|

Source: VietstockFinance

|

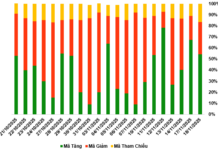

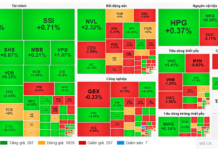

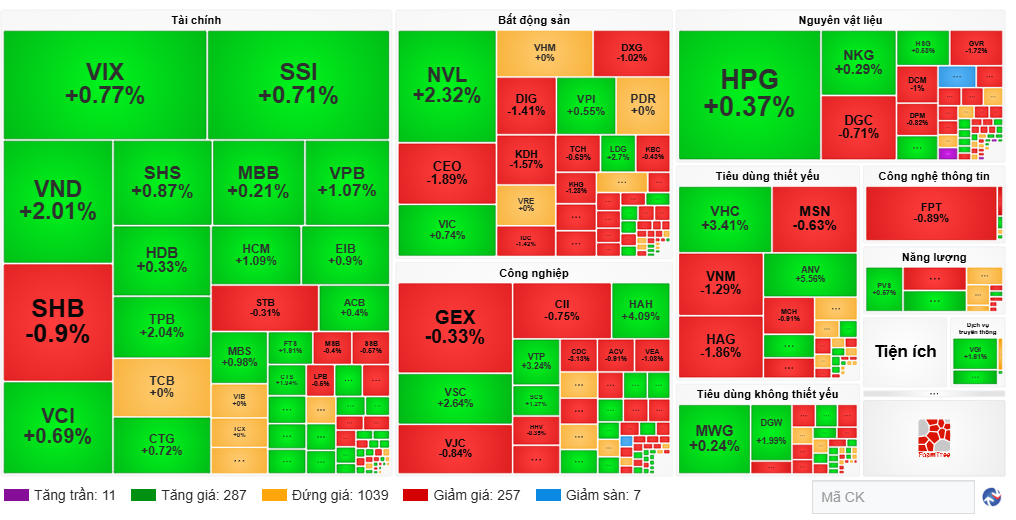

Closing the session on November 18th, the VN-Index settled at 1,659.92 points, up by 5.5 points. Conversely, the HNX-Index dipped by 1.3 points to 267.33 points. On the HOSE market, VIC and VHM were the primary drivers of the VN-Index, contributing nearly 4 points to its rise. VPB also added over 1.3 points. In contrast, GVR, VNM, FPT, GAS, and several banking stocks like VCB, LPB, and MBB exerted downward pressure on the index.

| Top 10 Stocks Impacting VN-Index on November 18, 2025 (Point-Based) |

On the HNX, PVI boosted the index by 0.5 points, while KSF weighed it down by nearly 0.7 points.

The hardware and equipment sector, along with insurance, were the top performers of the day. The hardware sector was buoyed by VEC, DLG, VTE, and BVH. In the insurance sector, PVI rose by 4%, PTI gained over 3%, and BVH, BIC, MIG, PRE, VNR, and ABI saw modest increases.

The seafood sector was a highlight of the session. Toward the close, ANV surged to its upper limit, while VHC gained 3.4%, IDI rose by 4.6%, and ASM climbed over 3%. Conversely, the energy sector was in the red, with PVD, PVS, BSR, PLX, PVT, and PVC all declining.

Liquidity remained consistent with the previous session, reaching nearly 25 trillion VND. Foreign investors were net sellers by a marginal 170 billion VND, thanks to strong buying in HPG, totaling nearly 380 billion VND.

| Top 10 Stocks with Highest Foreign Buy/Sell Net on November 18, 2025 |

Morning Session: Cautious Sentiment Persists Amid Broad Market Divergence

Market divergence continued into the midday break, with the VN-Index pausing at 1,656.16 points, up slightly by nearly 2 points. The HNX-Index dipped by 0.6 points. Liquidity held steady at around 12 trillion VND.

Buying and selling pressures were evenly matched, with approximately 300 stocks advancing and 300 declining. Sector performance was similarly balanced, with 12 sectors gaining and 10 losing.

The hardware and equipment, insurance, and real estate sectors led the gains, while software, personal and household care, and food sectors lagged.

Vingroup-affiliated stocks rebounded toward the end of the session, easing pressure on the index.

10:35 AM: Broad Divergence, Seafood Sector Active

Divergence persisted, but as selling pressure from Vingroup stocks eased, the VN-Index returned to its reference level. Market breadth reflected cautious sentiment, with nearly 290 stocks advancing and over 260 declining by 10:25 AM.

The financial sector remained a key driver early in the session, with VND and TPB both up over 2%. Other stocks in this sector saw modest gains of less than 1%. In real estate, only a few stocks like NVL, VPI, VIC, and LDG remained in the green, while most were down.

Steel stocks saw slight gains early in the session, with HPG, NKG, and HSG all up by less than 1%.

In the essential consumer goods sector, seafood stocks performed well, with VHC, ANV, IDI, and ASM all advancing. Meanwhile, other consumer stocks like MSN, VNM, HAG, MCH, BAF, DBC, and SBT saw modest declines.

FPT fell by 1% in the morning session, a moderate decline but enough to push the IT sector to the bottom of the sector rankings. This highlights the broad divergence across sectors, with none experiencing extreme negativity.

Source: VietstockFinance

|

Market Open: Early Divergence, Pressure from Real Estate Sector

The market opened the November 18th session with mild divergence. Notably, the real estate sector was predominantly in the red, with Vingroup stocks exerting significant downward pressure on the index.

As of 9:30 AM, the VN-Index was down by 3 points. VIC, VHM, and FPT were the primary drags on the index. Within the real estate sector, NVL led the gains, rising over 4% early in the session.

Financial stocks leaned toward the green, with SSI, VIX, VND, TCB, HDB, SHS, VCI, VPB, and CTG all up slightly. However, several stocks in this sector, including SHB, STB, TCX, MSB, VIB, and LPB, saw modest declines.

The telecommunications services sector led the early gains, with VGI, CTR, TTN, and MFS all performing well.

– 12:00 PM, November 18, 2025

Vietstock Daily November 19, 2025: Sustaining the Green Momentum

The VN-Index extended its winning streak to a third consecutive session, poised to retest the 50-day SMA. Both the Stochastic Oscillator and MACD continue their upward trajectory, reinforcing the earlier buy signals. Should this momentum persist in upcoming sessions, the short-term outlook remains decidedly bullish.

Dragon Capital: Robust Profits Amid Market Corrections

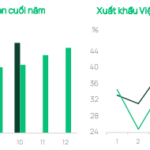

Vietnam’s stable macroeconomic foundation provides long-term support for its stock market. However, in the short term, the market may face pressure from foreign investor sentiment and domestic liquidity absorption capacity, particularly if external factors take an unfavorable turn. The next phase of growth will hinge significantly on the pace at which set goals and expectations are realized.

Technical Analysis for the Afternoon Session on November 18th: Entering the Third Consecutive Bullish Session

The VN-Index extended its winning streak to a third consecutive session, decisively breaching the Bollinger Bands’ Middle line. This level is poised to act as a key support in the near term. Meanwhile, the HNX-Index paused its upward momentum, forming an Inverted Hammer pattern.