Q4 2025 and 2026 Profits Poised to Reach New Heights

In a newly released report, Vietcap Securities forecasts that Binh Minh Plastics JSC (BMP) is entering a robust growth phase, with Q4 2025 and 2026 profits expected to set new records.

Vietcap projects that both gross margin and post-tax profit for Q4 will continue to rise compared to Q3, driven by the significant decline in PVC plastic prices—a key raw material.

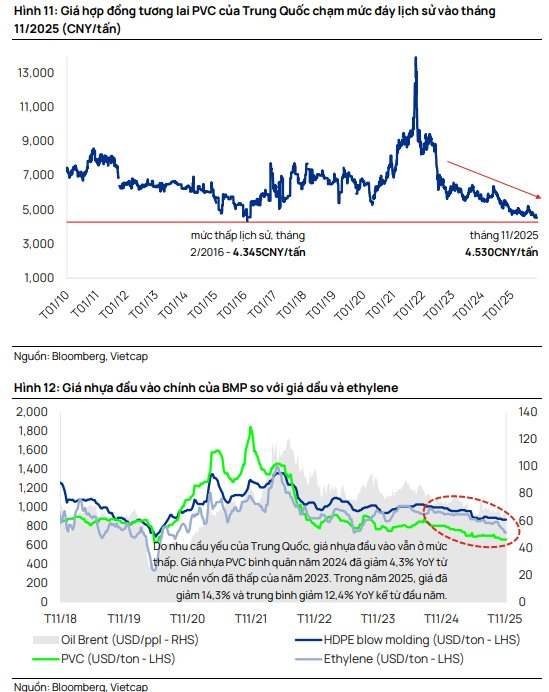

Since the quarter began, PVC prices in China have dropped by 6–7% compared to Q3. Year-to-date, PVC prices have fallen by 14.3% and are 12.4% lower than the same period last year. China’s PVC futures even approached historic lows in November 2025.

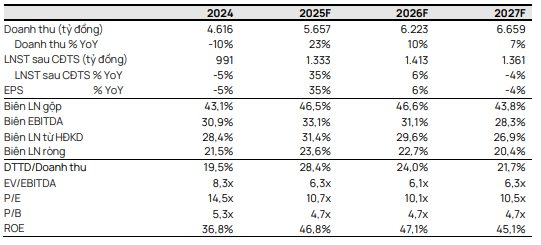

Leveraging favorable cost conditions, Vietcap predicts BMP’s 2025 post-minority interest profit will surge by 35% year-on-year, supported by strong nine-month performance and a low base in Q4 2024. Specifically, Q4 2025 profit is expected to rise by 4% quarterly and 60% annually.

In 2026, the company is anticipated to achieve exceptional growth, with projected revenue of VND 6,223 billion and post-tax profit of VND 1,413 billion—the highest in its history. This growth is fueled by sustained low input costs and a gradual recovery in domestic construction demand.

Vietcap has also significantly raised its 2026–2030 post-tax profit forecasts for BMP by approximately 20% annually. This adjustment is primarily due to an expected 3.5 percentage point annual improvement in gross margin, as China’s PVC market continues to face supply-demand imbalances.

Specifically, commercial PVC inventories are at historic highs, while industry capacity in 2025 is projected to increase by 9% year-on-year. Previously, Vietcap anticipated that PVC might be affected by China’s “negative competition policies,” but recent policy meetings have not addressed this sector.

As a result, analysts have revised their assumptions, expecting no significant reduction in PVC supply. On the demand side, China’s domestic construction demand has declined for over three consecutive years and remains weak in recent months. PVC exports also face risks from anti-dumping duties to be imposed by India. These factors lead Vietcap to maintain a bearish outlook on PVC prices, brightening BMP’s margin prospects.

Dividend Payout Ratio to Remain at 98–100% from 2025–2029

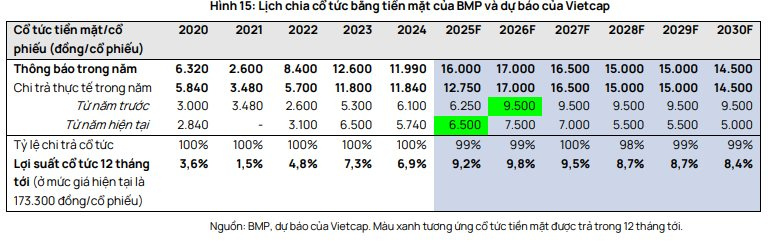

Regarding dividend policy, BMP has maintained a 100% cash payout ratio from 2019–2024. Vietcap expects the company to sustain a 98–100% ratio from 2025–2029.

For 2025, the dividend is projected to increase to VND 16,000 per share, with the first installment of VND 6,500 per share (ex-dividend date: November 17, payment expected on December 8, 2025) and the second installment of VND 9,500 per share in early 2026. The 12-month dividend yield is estimated at 9.2%. Vietcap also forecasts a 2026 dividend of VND 17,000 per share, equivalent to a yield of nearly 9.8%.

With robust profit growth and high dividend yields, Vietcap considers BMP’s current valuation highly attractive. At present, BMP is trading at a 2026 projected P/E ratio of 10.1 times.

“TBD Sustains 3 Consecutive Years of 20% Cash Dividend Payouts”

Dong Anh Electrical Equipment Corporation – JSC (UPCoM: TBD) announces the finalization of its shareholder list for the 2024 cash dividend distribution. Shareholders will receive a 20% dividend, equivalent to VND 2,000 per share. The ex-dividend date is set for November 21st, with payments expected to commence on December 24th.

Vietcap Securities Appoints New CEO: Female IB Director Succeeds Mr. To Hai

Vietcap Securities Corporation (HOSE: VCI) is undergoing a significant leadership transition as Mr. To Hai steps down from his role as CEO. Ms. Ton Minh Phuong, the current Director of Investment Banking (IB), has been appointed as his successor, marking a new chapter for the company.