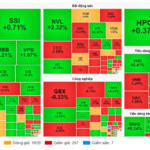

Amid ongoing global stock market volatility, Vietnam’s stock market witnessed a tumultuous trading session on November 19. The VN-Index dropped by 10.92 points (-0.66%), closing at 1,649.92 points, snapping a three-day winning streak.

Other indices fared no better. The HNX-Index fell by 2.33 points (-0.87%) to 265.03 points, while the UPCoM index inched up slightly by 0.51 points to 119.49. The VN30 group declined by 1.17% to 1,886.20 points, weighed down by significant pressure from banking and real estate stocks.

On the HoSE, only 84 stocks gained, compared to 222 that declined and 62 that remained unchanged, highlighting the dominance of selling pressure.

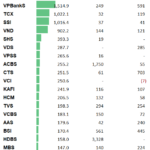

Total market liquidity exceeded 23.5 trillion VND, heavily concentrated in blue-chip stocks that ended in the red.

Vietnam’s stock market plunges on November 19, with the VN-Index breaching the 1,650-point mark.

Market dynamics revealed that the index opened near its low, fluctuating around the 1,650-1,660 range, but was repeatedly pulled down by deep afternoon corrections, reflecting investor caution amid macroeconomic risks.

Banks were a major drag, with all Big4 stocks and numerous large-cap shares closing in negative territory: VCB -2.4%, BID -0.8%, CTG -1.6%, MBB -0.8%, SSB -0.9%, and substantial trading volumes. Real estate stocks also faced pressure, with VHM down 0.1%, VRE -2.3%, BCM -2.4%, and DXG -2.8%.

Foreign investors continued their bearish stance, net-selling over 646 billion VND on the HoSE on November 19. Selling pressure was concentrated in large-cap stocks like VND, MBB, DGC, MWG, and DXG, significantly impacting market sentiment.

On the flip side, only a few stocks saw net buying, such as HPG and HDB, but their gains were insufficient to offset the broader sell-off.

Despite the downturn, many securities firms maintain a positive medium-term outlook. Most view this correction as technical, following the VN-Index’s failure to break through the 1,660-1,670 resistance zone. The next strong support level lies at 1,620-1,630 points, where the 50-day and 100-day moving averages converge. If this level holds, the index could resume its upward trajectory.

How Record-Breaking Stock Markets Have Fueled Bank Performance

The third quarter of 2025 marks a historic milestone as the VN-Index surpasses its peak, with the banking sector playing an irreplaceable leading role. Interestingly, the vibrant stock market has also delivered a powerful boost to the business operations of banks, particularly those owning securities companies.

Market Pulse November 18: Balanced Buying-Selling Pressure, VN-Index Edges Up on Vingroup Stocks

The market equilibrium persisted until the close of today’s session. Overall, buying and selling pressures remained balanced. Late-session gains in several large-cap stocks propelled the VN-Index to end above the reference level.

Vietstock Daily November 19, 2025: Sustaining the Green Momentum

The VN-Index extended its winning streak to a third consecutive session, poised to retest the 50-day SMA. Both the Stochastic Oscillator and MACD continue their upward trajectory, reinforcing the earlier buy signals. Should this momentum persist in upcoming sessions, the short-term outlook remains decidedly bullish.