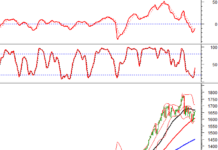

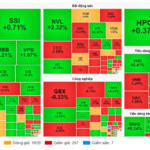

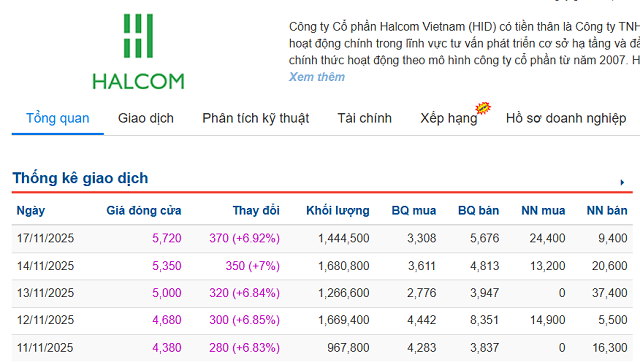

Over the course of a week, the stock price of HID surged from 3,980 VND per share to 5,720 VND per share, marking a remarkable increase of nearly 44%. This upward trend emerged after a prolonged period of sluggish trading. From 2023 to early July 2025, the stock had been largely stagnant, even dipping below 3,000 VND per share. However, in the past four months alone, the stock price has skyrocketed by approximately 130%.

| HID Stock Price Soars |

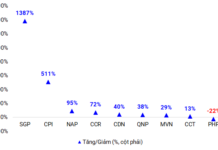

This surge coincides with the company’s positive financial performance in the second quarter of the 2025 fiscal year (01/04/2025–31/03/2026). During this period, HID reported revenues of 209 billion VND, a 2.2-fold increase year-over-year. Net profit reached 61 billion VND, an 8.4-fold jump and the highest since 2021. For the first six months of the fiscal year, the company recorded a profit of 46 billion VND, a significant turnaround from the 3.3 billion VND loss in the same period last year.

Chairman of the Board Nguyễn Quang Huân attributed the robust growth primarily to consulting services for a project in Lệ Thủy, Quảng Bình. In the first half of the year, the services segment generated 135 billion VND for HID, a fivefold increase year-over-year. With a gross margin of 81%, this segment contributed nearly 90% of the company’s gross profit, serving as the main driver of its improved performance.

Meanwhile, other segments such as goods sales, electricity sales, and clean water supply saw modest growth but had minimal impact on overall profitability.

HID began as a consulting firm specializing in water supply, drainage, and environmental services, later expanding into investments in water, wind energy, wastewater treatment, and transportation infrastructure. The company acquired the Phương Mai 3 wind power project in Bình Định and invested in several clean water projects in the northern region. Mr. Huân, one of the founding shareholders, currently holds 26.6% of the company’s capital.

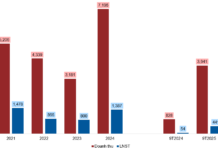

Despite revenue recovery in recent years, HID’s profits have remained inconsistent. The company reported a loss of 17 billion VND in 2022 and marginal profits of less than 5 billion VND in the following two years, primarily due to its reliance on low-margin trading activities. As a result, the 2025 semi-annual results are considered the most promising since the company’s listing in 2016. In just six months, HID has already surpassed its full-year profit target.

| HID Net Profit Reaches All-Time High Since Listing |

As of the end of September 2025, the company’s total assets exceeded 2 trillion VND, with half representing equity. Fixed assets accounted for approximately 785 billion VND, reflecting the company’s long-term infrastructure investments. Short-term receivables surged to 478 billion VND, doubling since the beginning of the year, while debt stood at 821 billion VND.

According to Mr. Huân, HID is channeling resources into clean energy and infrastructure projects, including waste-to-energy plants in Đà Nẵng and Long An, wind power projects in Đăk Lăk and Quảng Trị, the Nhơn Hội water plant, and projects in Hậu Giang and the Phương Mai 3 resort. By 2030, HID aims to develop 400–600 MW of wind and solar power capacity while advancing clean water projects in the northern region.

– 09:58 18/11/2025

FPT Allocates VND 1.7 Trillion for Interim Dividend Payout in December

FPT is set to distribute over 1.7 trillion VND in dividend advances for 2025 to its shareholders on December 12th.

ABBANK: Vũ Văn Tiền Reappointed as Chairman, Phạm Duy Hiếu Steps Down as CEO

On November 14, 2025, the Board of Directors of An Binh Commercial Joint Stock Bank (ABBANK) issued resolutions to adjust key leadership positions within the Board and the bank’s Executive Committee. These strategic changes aim to strengthen governance foundations and accelerate operational efficiency.