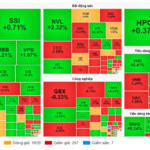

The stock market continued to experience volatility during the November 19th session. Increased profit-taking pressure in the afternoon led the VN-Index to reverse and close down 11 points (0.66%) at 1,649 points. Trading volume remained low, with transaction values on HOSE exceeding only 24 trillion VND.

Foreign trading activity was a negative factor, with net selling reaching 716 billion VND.

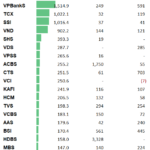

On HOSE, foreign investors net sold 647 billion VND

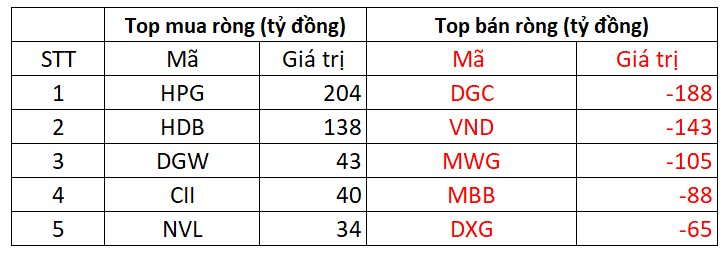

On the buying side, HPG was the most purchased stock by foreign investors on HOSE, with a value of over 204 billion VND. HDB followed closely, with 138 billion VND in purchases. Additionally, DGW and CII were bought for 43 billion VND and 40 billion VND, respectively.

Conversely, DGC was the most heavily sold stock by foreign investors, with 188 billion VND. VND and MWG followed, with sell-offs of 143 billion VND and 105 billion VND, respectively.

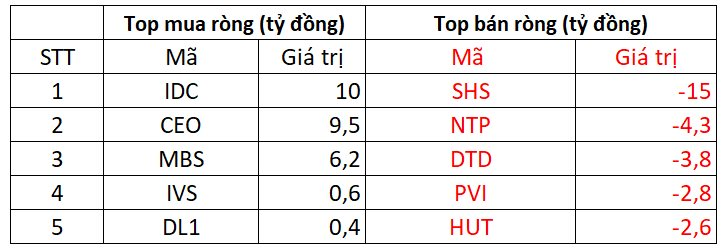

On HNX, foreign investors net sold 8 billion VND

On the buying side, IDC saw the strongest net purchases with a value of 10 billion VND. CEO was the next most bought stock on HNX, with 9.5 billion VND. Foreign investors also allocated a few billion VND to net buy MBS, IVS, and DL1.

Conversely, SHS faced the strongest selling pressure from foreign investors, with nearly 15 billion VND in net sales. NTP followed with 4 billion VND in sales, while DTD, PVI, and HUT saw sales of a few billion VND each.

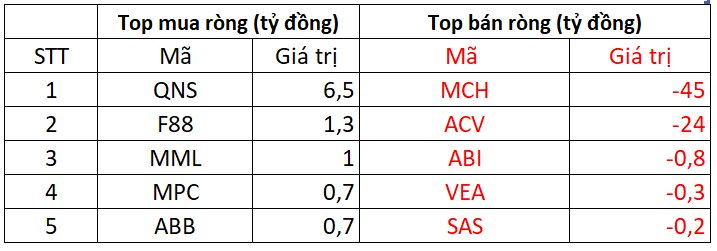

On UPCOM, foreign investors net sold 61 billion VND

On the buying side, QNS was purchased by foreign investors for 6.5 billion VND. F88 and MML also saw net purchases of a few billion VND each.

In contrast, MCH was net sold by foreign investors for 45 billion VND. Additionally, foreign investors also net sold ACV, ABI, and others.

Market Sell-Off Intensifies as Profit-Taking Pressure Mounts

Vietnam’s stock market took a sharp downturn on November 19th, with the VN-Index plunging below the 1,650-point mark.

How Record-Breaking Stock Markets Have Fueled Bank Performance

The third quarter of 2025 marks a historic milestone as the VN-Index surpasses its peak, with the banking sector playing an irreplaceable leading role. Interestingly, the vibrant stock market has also delivered a powerful boost to the business operations of banks, particularly those owning securities companies.

Market Pulse November 18: Balanced Buying-Selling Pressure, VN-Index Edges Up on Vingroup Stocks

The market equilibrium persisted until the close of today’s session. Overall, buying and selling pressures remained balanced. Late-session gains in several large-cap stocks propelled the VN-Index to end above the reference level.