As of 6 PM, gold prices remained relatively unchanged from the early afternoon but saw a significant drop compared to yesterday’s close.

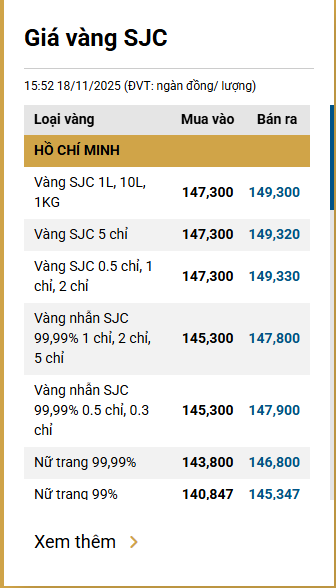

SJC, PNJ, and Doji listed the buying and selling prices of SJC gold bars at 147.3 – 149.3 million VND per tael, a decrease of 1.7 million VND per tael from yesterday’s close.

Meanwhile, Bao Tin Minh Chau bought and sold at 147.8 – 149.3 million VND per tael, with the buying price dropping by 200,000 VND and the selling price by 1.7 million VND compared to yesterday’s close.

For gold rings, SJC closed at 145.3 – 147.8 million VND per tael, a 1.2 million VND per tael decrease from yesterday’s close.

PNJ and DOJI listed at 146 – 149 million VND per tael, a 900,000 VND per tael drop from yesterday’s close.

Bao Tin Minh Chau’s gold rings traded at 146.8 – 149.8 million VND per tael, a 1.2 million VND per tael decrease from yesterday’s close.

Source: SJC

—————————————————–

As of 3 PM, domestic gold prices continued to decline from the morning session.

Currently, SJC, PNJ, and Doji list SJC gold bars at 147.3 – 149.3 million VND per tael, a 500,000 VND decrease from the morning and 1.7 million VND from yesterday’s close.

Bao Tin Minh Chau trades at 147.8 – 149.3 million VND per tael, with the buying price down 200,000 VND and selling price down 1.7 million VND from yesterday’s close.

Gold ring prices at jewelry stores also fell in the afternoon session.

SJC’s gold rings traded at 144.8 – 147.2 million VND per tael, a 500,000 VND drop from the morning and 1.7 million VND from yesterday’s close.

PNJ and DOJI listed at 146 – 149 million VND per tael, unchanged from the morning but down 900,000 VND.

Bao Tin Minh Chau’s gold rings traded at 146.5 – 149.5 million VND per tael, a 300,000 VND drop from the morning and 1.5 million VND from yesterday’s close.

—————————————————–

As of 9:45 AM today, domestic gold prices fell across the board compared to yesterday’s close.

SJC, PNJ, and Doji list SJC gold bars at 147.8 – 149.8 million VND per tael, a 1.2 million VND decrease from yesterday’s close.

Bao Tin Minh Chau also dropped similarly, trading at 148.3 – 149.8 million VND per tael.

Gold ring prices at jewelry stores also declined this morning.

SJC’s gold rings traded at 145.3 – 147.8 million VND per tael, a 1.2 million VND drop from yesterday’s close. PNJ and DOJI listed at 146 – 149 million VND per tael, down 900,000 VND. Bao Tin Minh Chau’s gold rings traded at 146.8 – 149.8 million VND per tael, a 1.2 million VND decrease.

—————————————————–

As of 7:00 AM today (November 18), domestic gold prices remained unchanged from yesterday’s close.

SJC, PNJ, and Doji list SJC gold bars at 149 – 151 million VND per tael. Bao Tin Minh Chau also maintained prices at 149.5 – 151 million VND per tael.

Gold ring prices at jewelry stores were also unchanged from yesterday’s close.

SJC’s gold rings traded at 146.5 – 149 million VND per tael. PNJ and DOJI listed at 146.9 – 149.9 million VND per tael. Bao Tin Minh Chau’s gold rings traded at 148 – 151 million VND per tael.

In the international market, global gold prices plummeted last night and early this morning. As of 7:00 AM, spot gold traded at $4,031 per ounce, down 0.36% from yesterday’s close. Earlier, gold had fallen nearly 1% in the November 17 session.

Gold prices declined on Monday, pressured by a stronger dollar and reduced expectations of a U.S. rate cut next month, as investors awaited upcoming economic data for clues on the Federal Reserve’s policy path.

“The market is seeing some tug-of-war ahead of key economic data releases following the U.S. government reopening,” said David Meger, director of metals trading at High Ridge Futures.

“Currently, expectations for further Fed rate cuts are diminishing, reducing gold’s appeal.”

This week, September employment data and minutes from the Fed’s latest meeting, where it cut rates by 25 basis points, will be released.

Meanwhile, more Fed policymakers maintain a hawkish stance on rate cuts for the central bank’s December meeting.

CME’s FedWatch tool shows traders now price a 25-basis-point rate cut in December at 45%, down from over 60% last week.

Gold, a safe-haven asset, tends to rise in low-interest-rate environments as it is a non-yielding asset.

Which Investment Channel Will Shine Next: Gold, Real Estate, or Stocks?

The three major investment channels are entering distinct phases. Gold is forecasted to continue its upward trajectory in the medium to long term, while real estate maintains short-term vibrancy but carries potential risks from 2027 onward. Meanwhile, the stock market is showing signs of bottoming out, paving the way for a more unified upward trend.

“We Sold 3 Taels of Gold to Buy a Car – Now It’s Unused, and Gold Prices Have Doubled”

Selling three taels of wedding gold at the beginning of 2024 to buy a car felt like the right decision for my spouse and me. Now, with gold prices soaring to 150 million VND per tael, our car sits unused, gathering dust. Job loss, reduced income, and the burden of vehicle maintenance costs have turned our once-proud purchase into a costly regret.