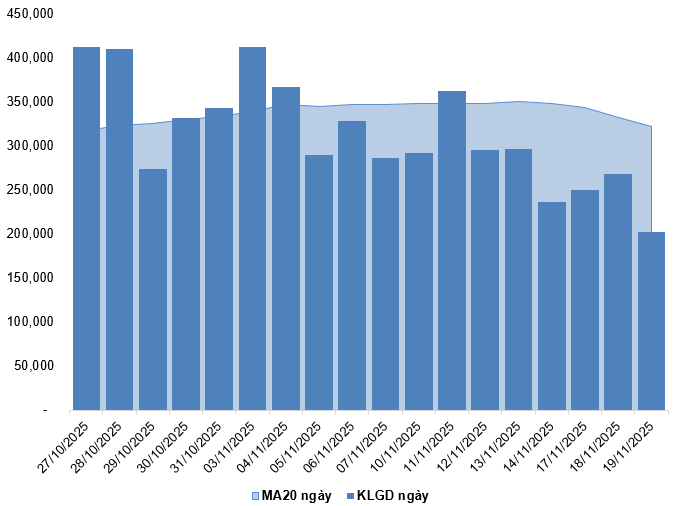

Trading volume and value in the derivatives market decreased by 24.55% and 24.74%, respectively, compared to the November 18, 2025 session. Specifically, I1FB000 trading volume fell by 26.88%, with 191,865 contracts matched. I2FB000 trading volume dropped by 51.35% to 36 contracts.

Foreign investors resumed net selling, with a total net selling volume of 1,222 contracts on November 19, 2025.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

I.2. Futures Contract Valuation

Based on the fair pricing method as of November 20, 2025, the reasonable price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments suitable for each futures contract.

I.3. Technical Analysis of VN30-Index

On November 19, 2025, the VN30-Index reversed its gains, forming a small-bodied candlestick pattern after retesting the 50-day SMA. This occurred alongside increased trading volume compared to the previous session, indicating less optimistic investor sentiment.

Currently, the index is testing the Middle line of the Bollinger Bands, while the MACD indicator continues to rise but remains below zero after generating a buy signal.

This suggests that the VN30-Index’s recovery efforts still face significant challenges, particularly given that trading volume remains consistently below the 20-session average.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

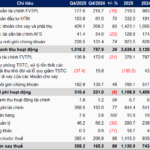

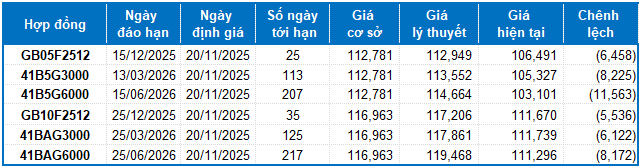

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of November 20, 2025, the reasonable price range for actively traded government bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments suitable for each futures contract.

According to the above valuation, contracts GB05F2512, 41B5G3000, 41B5G6000, GB10F2512, 41BAG3000, and 41BAG6000 are currently attractively priced. Investors should focus on and consider buying these futures contracts in the near term, as they offer excellent value in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:28 19/11/2025

November 2025 Crypto Report (Part 2): Returning to Critical Support Levels?

Uncover the latest insights and trends shaping the world of major cryptocurrencies, meticulously analyzed for both short-term and long-term investment strategies. These expert evaluations are designed to empower informed decision-making, catering to the interests of discerning investors.

Stock Market Update November 18: Shifting Capital to Attractive Stocks Drives Investment Flow

In the November 17th session, numerous stocks demonstrated significant upward momentum. Investors are advised to focus on those tickers currently attracting substantial capital inflows.